Hero - TEF

Total Emissions Footprinting

Streamline and unify the complex task of carbon footprinting.

Intro -TEF

See the complete picture of your financed emissions

Get a granular view of financed emissions for your total portfolio with disclosure-ready data for both public and private assets, including private equity and debt funds, real estate and infrastructure. Reduce the complexity of carbon footprinting and streamline reporting with data delivered via insights dashboards, Snowflake or any downstream integration tool.

Use cases - TEF

Use cases

See it all

See it all

Get aligned

Uphold fiduciary responsibilities

Align with regulatory requirements

Integrated Enterprise-wide view

As the first step on your climate journey, view your total financed emissions data in one place and measure your carbon footprint across both public and private asset classes, including direct investments and funds.

Deepen insight into the total financed emissions of your investing and lending, align with regulatory requirements and report on progress to stakeholders.

Integrate carbon footprinting into your investment process to align with fiduciary responsibilities and manage environmental risks that could impact long-term returns.

Report reliably with our investor-grade, disclosure-ready emissions data distinguished by its depth and quality.

Use our easy-to-access, unified financed emissions data and integrated insights dashboards on MSCI ONE dashboards and flexible output delivery through Snowflake.

Product preview - TEF

See total emissions clearly

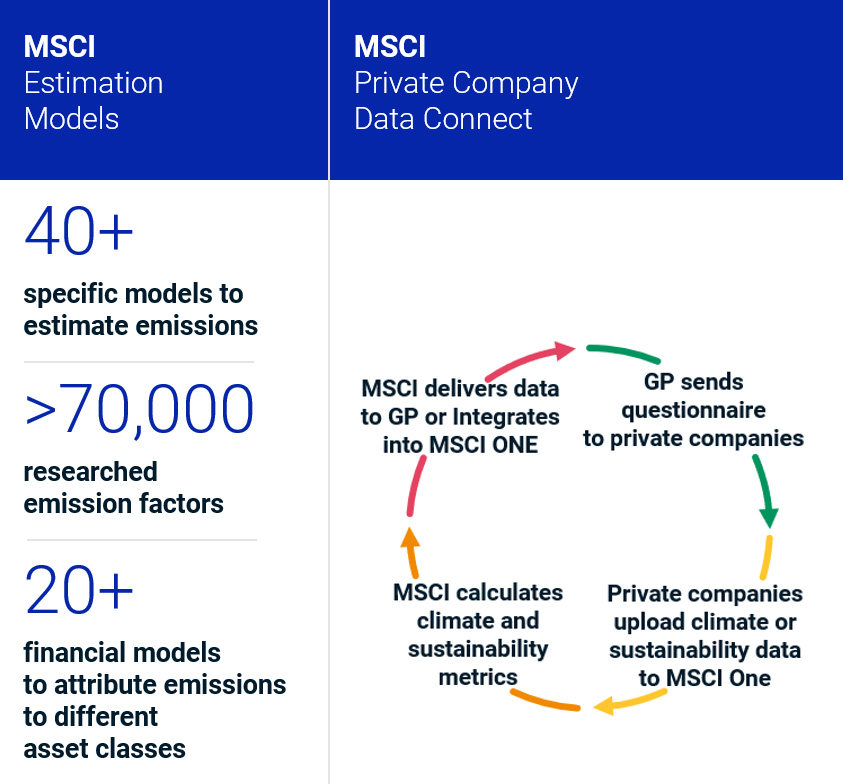

We cover your entire portfolio including Private Funds, Private Real Estate & Infrastructure. Manage reported emissions directly with private companies and leverage our growing body of private company data covering financed emissions across all emissions scopes.

Features and capabilities - TEF

Investor-grade, disclosure-ready emissions data

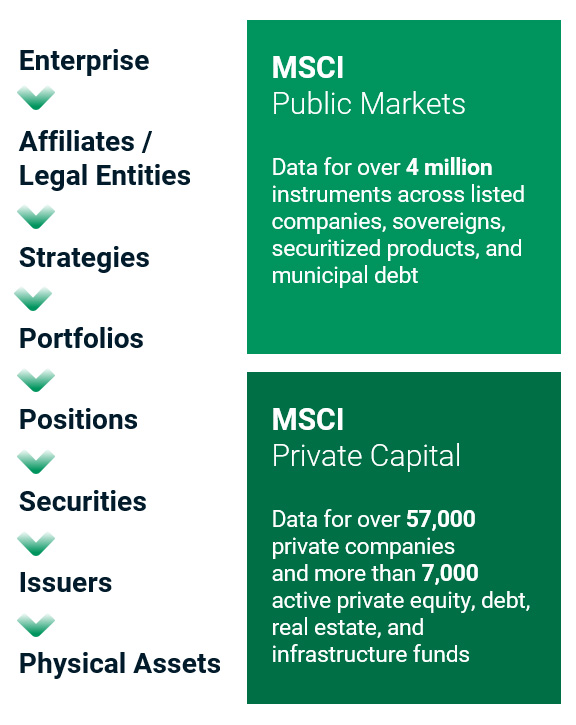

See the carbon footprint of your total portfolio clearly with our growing body of investor-grade, disclosure-ready data, offering the deepest insights into financed emissions. Enhance decision making with our proven methodology, leveraging multi-asset modeling and leading climate data delivered via our API and the cloud.

-

4 million+Securities across listed companies, sovereigns, securitized products and municipal debt

-

57,000+Private companies

-

7,000+Active private equity, debt, real estate and infrastructure funds

-

70,000+Emissions factors to get granular emission estimation for physical assets, companies, countries and local authorities

-

20+Financial models for attributing emissions to different asset classes

-

300+MSCI climate and sustainability experts in house

Source: MSCI ESG Research, as of March 2024

Accordion - TEF

Combined view of financed emissions with data where and how you want it

What will I see?

What asset classes does Total Emissions Footprinting cover?

Total Emissions Footprinting covers your entire portfolio including public and private equity and debt, private funds, private real estate and Infrastructure.

How can I use the data?

- Develop a granular carbon footprint as well as an aggregated view of your total portfolio.

- View financed carbon emissions and financed carbon intensity broken down by scope and asset type.

- Identify carbon intensive hotspots in portfolios to take action and minimize exposure to riskier assets.

- Surface drivers of real decarbonization.

- Deepen insight into position-level and issuer-sector analytics for financed emissions, carbon transitions, and fossil fuel and green revenue across sectors.

How do you deliver the data?

Our curated data model delivers your results directly in Snowflake or any downstream integration tool, so that you can pull information into your own enterprise data warehouse or proprietary systems at scale with ease.

CTA - TEF

Resources - TEF

Resources and research

What drives real decarbonization in your portfolio?

We present a framework that allows investors to understand to what extent changes in a portfolio’s carbon footprint are due to companies’ real-world decarbonization efforts, a portfolio manager’s investment decisions or changes in companies’ financing.

Demystify carbon footprinting

Assessing the carbon footprint of a portfolio is the first step in addressing the investment implications of climate change. But in a complex and fast evolving landscape, which are the best metrics and underlying inputs to use?

Related content - TEF

Related content

Climate and Net-Zero Solutions

Integrated data, analytical tools, indexes and insights for a clear view of the climate transition.

Learn morePortfolio Sustainability Insights

Get an integrated, enterprise view of climate risk exposure.

Explore moreFinancing the Climate Transition

Why investors combined decarbonization with financing the transition.

Read more