Wealth- hero image

Wealth Managers

Advancing wealth

Wealth Managers - Intro

High-net-worth individuals have faster access to financial data and news today. Armed with that information, they are becoming more sophisticated investors, seeking deeper analyses using state-of-the-art tools. Wealth managers need to meet these rising client expectations. We can help. MSCI is advancing wealth.

Social Sharing

Our Solutions content Type 2

Our solutions

Discover the key ways we assist wealth managers and advisers.

-

Solutions development

Research, test and build new portfolios for your clients

Create scale and consistency in portfolio construction with our capabilities across indexes, ESG, climate and analytics. We offer foundational solutions and tools and content to power your activities across:

- Manager research and product due diligence

- Portfolio construction

- Risk monitoring and suitability

- Scaled personalized investing, e.g., Direct Indexing

Create exemplary investment solutions. Integrate risk analytics, factor exposures and ESG research. Monitor risk analytics and ESG at scale.

-

Sales enablement

Grow and convert clients

Empower your teams with robust knowledge, fresh insights and enhanced confidence. We support your sales enablement capabilities through:- Differentiated risk insights

- ESG and climate reporting

- Investment planning

Get data-driven business intelligence. Power effective investment decisions between advisers and clients. Better understand new investments.

Download fact sheet

(PDF, 236 KB) (opens in a new tab)

-

Client engagement

Have better conversations

Shift your conversations from technical exposure views and performance metrics to valuable insights that lead to more tangible and meaningful client discussions and outcomes. We enhance your client engagement through:

- ESG Ratings

- Factor and revenue exposure

- Risk impacts and stress tests

Elevate the value of your advice. Differentiate yourself with holistic portfolio diagnostics. Expand your business.

Featured Content

Featured content

Direct Indexing Solutions

Explore our simple guide that shows how Direct Indexing helps solve your business challenges.

Climate Exposure and Its Impact on a Client’s Portfolio

This video series stresses the importance of understanding climate change's impact on portfolios. April Cody from MSCI discusses how climate investing metrics can help Advisors both navigate risks and identify opportunities. It also explores all the resources available to help Wealth Managers and Advisors to integrate climate considerations into their client's portfolios.

Personalizing Climate-Focused Wealth Management Portfolios

The growing focus by investors on climate change is leading wealth managers to personalize portfolios in ways that off-the-shelf model portfolios may not address.

ESG and Climate Guide for Advisers

Advisers with the knowledge and tools to understand the nuances of ESG and Climate investing and position client portfolios accordingly can deliver additional value to clients and strengthen relationships.

Visualizing Investment Data

We explore and explain topics covering ESG, Climate, thematic and global investing through visually impactful infographics.

Content box

Additional resources about our offerings

Want to dive deeper? Use these further resources as a starting point.

-

ESG Ratings

Learn more about ESG-driven risk and opportunities.

-

MSCI FaCS

Explore the benefits of using a common language for factor investing.

-

Thematic Investing

Review how thematic investing can help you capitalize on opportunities created by macroeconomic, geopolitical and technological trends.

WM Tab Part 2

If you’d like to know more, get in touch

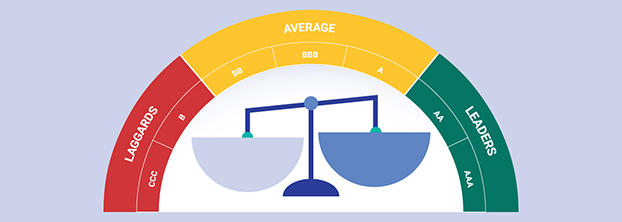

Whether you are incorporating ESG into portfolios, generating insights and reports, improving cost efficiencies or managing risk and return, you need the right tools and solutions to move your firm to a higher level.

WM Related Cards

Research for wealth managers and advisers

Our global research organization is a multi-disciplinary team made up of over 350 professionals specializing in ESG, fixed income, global equities, multi-asset classes and private assets.

Foundations of Climate Investing

This research looks at how equity markets have priced climate transition risks and whether companies climate transition risk profiles affect performance.

Access reportUsing Factors as a Magnifying Glass for Equities

Factors can provide great insights into stocks and equity portfolios. For instance, we can see that Amazon, Microsoft, Netflix and Zoom Video were not as similar as they appeared at first blush.

Read the blogSome ESG Funds Are Not Like the Others

ESG funds’ holdings can vary significantly, depending on their objectives, methodologies and geographic exposures. We examined the 20 largest ESG equity funds in our coverage universe.

Learn moreInterested in Insights for Wealth Managers?

Get the latest trends and insights straight to your inbox.

Select your topics and use cases to stay current with our award winning research, industry events, and latest products for wealth managers.

Email Sign-up

Sign up below and choose 'wealth management' as your business type to receive MSCI's latest updates and news for wealth managers.