low-carbon transition hero

Using Climate Indexes to Benchmark the Transition

Social Sharing

Benchmarking the transition

Owners and managers of assets may seek to move to investment policy benchmarks that provide a reference point for the path to net-zero. Climate indexes can help investors identify both stranded assets and green opportunities. Such indexes also may be used as the basis of climate-focused investment products.

How can Indexes support a Net-Zero investment strategy?

Though investors may have different objectives based on their investment strategy and time horizon, MSCI has observed three main objectives that investors commonly pursue as part of their climate strategy.

- Mitigate transition risk, by reducing exposure to carbon-intensive companies or industries

- Capture potential economic disruption and positive exposure,including how exposure to lower-carbon technologies and transition-solution stocks can be expressed while respecting other constraints.

- Promote stewardship by engaging with companies to encourage behavioral changes to improve operations and develop long-term strategies and incentives for climate risk management.

Each of these objectives can be addressed by using indexes such as MSCI Climate Paris Aligned Indexes, MSCI Low Carbon Indexes or MSCI Global Environment Indexes or combined with the use of MSCI Climate Change Indexes. The Climate Paris Aligned Indexes, for example, are designed to address climate change in a holistic way by minimizing exposure to transition & physical climate risks and aim to help investors seeking to align with a net-zero world.

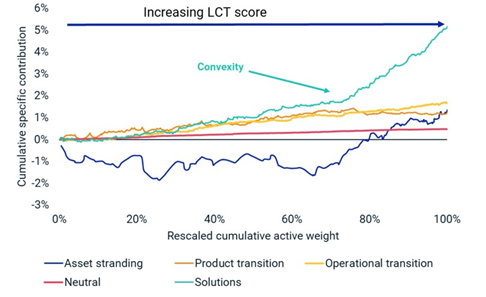

Companies with higher MSCI low-carbon transition (LCT) scores showed higher stock-specific returns over seven-and-a-half years that ended in January 2021

Companies with higher MSCI low-carbon transition (LCT) scores showed higher stock-specific returns over seven-and-a-half years that ended in January 2021

More broadly, MSCI has found that companies in the MSCI ACWI IMI with better environmental, social and governance characteristics were associated with higher profitability, less exposure to risk that led to major drawdowns, and lower exposure to systemic risk, as evidenced by less volatility over 13 years that ended in December 2019. The higher-rated firms also paid less for capital than their lower-rated counterparts.

Featured Content

Featured content

How the United Nations Joint Staff Pension Fund is leading the way to net-zero

How the United Nations Joint Staff Pension Fund is leading the way to net-zero

In this case study, learn how the fund is raising the bar for action by asset-owner investors to lower the greenhouse gas emissions of their investments using MSCI data.

How the United Nations Joint Staff Pension Fund is leading the way to net-zero

How the United Nations Joint Staff Pension Fund is leading the way to net-zero

In this case study, learn how the fund is raising the bar for action by asset-owner investors to lower the greenhouse gas emissions of their investments using MSCI data.

Identifying Climate Leaders and Laggards in your Portfolio?

Identifying Climate Leaders and Laggards in your Portfolio?

MSCI’s Low-Carbon Transition (LCT) Score calculates a company’s climate transition risk by aggregating Scope 1, 2 and 3 emissions, emissions avoided, and the quality of the company’s climate management into a score between 0 (highest risk) and 10 (lowest risk).

How ESG ratings affect performance

How ESG ratings affect performance

Researchers from MSCI explore how environmental, social and governance factors, including climate change, performed by time horizon, sector and weighting.

Low-carbon transition related content

Related content

Climate 101: Aligning your Portfolio with a Net-Zero Economy

Explore how owners and managers of capital can be a force in confronting the single biggest challenge of our time.

Read more