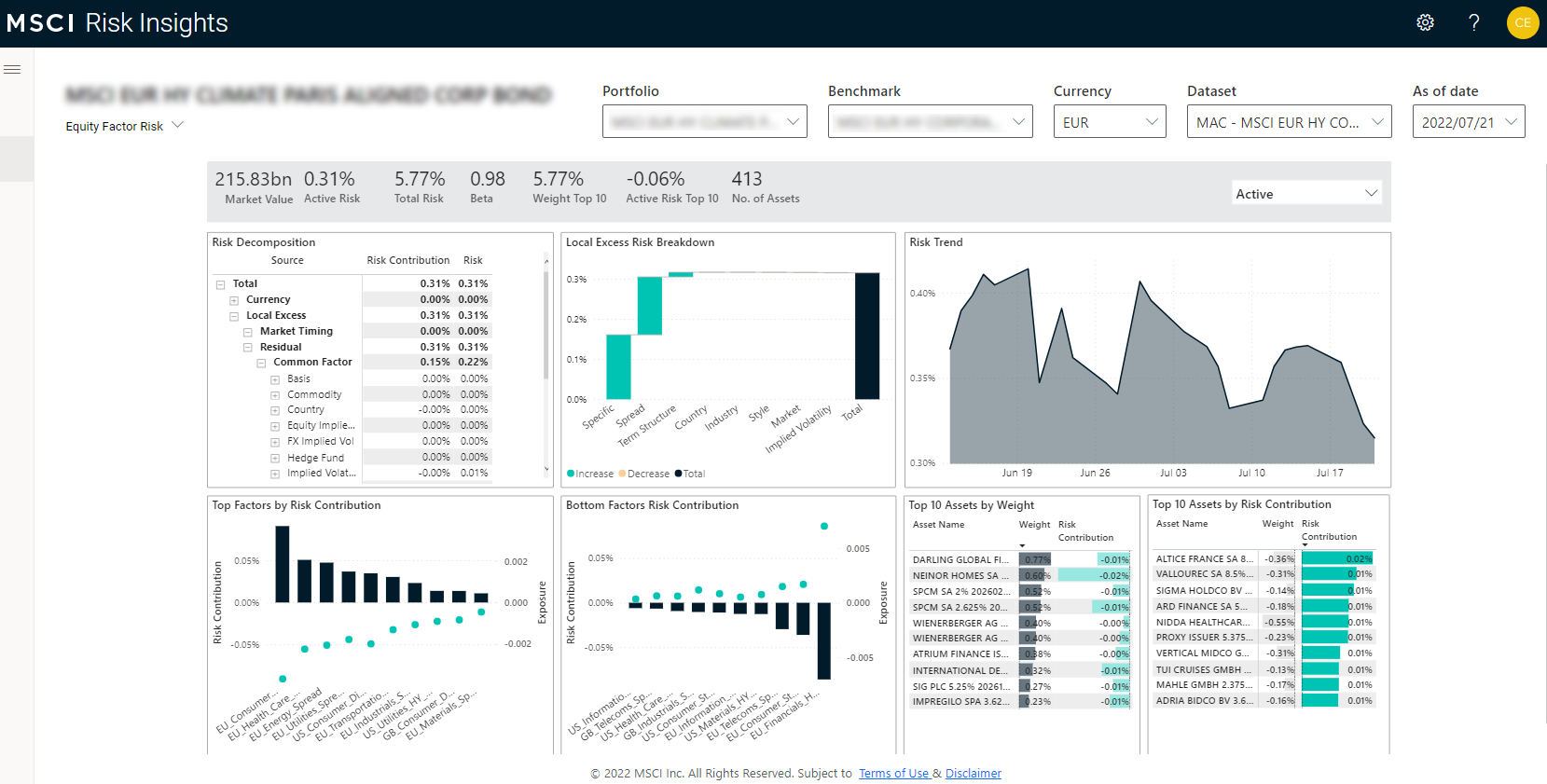

Make the data usable

- Flexible visualization with a curated set of default dashboards that deliver key insights

- Curated data model to make the results useful by storing them in a purpose-built cloud-based data model

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

Insights that matter

Risk managers need a wide range of risk measures to create a comprehensive picture of risk across their portfolios. Current processes focus on synthesizing large amounts of data and generating results rather than deriving meaningful insights from the data.

By automating processes -- going beyond data delivery -- and transforming data into usable information, we provide you with an understanding of the overall level of risk in your portfolios, how that risk has changed, what caused the changes, and what can be done about it. In short, insights that matter.

MSCI Risk Insights delivers a single view of risk to help you innovate faster, identify trends, and gain market insights to respond quickly to a rapidly changing investment landscape. Learn more.

Download Transcript (PDF, 85 KB) (opens in a new tab)

The Risk Insights module delivers a single view of risk allowing you to innovate faster, identify trends, and gain market insights to respond quickly to a rapidly changing investment landscape.

Through a curated set of dashboards, you will get a dynamic overview of time-series, factor risk, and stress testing capabilities, to turn risk results into actionable information.

Easily find concentrated positions, sectors, factors, or portfolios

Identify what contributed to your change in risk and quickly understand the elements that drive the risk of your portfolio over time

Analyze how your portfolios and their risk profiles have changed over different periods and regimes

Quickly pinpoint statistically significant outliers

As an innovator in risk analytics, from the modern factor model to Value-at-Risk (VaR), MSCI continuously delivers impactful risk statistics to help measure, monitor and manage risk.

With cloud delivery, world-class content and key insights, you can transform your risk management process to create efficiency and enable a risk management culture. Contact us today to start the transformation.

We offer institutional investors an integrated view of risk and return. Our research-enhanced content and tools help institutional investors make better investment decisions, enhancing their understanding and analysis of market, credit, liquidity, and counterparty risk across all major asset classes, including ESG, climate and private assets, spanning short, medium, and long-term time horizons.

A multi-asset class, multi-currency risk and performance analytics platform that enables investors to use its risk forecasting model, correlated stress test engine and performance analytics together in an integrated fashion.

Read moreA service that helps investors to better manage their hedge fund investments using analytics calculated on the position-level holdings of each fund.

DownloadExplore MSCI’s solutions to help clients address some of the most complex aspects of compliance in the midst of an evolving regulatory landscape.

Learn moreLeverage factors like sustainability, crowding and machine learning for building more resilient portfolios as market conditions change.

Learn moreThe report demonstrates the movement of select liquidity risk indicators involving U.S. and non-U.S. corporate bonds and bank loans liquidity, and is designed to help you identify strategies for liquidity risk management.

Explore moreThe MSCI MAC Factor Model provides high to low granularity in looking at systematic strategy factors through an integrated and consistent framework.

Read more