Illuminating the Relationship Between ESG and Performance

Research Paper

July 27, 2022

Preview

Time horizons are key to understanding the impact of environmental, social and governance (ESG) on stock returns. This paper, which was published in Investments & Wealth Monitor, illustrates the relative importance of short-term event-related risks (such as fraud, corruption or accidents) versus longer-term erosion risks (such as carbon emissions) over time. It also examines the relationship between ESG risks and specific issues that are used in calculating a company's ESG rating.

For example, short-term event-driven risks, such as fraud or corruption, are frequently tied to the G pillar. Others, such as accidents, strikes or oil spills, may be tied to E and S scores. In contrast, erosion risk represents long-term risk, often reflecting environmental and social issues' contributions to stock-price performance.

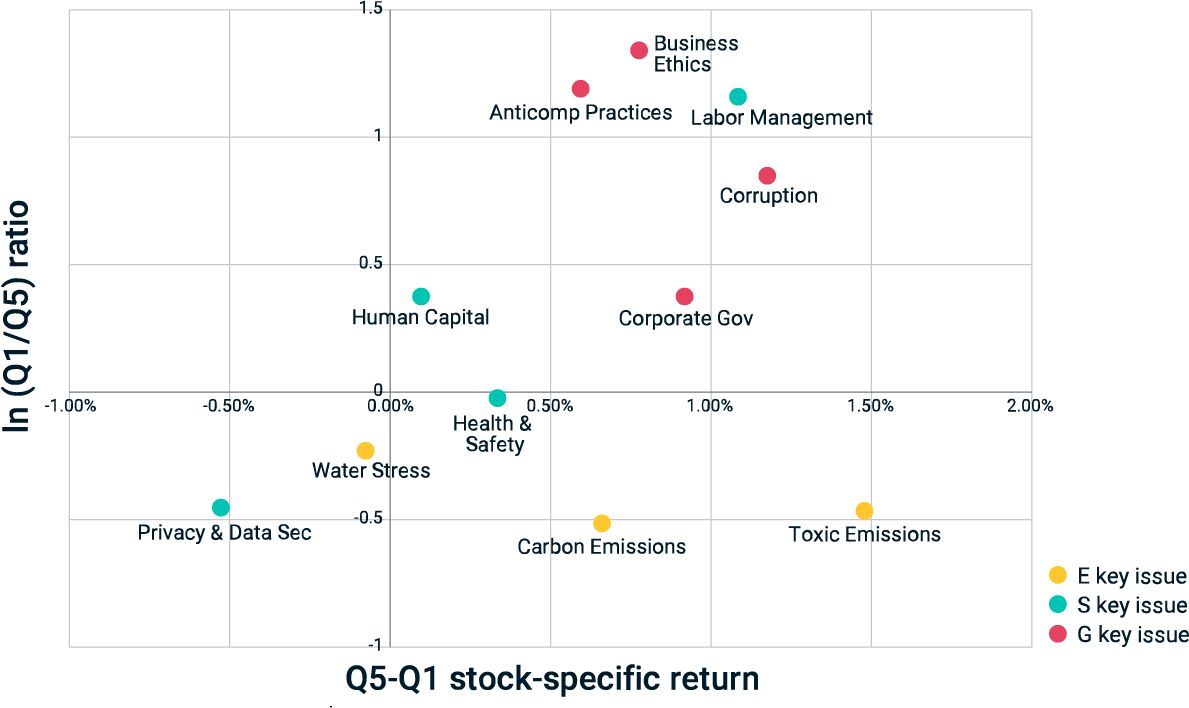

Event risk vs. erosion risk of 11 MSCI ESG Key Issues

This exhibit compares the performance of the equal-weighted top quintile (Q1=worst ESG characteristics) minus bottom quintile (Q5=best ESG characteristics) stock-specific returns. Source: MSCI ESG Research, based on the 15-year period ended Dec. 31, 2021

Read the full paper

Read the full paper

Provide your information for instant access to our research papers.

ESG Ratings

Measuring a company's resilience to long-term, financially relevant ESG risks

Deconstructing ESG Ratings Performance

MSCI's latest ESG paper deconstructs MSCI ESG Ratings to explore how environmental, social and governance factors performs by time horizon, sector and weighting.

Has ESG Affected Stock Performance?

Are ESG characteristics tied to stock performance? Many researchers have studied the relationship between companies with strong environmental, social and governance (ESG) characteristics and corporate financial performance.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.