Climate Lab Enterprise Hero Banner

Climate Lab Enterprise

A powerful solution for net-zero investing enterprisewide

Social Sharing

Climate Lab Enterprise Intro

What is Climate Lab Enterprise?

Climate Lab Enterprise provides institutional investors with the tools and services they need for net-zero alignment. It combines a comprehensive set of climate data and analytics with powerful forecasting tools to help investors measure, monitor and manage climate risk and the shift to sustainable growth consistently across companies, portfolios and enterprises.

For delivering on climate commitments

For delivering on climate commitments

Jorge Mina, Head of Analytics and Linda-Eling Lee, Head of ESG and Climate Research, discuss how Climate Lab Enterprise can help you align your portfolio with a net-zero future.

Why Climate Lab Enterprise

Who is Climate Lab Enterprise for?

Owners and managers of assets are aligning their investments with the goal of transitioning to an economy that removes as much greenhouse gas from the atmosphere as it puts in. Getting there will demand insight into how climate risk could affect their portfolios, an understanding of companies’ climate trajectories and the capacity to track and report progress.

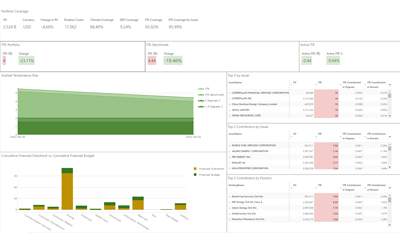

Enterprise-scale climate alignment

- Analytics for climate risk management and scenario analysis across asset classes, issuers, portfolios and enterprises

- Forward-looking tools, including Implied Temperature Rise, to manage portfolios’ pathways to net-zero

- Dynamic dashboards for easy monitoring of climate investment strategies across the entire organization

- Market-leading climate data across multiple asset classes

- Scalability from small institutions to enterprises with millions of positions

Climate investment data and analytics in a single solution

Climate Lab Enterprise brings together MSCI’s industry leading analytics and climate research to give investors the ability to take control of their net-zero alignment.

- Measure portfolio exposure to carbon-intensive issuers and visualize companies’ future emissions trajectories.

- Explore climate risk and opportunities by issuer or sector.

- Perform climate-related scenario analysis and model exposure to climate transition and physical risk, including policy scenarios and physical hazards.

- Drill down on data for insights that underpin our equity, fixed income and private asset models.

- Understand climate exposure trends over time and track toward targets.

- Forecast enterprise climate emissions based upon issuer targets.

- Identify issuers for engagement.

- Compare portfolios to benchmarks, positions across portfolios, and how rebalancing strategies may affect climate exposures.

- Deepen insight into financed emissions relative to benchmark at different levels of the hierarchy as well as by sector and rating.

Take your first step toward net-zero. Demo Climate Lab Enterprise

climate risk exposures across all portfolios

Leading-edge climate data with multi-asset class coverage

Climate Lab Enterprise Image

subscribe callout

Climate Lab Enterprise

Featured content

Introducing Climate Lab Enterprise

Introducing Climate Lab Enterprise

Explore how owners and managers of capital can be a force in confronting the single biggest challenge of our time.

Climate lab Cards

Related content

Climate Investing

Learn how Climate Investing can help investors and issuers utilize climate data and tools to support their investment decision making.

Explore moreClimate and Net-Zero Solutions

MSCI offers a suite of tools to help institutional investors benchmark, measure and manage portfolio exposure to climate risk, identify low carbon investment opportunities, and support investors seeking to set a net-zero target.

Read moreClimate Data & Metrics

MSCI offers over 700 climate change metrics including Climate VaR, Low Carbon Transition Score, forward looking indicators, emission data, fossil fuel exposure, clean tech solutions to facilitate integration across the investment process.

Learn moreImplied Temperature Rise

Designed to show the temperature alignment of your investments with global climate targets.

Read more