MSCI Markets in Motion

Stay ahead of global market trends with timely research-based insights. With data visualizations, expert commentary and educational content all in one place, MSCI Markets in Motion helps investors cut through complexity, build credibility and drive better decisions.

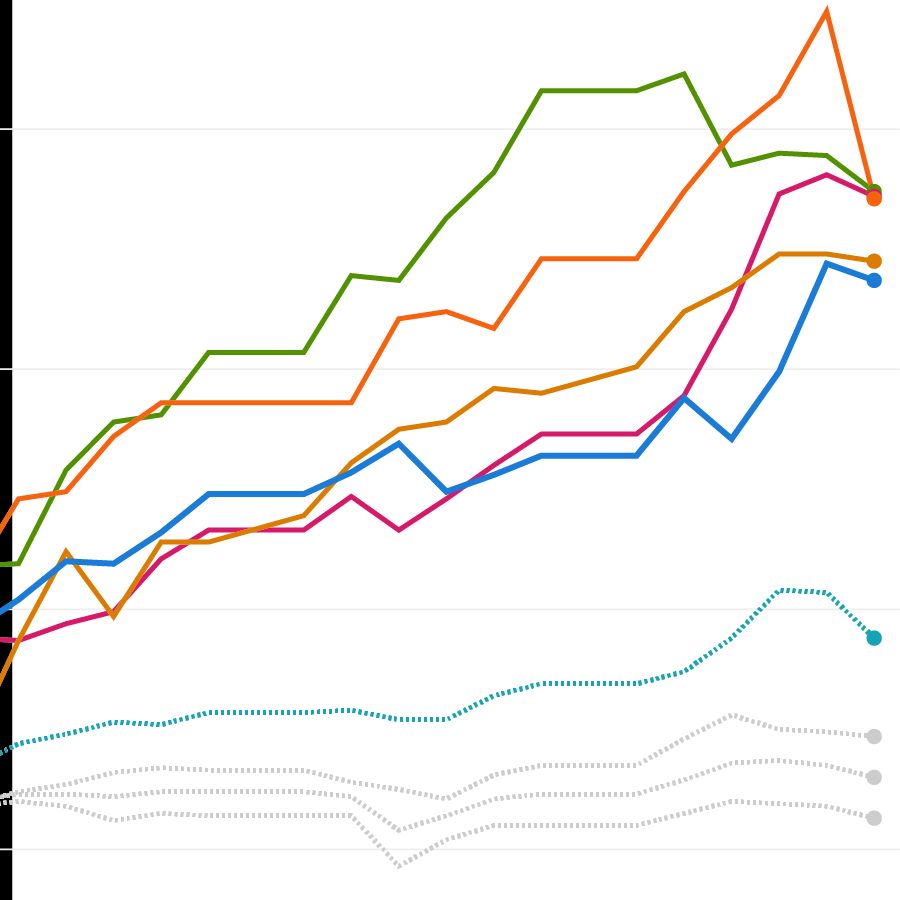

Featured chart of the week

Top five performing countries that led January EM returns

EM performance isn’t one-dimensional. A changing mix of countries and return drivers underscores why emerging markets are a dynamic opportunity set for investors.

Trending topicsIdeas shaping global investing

2026 Outlook: 4 Themes Defining Markets

Four trends to watch in 2026 – how U.S. market confidence, AI momentum, data center energy demand, and private credit risks are shaping the investment outlook.

.webp&w=3840&q=80)

Why EAFE Now?

Explore international market insights across currencies, policy cycles, sector structure and factor exposure.

ETFs in 2025: Defining Market Themes and Innovation Trends

Christine Berg, CFA®, Head of Americas Index for MSCI discusses all the biggest themes and trends in the markets in 2025, and looks ahead to some of the biggest innovations in the ETF wrapper.

Free Float and Stock Returns

When companies increase their free float, stock-specific returns tend to rise the following month. When free float decreases, returns often fall.

Why Emerging Markets Now?

Cut through the noise on emerging markets with concise insights and visuals linked to MSCI research — built for investors who want to turn market signals into strategy.

Market reportsInsights you can act on

Index reviewsKeeping indexes aligned with markets

Power your strategy withMSCI index-linked ETPs

MSCI IndexesMore than benchmarks: Engines of your innovation

Your partner for advanced index intelligence

Index solutions built to match your goals and power your strategy.

Index Education

From the basics to advanced knowledge, discover why indexes matter and how they shape markets.