ESG rating hero image

What is ESG? | ESG Ratings methodology and video

Sidebar Navigation

- How MSCI ESG Ratings work

- How has ESG affected performance?

- What do we measure?

- AI & alternative data

- Our experience

- Applications

- ESG Ratings video

- For issuers

ESG Ratings Profile

Individual Investors

MSCI ESG Research LLC does not provide products or services to individual investors.

Contact your financial advisor or an investment professional

Search tool disclaimer

This information is subject MSCI Inc’s and MSCI ESG Research LLC’s terms of use that you can find here: https://www.msci.com/terms-of-use and here additional-terms-of-use-msci-esg-research-llc

This information may not be used for corporate financing purposes (including, without limitation, ESG-linked loans, credit facilities, securities or structured products), as a basis for any financial instruments or products (including, without limitation, passively managed funds and index-linked derivative securities) or other products or services, to manage any funds or portfolios, to verify or correct data in any other compilation of data or index, to create any derivative works, nor to create any other data or index (custom or otherwise), without MSCI's prior written permission.

MSCI App - ESG Ratings Promo

How MSCI ESG Ratings work

How MSCI ESG Ratings work

We use a rules-based methodology to identify industry leaders and laggards. We rate companies on a ‘AAA to CCC’ scale according to their exposure to ESG risks and how well they manage those risks relative to peers. We also rate countries and mutual funds and ETFs.

MSCI ESG Ratings provide insights into potentially significant ESG Risks so you can make better investment decisions and communicate with your clients. Download the MSCI ESG Ratings brochure.

Interactive Assets

How has ESG affected equity valuation, risk and performance?

How has ESG affected equity valuation, risk and performance?

In a recent study, MSCI researchers focused on understanding how ESG characteristics have led to financially significant effects. Our research showed that ESG affected the valuation and performance of many of the companies in the study.

ESG Ratings Separator

What do we measure?

What do we measure?

We rate 8,500 companies (14,000 issuers including subsidiaries) and more than 680,000 equity and fixed income securities globally*

We collect thousands of data points for each company, but there are only a handful of key issues that we’ve determined to be financially relevant.

* - as of June 2020

Explore the 37 ESG Key Issues below:

Interactive Assets

Climate change

Natural resources

Pollution & waste

Environmental opportunities

Human capital

Product liability

Stakeholder opposition

Social opportunities

Corporate governance

Corporate behavior

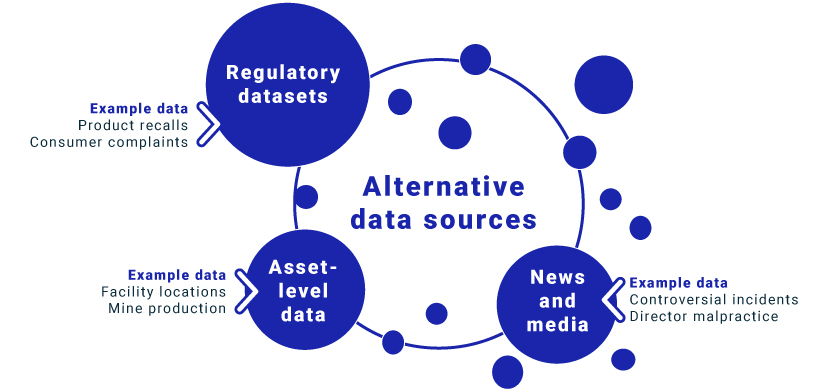

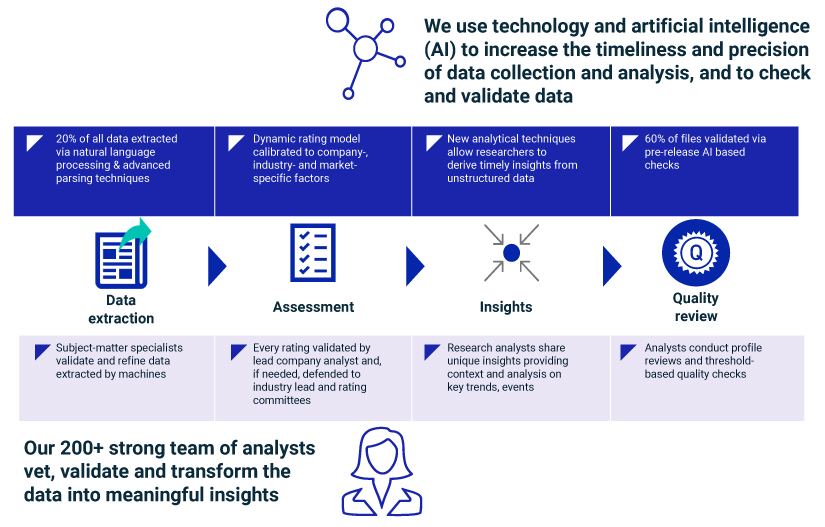

Artificial intelligence and alternative data

Artificial intelligence and alternative data

We use technology and AI, combined with our 200+ strong team of ESG analysts, to extract investment-relevant insights from unstructured data. Machine learning and natural language processing help us increase the timeliness and precision of data collection, analysis and validation to deliver dynamic content.

