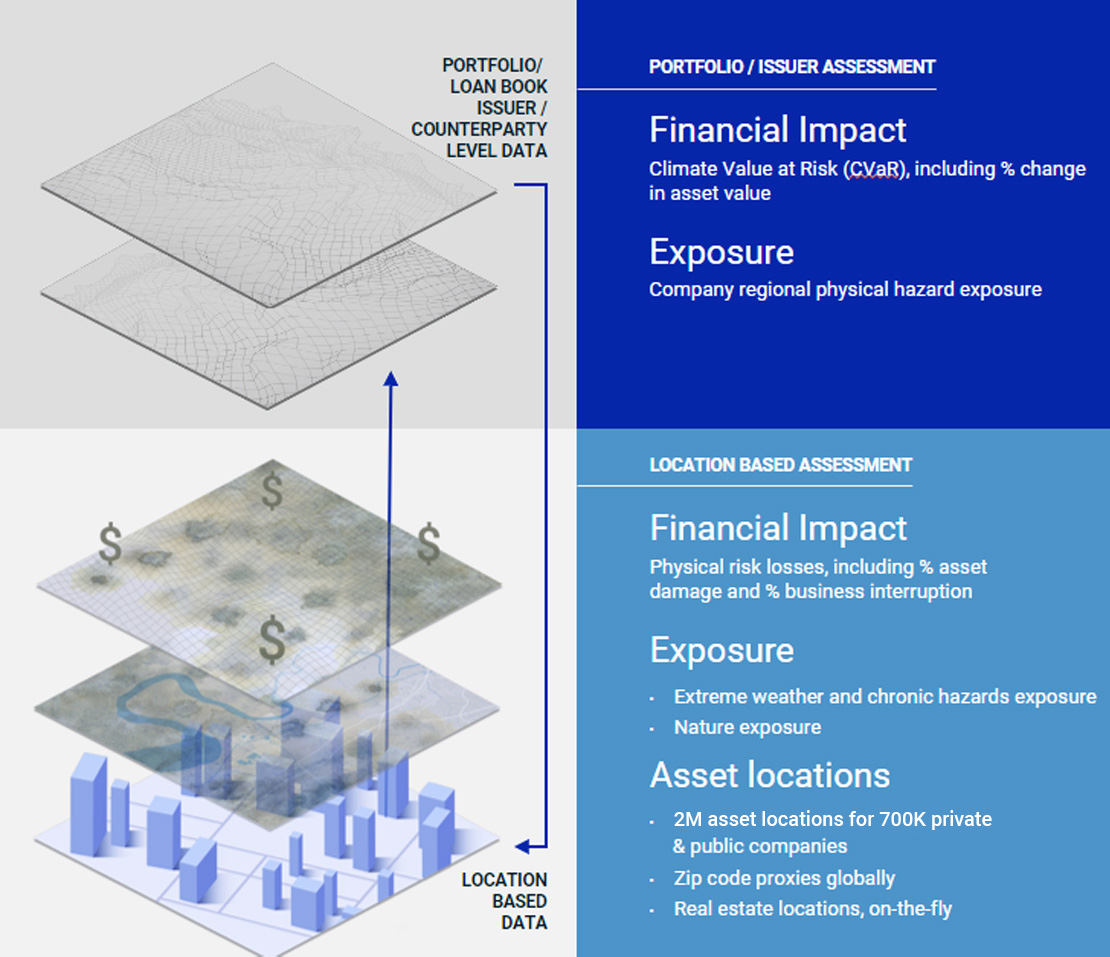

Identify asset locations

Gain insight from global, detailed, company-linked asset location data with MSCI’s AI-powered Geospatial intelligence.

Submit your own real estate locations for a full portfolio picture across asset classes

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

Identify risk where it matters

The transition to a low-carbon economy is taking longer than expected, while physical risks from climate change are accelerating. Physical risks and biodiversity are a critical financial factor, affecting not only companies but investors, insurers and banks.

$300 billionof damages from a record number of extreme weather events that hit Earth in 2023.1

50%of global economic output is dependent on functioning ecosystems, while biodiversity is on the verge of collapse over the coming decade.2

Physical risks from climate change are accelerating globally, but impacts are felt at the local level. Geospatial intelligence of where a company operates is essential for risk management, investment/lending due-diligence, regulatory compliance, and corporate engagement.

MSCI GeoSpatial Asset Intelligence is designed to help you identify the operational assets that matter. Powered by AI for data collection processes, mapping capabilities and enhanced coverage on-demand, our technology enables drill-down insights into physical risk & nature and their financial impacts from your portfolio or loan book to individual locations.

Gain insight from global, detailed, company-linked asset location data with MSCI’s AI-powered Geospatial intelligence.

Submit your own real estate locations for a full portfolio picture across asset classes

Understand location-specific exposure to physical hazards and nature risks. Uncover the likelihood and severity of a hazard at a given corporate or real estate location.

Translate physical risk to financial impacts including asset damage and business interruption for any corporate facility or real estate building.

Download our factsheet to learn more about the capabilities of MSCI GeoSpatial Asset Intelligence. Discover more solution details, data coverage, and additional benefits.

Acquiring asset-level data, especially data tied to corporates, can be challenging.

Continuously expanding, detailed location-based data of 700K public and private companies with over 2M4 locations.

Zoom in any asset location, explore by hazard type, climate scenario or point in time. Our extensive core mapping file enables easy look-up and matching of any identifier in your portfolio with our large asset location core universe.

Enhance your coverage where it is most relevant to you. We expand our coverage universe on request for missing companies or funds, adding relevant location data. Additionally, submit your real estate locations on-the-fly.

In collaboration with Google Cloud, we use AI and Large Language Models to enhance our data collection and querying processes to fuel the calculations that power our solution.

Biological diversity is rapidly declining — and becoming a material risk to investors. That means they need advanced tools to measure impact and manage risk.

Learn moreClimate change does not impact every region in the same way. Gain a clear view to better manage risk and take climate action.

Read moreMeasuring the impact of climate change on real estate assets.

Download PDF