Multi-asset class hero image

Multi-asset class overview

Overview

We are committed to meeting our clients’ needs for coverage of both traditional and alternative asset classes. Our experience in equity markets dates back to 1969, when we introduced the first set of global equity indexes. We launched our first multi-asset class risk models in 1975.

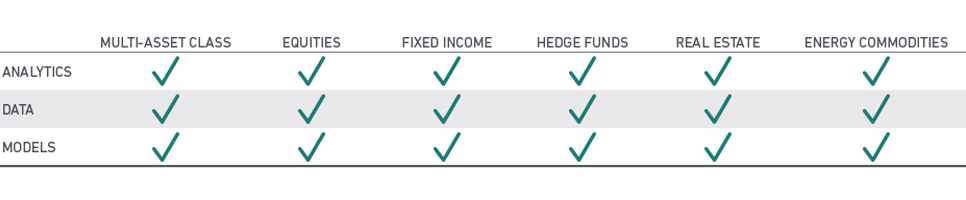

Today, MSCI offers research and sophisticated tools for constructing, managing and reporting on portfolios across both liquid and illiquid asset classes, including energy commodities, equities, fixed income, hedge funds and real estate.