Alternative data helps minimize reliance on voluntary disclosure to deliver key insights. Alternative data sets are information about a company published by sources outside of the company. We use them to:

|

|

ESG Ratings Parallax 01

Our experience

Our experience

We have over 40 years1 of experience measuring and modelling ESG performance.

MSCI ESG Research is used by over 1,400 investors worldwide2 and forms the basis of our 1,500 Equity and Fixed Income Indexes.

We are recognized as a ‘Gold Standard data provider’3 and voted 'Best Firm for SRI research' and ‘Best Firm for Corporate Governance research' for the last four years.4

1 Through our legacy companies KLD, Innovest, IRRC, and GMI Ratings

2 Clients of MSCI ESG Research LLC and its affiliates as of March 2020

3 Deep Data Delivery Standard

4 The Extel & SRI Connect Independent Research in Responsible Investment (IRRI) Survey – 2015, 2016, 2017 & 2018/19

IRRI Awards Survey: MSCI ESG Research voted Best for SRI and Governance research 2015, 2016, 2017 and 2018/19

ESG Ratings Parallax 02

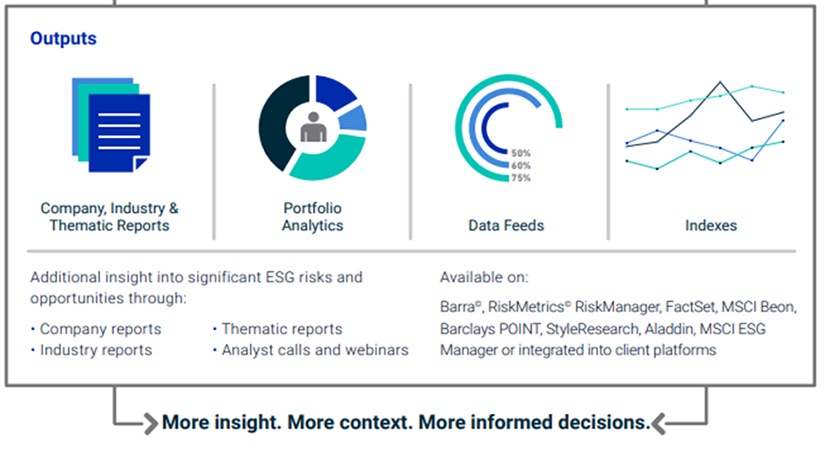

Applications: How clients use MSCI ESG Ratings

Applications: How clients use MSCI ESG Ratings

MSCI ESG Ratings is available in a variety of formats and platforms

How our clients use MSCI ESG Ratings

We do not just provide data; we find practical ways to make our data and analysis easy to use. We have also launched a new ESG Reporting Service.

MSCI ESG Reporting service

The MSCI ESG Reporting Service is intended to make your regular reporting to clients easier, more comprehensive, and more frequent. MSCI ESG Research can deliver batch portfolio reporting across any number of portfolios in a format and frequency that suits you. For more information contact esgclientservice@msci.com.

<!--How has the global real estate investment market evolved in 2018-->

For issuers

For issuers

If you are an issuer and would like to learn more about MSCI ESG Research, how we rate companies on ESG risks and opportunities and what data we collect, please visit our Issuers page. If you would like to reference your MSCI ESG Ratings on your website and marketing material, request your ESG Ratings badge.

ESG Ratings Our Topics

Legislation

MSCI ESG Research LLC. is a Registered Investment Adviser under the Investment Adviser Act of 1940. The most recent SEC Form ADV filing, including Form ADV Part 2A, is available on the U.S. SEC’s website at www.adviserinfo.sec.gov.

MIFID2/MIFIR notice: MSCI ESG Research LLC does not distribute or act as an intermediary for financial instruments or structured deposits, nor does it deal on its own account, provide execution services for others or manage client accounts. No MSCI ESG Research product or service supports, promotes or is intended to support or promote any such activity. MSCI ESG Research is an independent provider of ESG data, reports and ratings based on published methodologies and available to clients on a subscription basis.

Interested in Sustainable Investing?

Get the latest trends and insights straight to your inbox.

Select your topics and use cases to stay current with our award winning research, industry events, and latest products.