Talking Taxes This Week? Plan Now for 2024

As individual investors prepare to pay their 2023 U.S. tax bills, many may be open to strategies to reduce their 2024 tax liability. A common approach is tax-loss harvesting, selling a capital asset to realize a loss that can offset a realized capital gain and lower overall tax owed.1

To illustrate the potential benefits and related trade-offs of this strategy, we compared the after-tax returns a hypothetical U.S.-domiciled investor could have obtained from an ETF tracking the MSCI USA Index and from a simulated loss-harvesting strategy for a portfolio of individual stocks with similar market exposure.2 We assumed a cash-funded portfolio of USD 10 million at the end of 2022. All realized losses incurred would thus be short term. For simplicity, we assumed no other constraints.3

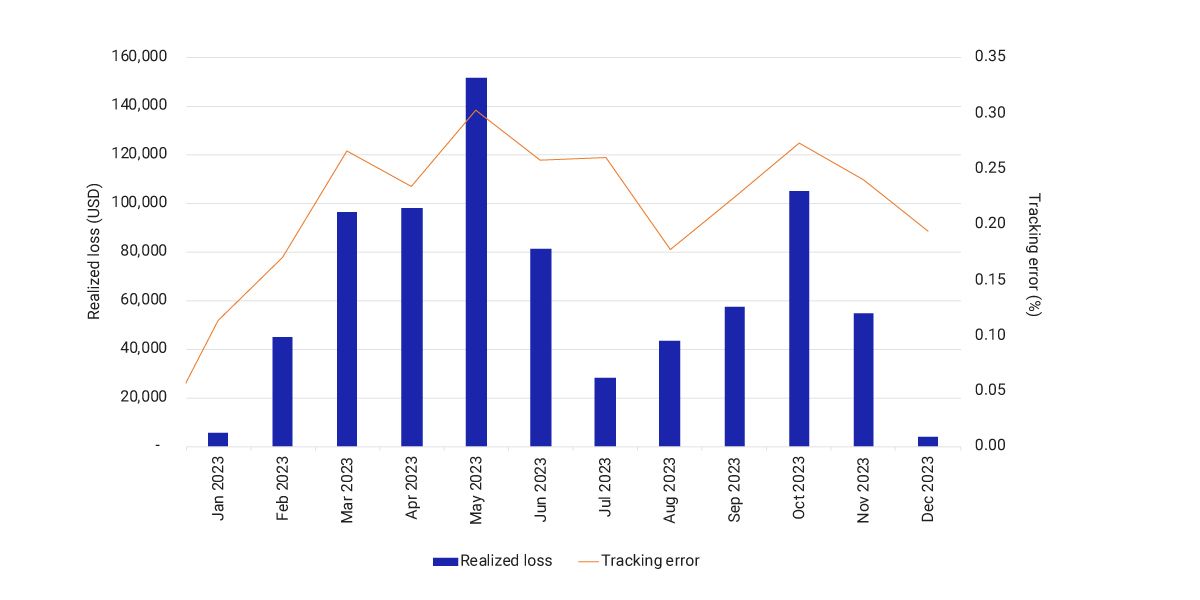

On average, the loss-harvesting strategy realized losses of USD 60,000 each month, with an average tracking error (TE) of 21 basis points.4 We assumed all realized losses could produce after-tax benefits by avoiding capital-gains tax due.5

Because an ETF does not pass through capital gains to the investor when it rebalances, its after-tax and pre-tax returns are the same.6 But by applying the loss-harvesting strategy, our analysis showed that the hypothetical investor would boost their after-tax return by 2.8% for the 2023 calendar year.

Maximizing after-tax return may mean high turnover

A downside to the strategy is its typically high turnover, which incurs direct and indirect trading costs; in our analysis, annual turnover was 80%. An investor may therefore choose to harvest losses less frequently, despite potentially reduced after-tax return and increased TE — the latter introducing potential performance slippage.

By implementing a tax-loss-harvesting strategy for individual stocks, investors with accrued capital gains could have lowered their total tax liability and increased after-tax return. Investors can also fine tune the strategy to control turnover and its related costs. The trade-off, however, may be lower after-tax returns.

Hypothetical USD equity portfolio’s realized short-term losses and tracking error

Data period is from Jan. 1, 2023, to Dec. 31, 2023.

After-tax performance of a simulated loss-harvesting strategy vs. ETF

Data period is from Jan. 1, 2023, to Dec. 31, 2023. Performance shown is net of accrued taxes.

Subscribe todayto have insights delivered to your inbox.

EAFE ADRs vs. Shares: How Do They Compare in Tax Efficiency?

Wealth managers, interested in adding EAFE equity exposure to a U.S. client’s portfolio but concerned about the potential tax implications? We compared the tax efficiency of EAFE ADRs and shares of the underlying securities.

What Connects Correlation and Tax-Loss Harvesting?

Selling a capital asset at a loss to reduce your tax liability is one side of the coin. The other side is thoughtfully selecting the security that replaces it.

Measuring Tax Alpha

The concept of tax alpha can help a wealth manager explain a client’s after-tax performance. We propose two frameworks to provide transparency around the after-tax attribution calculation used to measure tax alpha.

1 Careful selection and timing of the replacement security could potentially boost the taxpayer’s after-tax return.2 Illustration only, not indicative of actual results. This analysis includes hypothetical, backtested or simulated performance results. There are frequently material differences between backtested or simulated performance results and actual results subsequently achieved by any investment strategy.3 Rebalancing occurred monthly and sought to realize capital losses with the lowest feasible forecast TE against the benchmark of the MSCI USA Index. We discuss the impact of frequency variation and turnover constraints later.4 The TE is calculated using the MSCI US Total Equity Market Model for Long Term Investors (USSLOWL).5 It is standard practice to assume there are sufficient realized short-term gains from other investments to net against all short-term losses generated in the loss-harvesting analysis. In our analysis, the reduction in capital-gains tax equals tax savings calculated as short-term losses multiplied by the short-term capital-gains tax rate. This savings was added to the before-tax return to determine the after-tax return.6 We consider pre-liquidation returns, ignoring for this analysis the taxes incurred when the portfolio was liquidated.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.