Property Climate Risk Varied Across — and Within — Markets

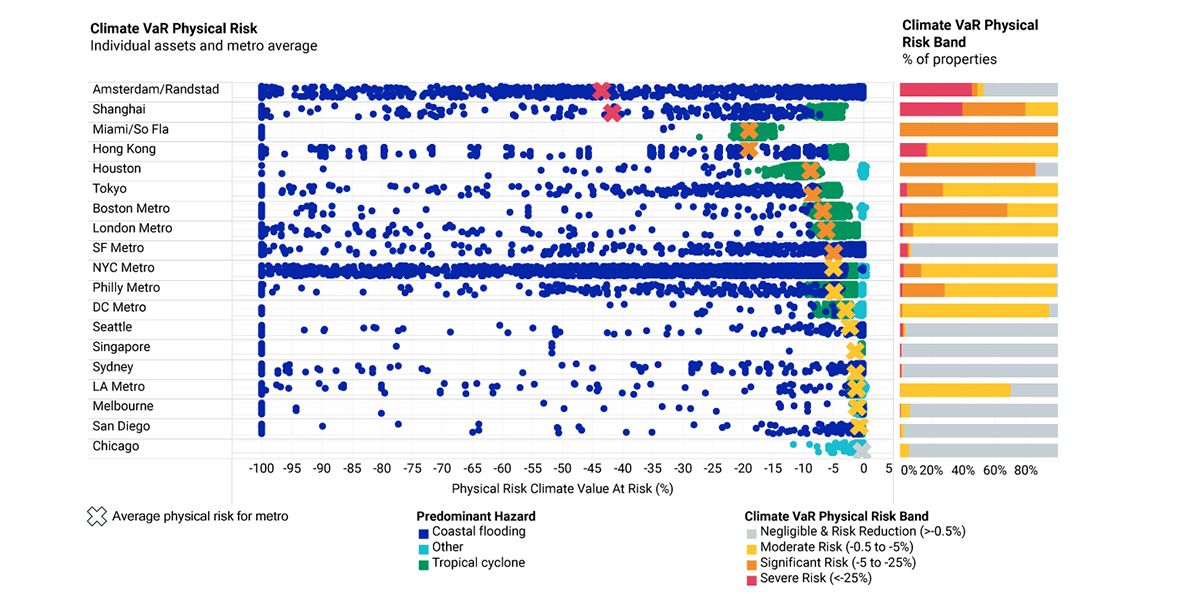

Using MSCI's Real Capital Analytics database of global real estate holdings and MSCI Real Assets Climate Analysis, we can see a broad range of aggregated physical climate value-at-risk (VaR) across selected global cities, as shown in the chart below, but these risks are not equally distributed within each city. Investors need to appreciate this wide variation of risk in each market.

Two of the cities with the highest physical-climate-change risks are Amsterdam and Miami, but their physical climate VaR profiles are very different. Although 45% of assets in Amsterdam are classified as having "severe risk," 47% of assets were classified as "negligible & risk reduction" as they are on slightly higher ground, where flooding is less likely. By contrast, for Miami the primary hazard is tropical cyclones, which are likely to have an impact across the entire city, leading to "significant risk" for nearly 100% of the market.

Location and topography can be decisive factors behind the impact of physical climate change risks, and both need to be understood at the individual asset level — not just the market level — when considering the climate VaR for real estate portfolios and prospective investments.

Average physical risk vs. risk distribution across major metros

Source: MSCI Real Capital Analytics database of property holdings. MSCI Real Assets Climate Analysis. The physical risk impact of an asset is quantified by assessing the exposure of a property to a hazard and computing the costs associated with that risk using vulnerability functions specific to the real estate market.

Subscribe todayto have insights delivered to your inbox.

2023 Trends to Watch in Real Assets

Real estate investors enter 2023 facing a very different investment landscape to the one they encountered at the beginning of 2022. Many property markets were still riding high this time last year.

London and Paris Offices: Green Premium Emerges

Analysis of prices paid by investors for offices in London and Paris, Europe’s largest property markets, shows a premium has emerged for buildings that have sustainability ratings such as LEED.

Five Misconceptions About Climate-Change Risk in Real Estate

Real estate portfolios may be particularly vulnerable to the threat of climate-change risks. While investors are increasing their focus on the topic and considerable progress has been made in recent years, some misconceptions remain.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.