Investment Insights Report Hero Banner

Investment Insights 2021

Global Institutional Investor Survey

MSCI Investment Insights 2021 Report

What are the critical challenges facing institutional investors?

We surveyed 200 institutional investors globally to better understand their views on the most important investment issues. What are the most important trends for the next three to five years? What is the lasting impact of COVID-19? And what is their latest thinking on factor investing, risk management, and diversity?

This report combines survey results with insights from our experts.

Investment Insights Video

Investors' Key Highlights

一月 27, 2021

What challenges and trends are driving institutional investment decisions across the world? The headline findings of the MSCI Investment Insights 2021 report are captured in this short video.

Key findings include:

Report Highlights

Flip cards

-

The move to ESG has accelerated

The move to ESG has accelerated

Some 73% said they were increasing ESG investing as a response to the pandemic, at least to some extent.

-

Data as a solution

Data as a solution

From real estate to private investments to risk management, investors are deploying data to solve problems. Some 79% use climate data to manage risk, at least sometimes, and 69% use this data to identify opportunities.

-

Factors and the quiet revolution

Factors and the quiet revolution

With little fanfare, factor investing has penetrated many investors’ thinking. Around half say factors are “completely central” to asset allocation. The study shows how investors are trying to connect together factor and ESG investing.

-

Pressure on diversity

Pressure on diversity

Although 63% reported at least some pressure to improve internal diversity, the pressure is uneven . Progress seems slow: Just 11% agreed that “I think the industry has become more diverse.”

-

U.S. investors: myths and reality

U.S. investors: myths and reality

U.S. investors, especially the largest, are in line with global trends on ESG—sometimes leading. U.S. investors emerge as agile and more focused on disruptive technology than those elsewhere.

Investment Insights Report Key Baer Pettit Duplicate 7

Investment Insights Report Key Baer Pettit

MSCI View

-

Introducing Investment Insights 2021 by Baer Pettit

Baer Pettit, MSCI’s President and Chief Operating Officer, shares his views on the challenges faced by institutional investors in today’s complex and unstable financial environment.

Investment Insights Report by Alvise

-

The Investment Ecosystem Under Stress

Global Head of Client Coverage, Alvise Munari, explains the interconnectedness of the challenges facing the investment industry, and how institutional investors of varying sizes can go about tackling them.

Investment Insights Report by Diana

The Investment Benefit Of Diversity

Diana Tidd, MSCI’s Head of Index and Chief Responsibility Officer, discusses diversity in the investment industry - and how the conversation is shifting from policies and metrics to tangible results.

Infographics

Infographic

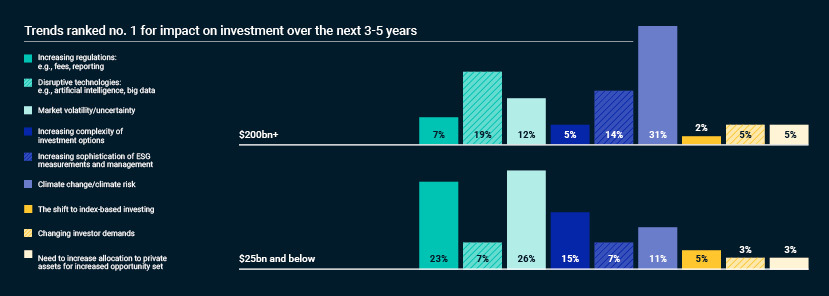

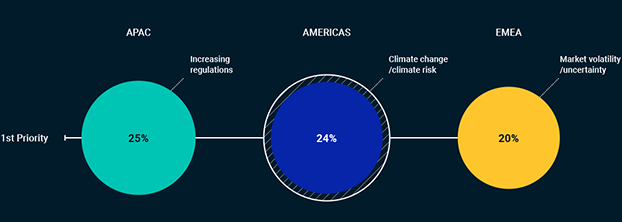

How Scale Makes A Difference

How Scale Makes A Difference

This infographic highlights the pressures acting on institutional investors - and how they differ according to AUM. The largest firms have the resources to lead the industry on major issues, leaving smaller ones under pressure to keep up.

The State of Play in ESG

The State of Play in ESG

Once an issue for niche ‘green’ investors, data from our recent survey shows that ESG is now firmly established as a high-priority concern for institutional investors in all regions. View the key findings in our infographic.

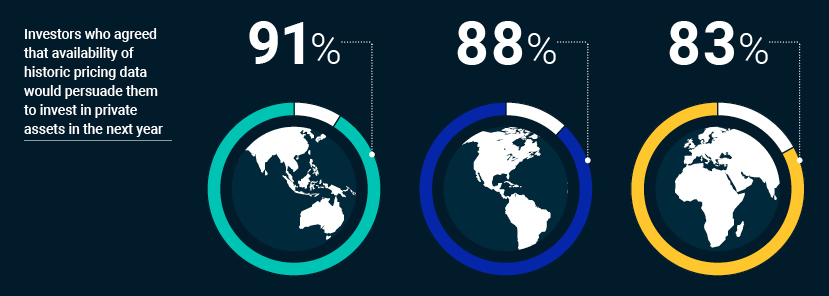

The Data-Driven Investor

The Data-Driven Investor

Where data on climate is available, investors are using it to make crucial decisions. This infographic shows how robust, high-quality data is becoming increasing important in all areas of investment decision-making

Related Content

Related Content

Asset Owners

MSCI helps pensions, sovereign wealth funds, insurance companies and other institutional investors make better investment decisions through consistent frameworks and tools to assess their portfolios.

Read MoreESG Framework for Asset Owners

We developed a six-step framework designed to support institutional investors seeking to integrate ESG & climate considerations into their portfolio construction and benchmarks.

Learn MoreHighlights of the MSCI Institutional Investor Conference 2020

At our recent annual Institutional Investor conference co-hosted by CalPERS and CalSTRS, we explored the issues asset owners face in building resilient portfolios.

Explore MoreContact Us

Want to learn about Investment Trends? Request for more information from one of our representatives.

Contact Us

Want to learn about Investment Trends? Request for more information from one of our representatives.