ITR Hero Banner

Implied Temperature Rise

Designed to show the temperature alignment of your investments with global temperature goals

Social Sharing

ITR Intro

As investors sharpen their focus on the financial impacts of climate change, they may want to know whether the companies they are investing in today align with the global goal of keeping average temperature rise this century to well below 1.5 degrees Celsius (1.5°C) to prevent the worst effects of warming.1

What is Implied Temperature Rise?

What is Implied Temperature Rise (ITR)?

Implied Temperature Rise from MSCI ESG Research is an intuitive, forward-looking metric, expressed in degrees Celsius, designed to show the temperature alignment of companies, portfolios and funds with global temperature goals. Investors can use Implied Temperature Rise to set decarbonization targets and support engagement on climate risk. The ITR measure, which is also designed to support reporting for the Task Force on Climate-related Financial Disclosures (TCFD), is part of a platform of analytical tools from MSCI ESG Research for institutional investors to navigate the transition to net-zero at every stage.

|

|

|

|

To help investors navigate the transition to net-zero, MSCI ESG Research has made the Implied Temperature Rise of over 2,900 companies publicly available. You can search by company name or ticker to see the Implied Temperature Rise and the company's decarbonization target.

Explore the Tool

How Implied Temperature Rise works?

How Implied Temperature Rise works

- We look at the remaining carbon budget left for the world if we are to keep warming this century well below 1.5 degrees Celsius (1.5°C)2

- We use this budget and allocate an amount to about 12,000 public companies—including all companies within the MSCI ACWI Investable Market Index (IMI) universe

- We then look at all the public companies’ projected emissions until 2050, based on their current emissions, our analysis of their stated reduction targets and a credibility assessment

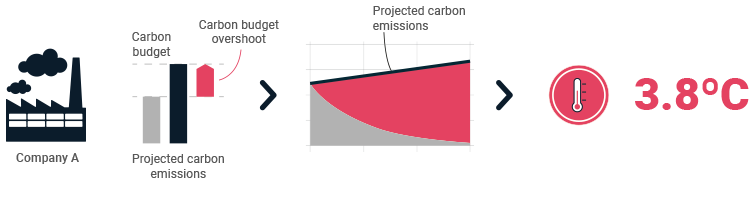

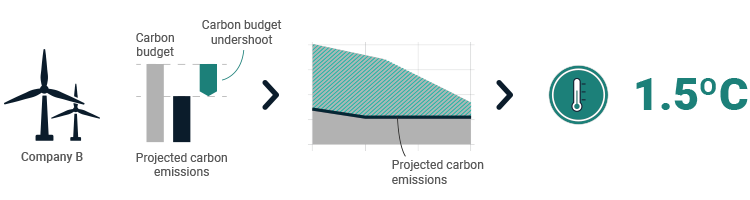

- All things being equal, a company whose projected emissions are below budget can be said to “undershoot,” while those whose projected emissions exceed the budget “overshoot”

- The over or undershoot is then converted to an implied global temperature rise - meaning how much would the temperature of the world increase if the whole economy had the same carbon overshoot or undershoot as the company in question

Company Overshoot Example

Company Undershoot Example

Header Required Duplicate 4

Implied Temperature Rise for Portfolios and Funds

Like the company metric, the Implied Temperature Rise of an investment portfolio provides an indication of how well the underlying holdings align with global climate goals.

Here is how we calculate it:

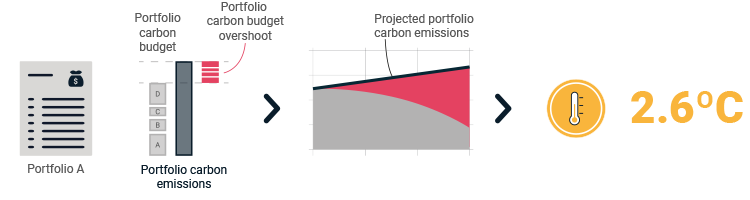

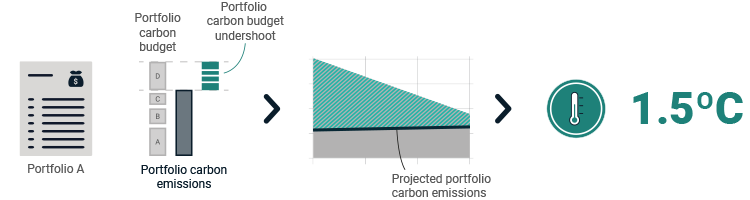

- We look at what public companies the portfolio holds and the carbon budget allocated to these holdings collectively.

- Then we look at the carbon budget overshoot for these same holdings collectively.

- The portfolio’s relative carbon budget “overshoot” / “undershoot” is then converted to a degree of temperature rise (°C) using the same approach as we do at the company level.

Portfolio Overshoot Example

Portfolio Undershoot Example

To learn more, please read our blog What Implied Temperature Rise Means for Funds.

