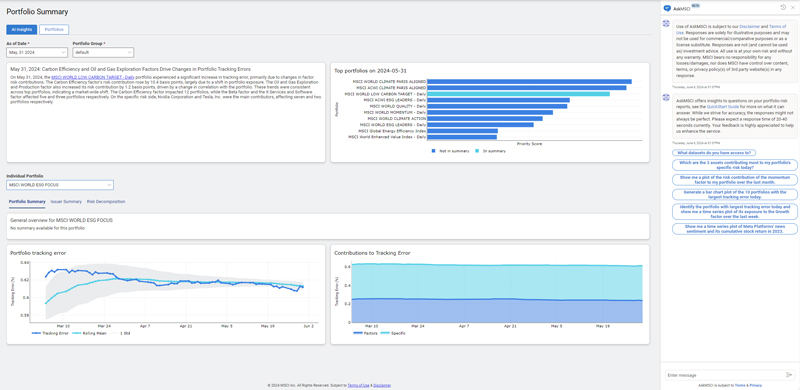

AI Portfolio Insights

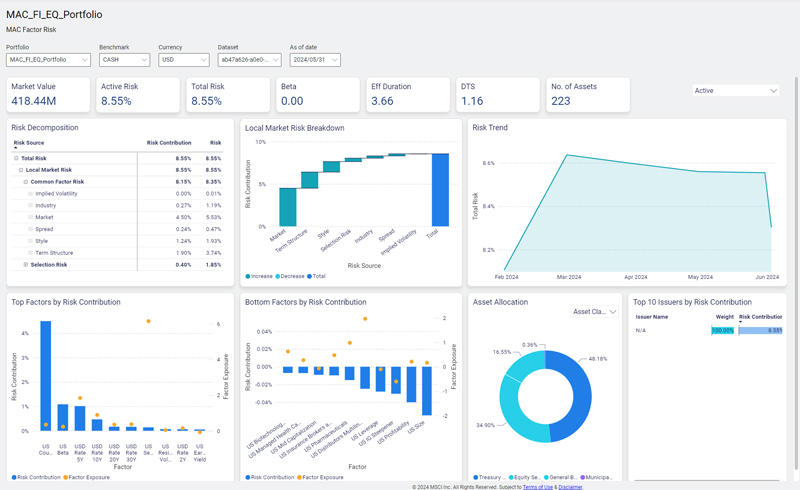

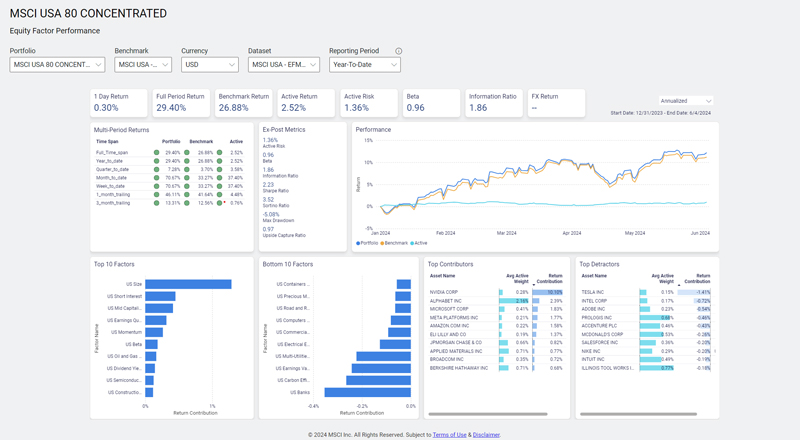

Scale your risk management process and act faster leveraging GenAI and cloud-based technologies. AI Portfolio Insights is designed to quickly draw your attention and explain the most important changes to portfolio characteristics. Supported by an AI agent, clients can dive deeper into portfolios.