Private-Equity Distributions in Limbo: How Low Can They Go?

For private-equity investors facing what are already historically low distribution rates, keeping an eye on the movement of public markets may provide a signpost for their future cash flows.

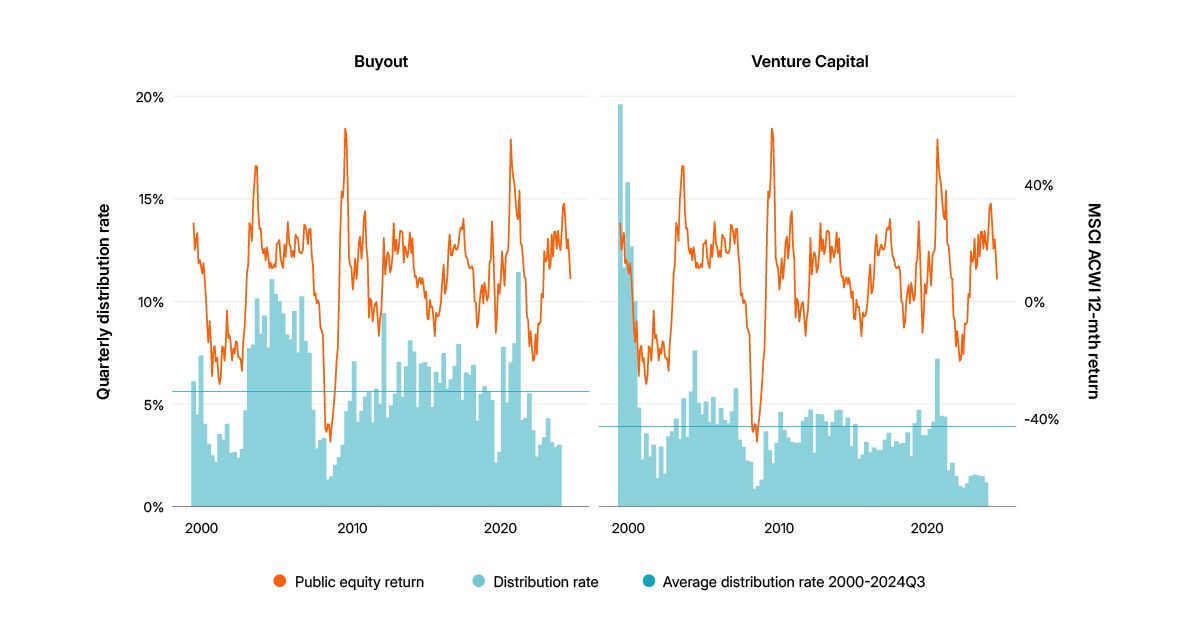

Prolonged market downturns, like those following the dot-com bust in 2002 and the 2008 global financial crisis, corresponded with depressed distribution rates in buyout and venture capital (VC). What has not been seen in the past two decades is a period where low distribution rates were the status quo entering the downturn. Data from the MSCI Private Capital Universe shows distribution rates for buyout and VC funds were already near record lows before the recent market disruption.

Calling for capital

Distributions provide private-equity investors with liquidity to fund upcoming capital calls or meet other obligations. When distributions dry up, limited partners (LPs) must sell liquid assets to fill the void, and more assets must be sold to generate the same level of capital when public markets are down. The possibility remains that the current market downturn reverses course, or that capital calls from general partners slow enough to offset lower distributions, softening any liquidity crunch for LPs.1 But already-depressed distribution rates offer cold comfort to LPs hoping for liquidity from their private-equity portfolios.

Downturns in public equities corresponded with private-equity distribution dips

Data for global closed-end funds from the Q3 2024 update of the MSCI Private Capital Universe.

Subscribe todayto have insights delivered to your inbox.

Private-Credit Fundraising May Face Testing Times

Economic fallout from shifting U.S. trade policy and heightened market volatility could prove a headwind for fundraising in private credit amid early signs of a slowdown in the asset class.

1 Our analysis shows that LP contributions also decline during extended market downturns. However, the decline does not offset the drop in distributions; thus, downturns tend to coincide with negative net cash flows.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.