Download Factsheet

(PDF, 440 KB) (opens in a new tab)

Key Features

Key Features

|

|

Easy-to-grasp metric to express portfolio alignment with global temperature targets |

|

|

Covers companies’ Scope 1, 2 and 3 carbon emissions (may include estimates) |

|

|

Available for nearly 10,000 issuers2 |

|

|

Forward-looking assessment developed by the MSCI Climate Risk Center |

|

|

Aligned with recommendations published by the TCFD Portfolio Alignment Team4 |

|

|

Based on data that can be easily examined and traced, together with analysis of companies’ decarbonization targets |

|

|

Supports TCFD reporting and net-zero strategy implementation |

|

|

Part of MSCI’s net-zero solutions and available via MSCI ESG Manager, MSCI Climate Lab, MSCI Analytics and other platforms |

subscribe callout

Our Net-Zero Strategy

Our Net-Zero Strategy

Our net-zero strategy

Path to Net-Zero Emissions

Target-Setting and Engagement

Client Communication

Facilitates Reporting

Our Net-Zero Resources ITR

Our Net-Zero Resources

Implied Temperature Rise is part of a platform of analytical tools that can help make climate considerations part of investment strategies.

-

Net-Zero Tracker

Gauge the contribution by the world's publicly listed companies to total carbon emissions together with their progress towards a net-zero economy.

-

Climate Target and Commitments Dataset

For untangling corporate decarbonization commitments.

-

Climate Scenario Analysis

Deep insight into how the physical and transition risks and opportunities of climate change may affect company valuations.

Want to get in touch to find out more?

Want to get in touch to find out more?

Please contact our team of climate specialists to learn more about Implied Temperature Rise, our series of net-zero solutions or to discuss your own climate objectives.

Contact Us

ITR Related Cards

Related Content

Climate Investing

Investors and issuers utilize climate data and tools to support their investment decision making.

Read MoreMeasuring the Temperature of Your Portfolio

Institutional investors are setting targets to align their portfolios with a 1.5˚-2°C global warming scenario. But measuring and reporting portfolio temperature rise remain challenging. How can investors measure the temperature of their portfolios?

Read MoreThe Implied Temperature Rise of Paris Aligned Indexes

Using Implied Temperature Rise — an intuitive metric that can be used to assess net-zero alignment — we analyze temperatures for climate-focused indexes designed to meet or exceed the requirements of the EU Paris-Aligned Benchmarks standard.

Explore MoreWhat Implied Temperature Rise Means for Funds

With COP26 over, the hard work begins as investors seek to limit temperature rise to less than 2°C above preindustrial levels in their portfolios. We investigate how they can understand whether a portfolio or fund is aligned with temperature targets.

Learn MoreESG Investing footnotes 2

Implied Temperature Rise is provided by MSCI ESG Research LLC. MSCI ESG Indexes and Analytics utilize information from, but are not provided by, MSCI ESG Research LLC. MSCI Indexes and Analytics are products of MSCI Inc. and are administered by MSCI Limited (UK).

ESG Investing footnotes

MSCI ESG Research LLC. is a Registered Investment Adviser under the Investment Adviser Act of 1940. The most recent SEC Form ADV filing, including Form ADV Part 2A, is available on the U.S. SEC’s website at www.adviserinfo.sec.gov (opens in a new tab).

MIFID2/MIFIR notice: MSCI ESG Research LLC does not distribute or act as an intermediary for financial instruments or structured deposits, nor does it deal on its own account, provide execution services for others or manage client accounts. No MSCI ESG Research product or service supports, promotes or is intended to support or promote any such activity. MSCI ESG Research is an independent provider of ESG data, reports and ratings based on published methodologies and available to clients on a subscription basis.

ESG ADV 2A (PDF, 355 KB) (opens in a new tab)

ESG ADV 2B (brochure supplement) (PDF, 232 KB) (opens in a new tab)

ESG Investing footnotes 3

1The Paris Agreement (PDF, 4.33 MB) (opens in a new tab), United Nations (2015)

2The company-level dataset will cover nearly 10,000 publicly listed companies based on the MSCI ACWI Investable Market Index, as of August 2021

3MSCI uses IPCC (Intergovernmental Panel on Climate Change) guidance to calculate a global 2°C carbon budget: “The IPPC Special Report on Global Warming of 1.5 °C (PDF, 2.68 MB) (opens in a new tab),” sets the remaining global carbon budget for varying temperature rises and probabilities (Table 2,2, at page 108 of the report).

4“Measuring Portfolio Alignment: Technical Supplement (PDF, 69 KB) (opens in a new tab),” Task Force on Climate-related Financial Disclosures, June 2021.

5The 2020 Measuring Portfolio Alignment Report recommends a TCRE factor of 0.000545°C warming per Gt CO2 which is based on IPCC 2013 The Physical Science Basis report (https://www.tcfdhub.org/wp-content/uploads/2020/10/PAT-Report-20201109-Final.pdf (PDF, 7.25 MB) (opens in a new tab)).