Factor Indexes - hero

Factor Indexes

Social Sharing

What are Factor Indexes?

What are Factor Indexes?

Our Factor Indexes are designed to help institutional investors who seek to capture the excess return of factors in a cost-effective and transparent way. These rules-based, transparent indexes target stocks with favorable factor characteristics – as supported by robust academic findings and empirical results – and are designed for simple implementation, replicability - and use for both traditional indexed and active investment mandates.

A factor index also can bring transparency to factor allocations, helping to alleviate the potential problem of manager style drift and may have positive implications for risk management. Due to the historical cyclicality of factors, investors may want to diversify away from a single factor without diluting their exposure to their target factors or changing the risk profile of their portfolios. MSCI’s Multiple-Factor Indexes provide building blocks that let investors assemble multiple-factor allocations based on their objectives for risk and return, their investment beliefs on individual factors- and their investability constraints.

Icons

Click on any of the factor icons below to learn more about the MSCI single factors:

Benefits of our Factor Indexes

Benefits of Factor Indexes

-

Asset allocation

Adding a factor-return component to portfolio strategies.

-

Performance measurement and attribution

Benchmark factor-driven performance of specific investment strategies, as well as define factor-based stock universes.

-

Research

A trusted source of data for sell-side research.

-

Investment product development

May be licensed for use as the basis for structured products and other index-linked investment vehicles, such as ETFs and ETNs.

What types of Factor Indexes do we offer?

What types of Factor Indexes do we offer?

In addition to Single - Factor Indexes, we offer MSCI Multiple-Factor Indexes, which aim to give institutional investors a foundation for implementing multi-factor strategies transparently and efficiently. There are two primary ways to gain multi-factor exposure using our tools:

- MSCI Diversified Multiple-Factor Indexes: Target outperformance while maintaining a risk profile similar to the parent index, using factor optimization.

- MSCI Factor Mix Indexes: Aim to represent the performance of equity in multiple factors, while benefiting from diversification and flexibility. The MSCI Factor Mix A-Series, MSCI Factor Mix A-Series Capped and MSCI Quality Mix (E-Series) are part of the MSCI Factor Mix Indexes.

Factor Indexes wm

MSCI Single

Factor

Indexes

MSCI Single

Factor

IndexesMSCI

Diversified

Multiple-Factor

IndexesMSCI Factor

ESG Target

IndexesMSCI Factor

Tilt

Indexes

MSCI Single Factor Indexes: MSCI Factor Indexes are rules-based, transparent indexes targeting stocks with favorable factor characteristics – as backed by robust academic findings and empirical results – and are designed for simple implementation, replicability, and use for both traditional indexed and active investment mandates.

Read moreMSCI Diversified Multiple-Factor Indexes: These indexes combine four well-researched factors — value, momentum, size and quality — with a control mechanism designed to keep volatility in line with the market.

MSCI Factor ESG Target Indexes: As factor allocations and ESG objectives become simultaneous requirements for many asset owners, MSCI Factor ESG Target Indexes allow clients to develop factor strategies while also integrating ESG considerations.

MSCI Factor Tilt Indexes: For large-scale asset managers and asset owners for whom investability is critical, narrow factor indexes may not have sufficient liquidity and capacity due to their concentrated nature. The MSCI Factor Tilt Indexes have higher investability requirements by tilting market - capitalization weights of securities based on relevant factor scores.

Additional Factor Indexes

- MSCI Diversified Multiple-Factor Indexes

- MSCI Factor Mix A-Series Indexes

- MSCI Dividend Masters Indexes

- MSCI Equal Weighted Indexes

- MSCI Factor Indexes

- MSCI High Dividend Yield

- MSCI Single Factor ESG Reduced Carbon Target Indexes

- MSCI Minimum Volatility Indexes

- MSCI Risk Weighted Indexes

- MSCI Select Value Momentum Blend Indexes

- MSCI Top 50 Dividend Indexes

- Índices MSCI Mexico Select Momentum Capped & Mexico Select Risk Weighted

- MSCI Dividend Points Indexes

- MSCI USA Quality GARP Select Index | Performance website | Factsheet (USD) | Methodology

Additional insights and research

Research

Factor Investing basics

- Foundations of Factor Investing

Full Paper | Research Spotlight

Factor Investing

- Can Alpha be captured by Risk Premia?

- Harvesting Risk Premia for large scale portfolios

- Harvesting Risk Premia with Strategy Indexes

- Incorporating Risk Premia mandates in a strategic allocation a case study

- Portfolio of Risk Premia: a new approach to diversification

- Applications of Systematic Indexes in the investment process

- Factor Indexes in perspective: Insights from 40 years of data part I

- Factor Indexes in perspective: Insights from 40 years of data part II

Single Factor Investing

- Finding value: understanding Factor Investing

- Flight to quality: understanding Factor Investing

- Harvesting equity yield: understanding Factor Investing

- Riding on momentum: understanding Factor Investing

- Constructing low volatility strategies: understanding Factor Investing

- One size does not fit all: understanding Factor Investing

Multi-Factor Investing

- Deploying Multi-Factor Index allocations in institutional portfolios

- Multi-Factor Indexes made simple

Factor indexes/Fact or Fiction

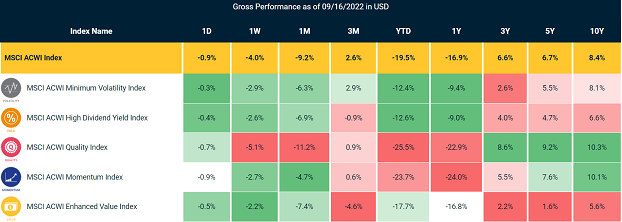

Factor Indexes Performance scorecard

This performance heatmap provides daily and historical performance of our Factor Indexes across various regions to power better investment decisions.

Factors are a Thing of the Past - Fact(or) Fiction?

Actually, our data shows factors matter now as much as ever. Read this to understand why.

Factor Indexes - related content cards

Related content

Equity Factor Models

Leverage factors like sustainability, crowding and machine learning for building more resilient portfolios as market conditions change.

Learn moreAwards 2021

Equity Factor Index Provider of the Year at Professional Pensions Investment Awards 2021.

Explore more