Hero banner content

ESG Reporting Service

The service is designed to make reporting on the ESG characteristics of portfolios easier, more comprehensive, and more frequent.

Intro

The MSCI ESG Reporting Service aims to offer clients access to greater transparency and convenience by introducing reporting as a managed solution that can be scaled to tens or thousands of portfolios. Our portfolio reporting service, part of our Managed Solutions offering, includes a library of reporting templates that meet specific use cases, including Climate Change and TCFD reporting, as well as customization capabilities to deliver client-branded reports.

Contact our ESG Client Service team to learn more.

First Header

Reporting in the Age of Transparency

Quotes from Linda

First Header Para

There is growing demand amongst investors for greater transparency, driven by a desire to better reflect their investment strategies, views, and values. The age of transparency calls for improved reporting capabilities, designed to facilitate detailed reporting on the ESG characteristics of their portfolios to meet the needs of clients seeking to align with regulatory requirements.

Second Header

ESG Regulations are on the Rise

The number of ESG regulations has increased substantially since the early 2000s. Investors generally have welcomed regulatory and quasi-regulatory measures that target issuers, as most of these regulations led to improved data disclosure and transparency on their portfolio companies. However, increasingly, regulators are ramping up scrutiny on the business of ESG investing, which may affect both asset owners and asset managers.

The Financial Stability Board (FSB) created the Task Force on Climate-related Financial Disclosure (TCFD) in 2015 to support the goals of the Paris climate agreement.1

In March 2018, the European Commission published its Action Plan on Financing Sustainable Growth. The action plan will have impacts all along the investment value chain including on Asset Owners, Asset Managers, Insurance Companies, Banks, Brokers/Dealers, Advisors, Credit Rating Agencies, Index Providers and Issuers. The plan includes measures with the aim of reorienting capital flows to sustainable investments, managing financial risks stemming from ESG issues like climate change and environmental degradation, and fostering transparency and long-termism in capital markets.2

Standards ESG

Standard ESG reporting templates for your reporting needs

We offer a library of standard, best practice reporting templates designed by MSCI ESG experts to solve for three common use cases including climate change and TCFD reporting, ESG integration reporting, and EU regulatory reporting. In addition to reporting services for ESG, our managed solutions suite combines three core offerings: data management, reporting and professional services, to help you solve complex operational challenges.

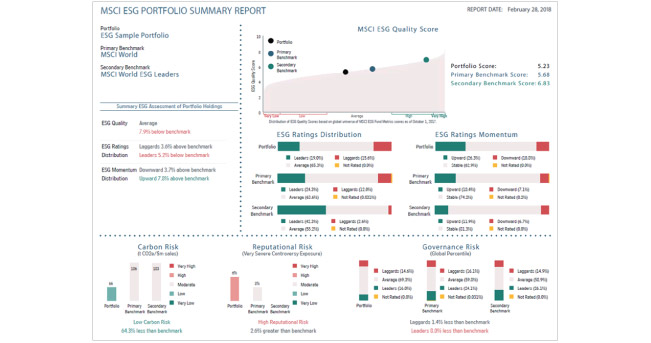

ESG Summary

ESG Summary

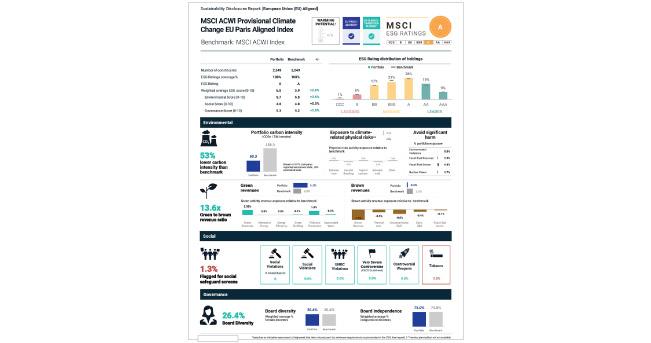

Climate Risk & TCFD

EU Sustainable Disclosures

A two-page report designed to assess ESG integration in a simple and intuitive way, featuring key portfolio level ESG signals including:

- MSCI ESG Ratings Quality,

- Distribution and Momentum,

- Carbon Risk,

- Reputational Risk, and

- Governance Risk

Designed to facilitate TCFD-aligned reporting by measuring portfolio exposure to:

- Climate risk, which measures how companies are positioned with regards to transition risk in the shift to a low carbon economy

- Clean technology, which measures portfolio exposure to companies providing solutions intended to mitigate climate change

Designed to provide sustainability metrics that are informed by the EU Green Taxonomy and Benchmark ESG Disclosure requirements of the EU Sustainable Finance initiative.2 The report provides metrics relating to:

- Alignment with EU Paris benchmark standards

- Alignment with EU Climate Transition benchmark standards

Third Header

ESG Reporting Capabilities and Customization Options

Reporting has become a strategic imperative for many investors as they look to intuitively illustrate the value of their ESG integration efforts and the impact on client portfolios. Our ESG reporting service is designed to help clients transform their internal production processes and enable increased reporting and transparency on the ESG quality of a portfolio to the end client.

We offer report customization as a managed solution where report templates are designed according to a client’s branding and content needs.

Start with existing templates

Customize or define new layouts

Scale delivery

Start with our existing templates for idea generation or to understand the capabilities and content set.

Design your own layouts and data outputs that MSCI ESG Research can then implement and deliver.

We automate the delivery of your reporting at your defined frequency.

Webinars

Recorded Webinars

|

|

TCFD Reporting and Scenario Analysis for North American Institutional Investors |

|

During this webinar, we will identify key questions to consider, share examples from market participants, and outline the tools available from MSCI to support the journey to TCFD implementation, from carbon footprinting and climate reporting to scenario analysis and stress testing solutions. |

|

Listen to Recorded Webinars: | |

| Americas EMEA | |

|

|

Part I: The European Commission's EU Taxonomy for Sustainable Activities: What do institutional investors need to know? |

|

The cornerstone of the EU's Action Plan on Financing Sustainable Growth calls for the establishment of a unified EU classification system for sustainable activities (the “taxonomy”), which is intended to provide guidance on activities qualifying as contributing to climate change mitigation and adaptation, environmental and social objectives. Listen to Webinar |

|

|

|

Part II: The European Commission’s Taxonomy for Sustainable Activities and other Key EU Action Plan Developments |

|

In Part II of this series, we provide an update on significant legislative developments, flag important consultations and the opportunity to provide feedback, and review what to anticipate from the EU next. Listen to Webinar |

|

Learn More about our ESG Solutions

Learn More about our ESG Solutions

TCFD

This voluntary disclosure platform was designed to “provide a framework for companies and other organizations to develop more effective climate-related financial disclosures".

Read MoreManaged Solutions

Learn more about our solutions to help you solve complex operational challenges.

Explore Solutions