Hero - Portfolio management

Portfolio Management

Measure performance with a sharper, integrated view

Social Sharing

Intro - Portfolio management

Private capital standards that serve as Performance and Investment Books of Record

Manage your performance and cash flows confidently. Our platform is designed to organize and unify private asset information into a centralized hub that empowers users with the clarity needed to build better portfolios.

get in touch - Portfolio management

first screenshots - Portfolio management

commitments - Portfolio management

All your private capital commitments on one portfolio management platform

-

Improve visibility

Forecast cash flows and valuations to make more informed decisions about your private capital portfolio.

-

Better manage liquidity

Capture the full breakdown of capital calls, fees, distributions and recallable capital to see the full scope of your investment operation.

-

Gain insights

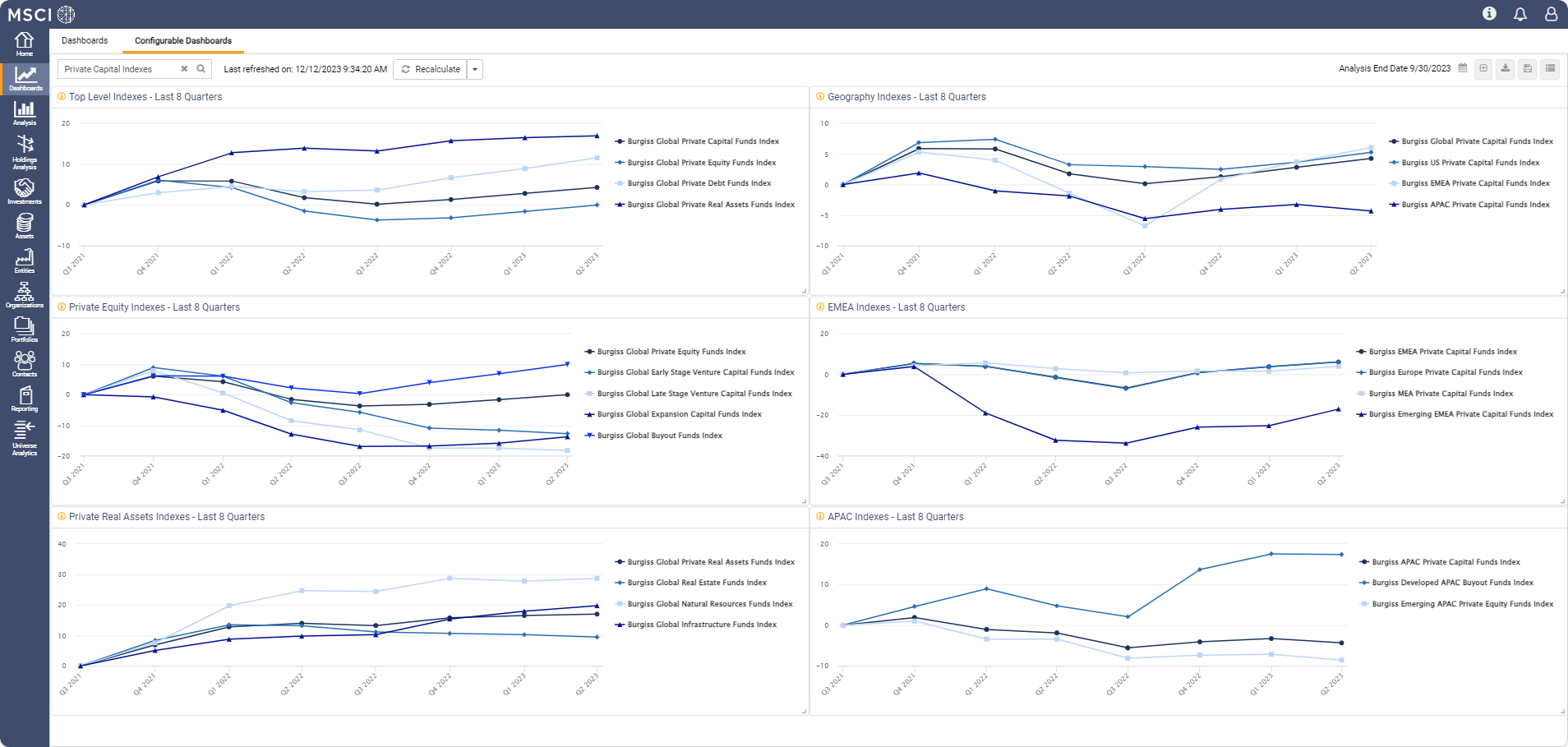

Streamline data interactions on one integrated, browser-based platform with reports, dashboards and advanced analytics.

monitor - Portfolio management

How we can help

-

Capture transaction activity

Gain confidence in your data through our investment book of record or shadow custodian record keeping services.

-

Measure performance

Calculate absolute and relative performance, standardized across managers, portfolios and peers.

-

Improve forecasts and pacing

Realize target allocations by better understanding future cash flows, valuations and unfunded commitments.

-

Analyze and report

Strengthen strategic decision-making with interactive dashboards and dynamic board-quality reports.

screenshot 2 - Portfolio management

the source title - Portfolio management

Who we serve

who we serve - Porfolio management

Why MSCI - Portfolio management

Why MSCI?

Over three decades, we have helped boost transparency for public and private markets. With experience in enriching, classifying and distilling data, we transform raw information into actionable insights presented in an easily digestible format. And as a result, the largest pools of capital use our vast datasets and tools to inform their critical investment decisions.2

interested in - Portfolio management

Related content - Portfolio management

Related content

Private i® Platform

Learn moreSurveying the Medley of Sub Lines in Private Funds

Read moreReal Assets

Learn moreFootnotes - Portfolio management

- 1 Funds Europe, June 30, 2022.

- 2 Eight of the ten largest private equity investors globally use our data and services as of December 2023.