SES factors - hero image

Introducing Systematic Equity Strategy Factors

Understanding systematic equity strategy factors

A Paper Series on How MSCI Models Can Help Monitor Style Risk in Global Portfolios

A recent paper published by MSCI shows that Systematic Equity Strategy (SES) factors earned positive returns over a 20-year period. These factors aim to capture the risk and return attributes of certain investment strategies such as valuation, quality and momentum. Although past performance does not predict future returns, Systematic Equity Strategy factors have been historical predictors of companies’ future cash flows and active managers often have exposure to them regardless of their investment style.

As a result, MSCI includes these factors in its next-generation suite of equity models for improved risk and performance attribution. Due to factors’ popularity, these strategies are subject to crowding risk, which makes monitoring their effects especially important.

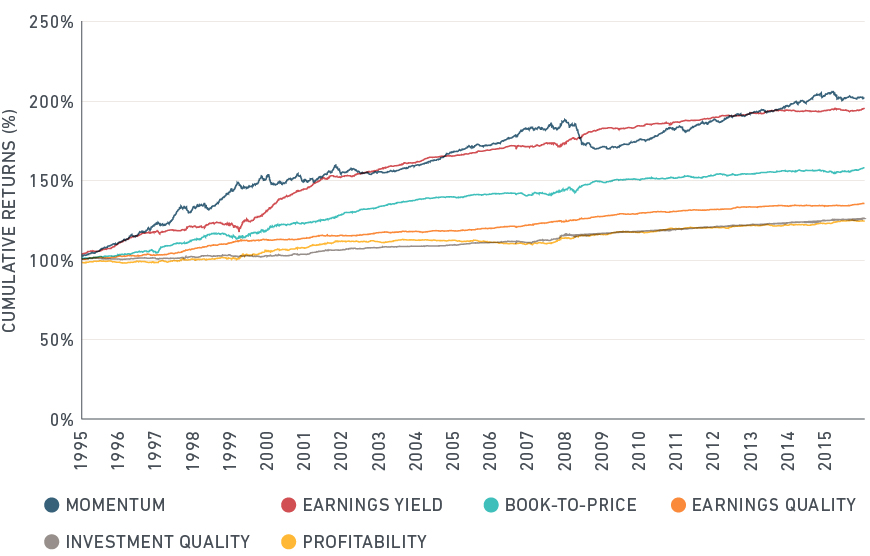

MSCI’s new Barra Global Total Market Equity Model now includes 16 SES factors, providing more granular attribution of risk and return in global portfolios. These rich datasets are also valuable as a tool for alpha research and portfolio construction. The exhibit below illustrates the historical long-term performance of six SES factors over a 20-year period ending in 2015.

These SES Factors Earned Positive Returns Over a 20-Year Period

The papers below discuss in greater detail how individual SES factors have performed over time and provide perspectives to understand that historical performance. These papers are part of a series that focuses on individual SES factors.

Related Items:

Read the blog about SES factors, "Using Systematic Equity Strategies".

Read the paper, “Using Systematic Equity Strategies: Managing Active Portfolios in the Global Equity Universe” by Imre Balint and Dimitris Melas.

Read the Product Insight, “Employing Style Rotation with MSCI’s Systematic Equity Strategy Factors” by Audrey Choi.

Download a fact sheet about MSCI’s Barra Global Total Market Models.

Read earlier papers in this series:

- Introducing Profitability by Vikas Kalra and Christian Celis

- Introducing Earnings Quality by John Regino, Daniel Young and Leon Roisenberg

- Introducing Investment Quality by Ting Fang

- Introducing news sentiment by Ashutosh Singh

- Introducing analyst sentiment by Ashutosh Singh

- Introducing momentum by Bradley Ursillo

Contact us to speak to an MSCI representative about integrating SES factors into your investment process.

Earnings quality

Investment quality

Investment quality

Tracing the link between stock issuance and equity performance.

Profitability

Profitability

MSCI’s unique definition of profitability and its performance.