Business Development

Evaluate an Investor’s or Lender’s exposure to different property types and markets.

- Make market to market and peer to peer comparisons.

- Assess overall impacts to challenged sectors.

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

Assess debt from every angle with game changing data

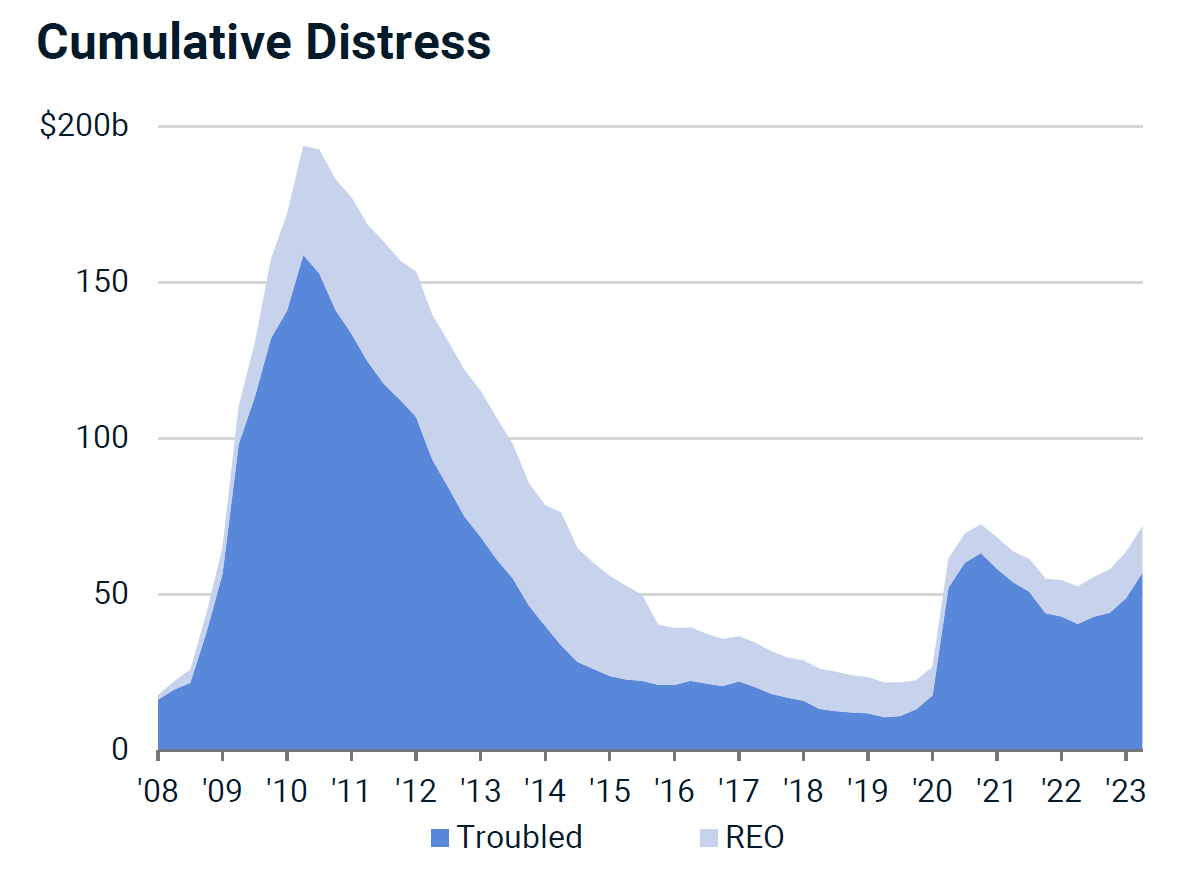

Our recent analysis shows U.S. commercial real estate loans set to mature in 2023 and 2024 total nearly $900b*. Find and understand distress from the very first signs of trouble, or even potential trouble, through to resolution with one of our key solutions, Mortgage Debt Intelligence (MDI).

Get the data, tools, and insights to help you locate distressed assets and find upcoming loan maturities--covering both securitized and private loans. We track distress cycles so that you can uncover opportunity, fuel action, and get ahead.

Evaluate an Investor’s or Lender’s exposure to different property types and markets.

Search by Potentially Troubled, Watchlist, Troubled, Special Servicing, Lender REO, Surveillance, Stalled Construction Projects, and Terminated Transactions.

Data as of July 18, 2023. Source: MSCI Mortgage Debt Intelligence.

Contact us to learn more about the US Distress Tracker report, powered by MDI.

The office market was the largest source of distress in U.S. commercial property in the second quarter, ahead of retail and hotel, which had previously been the biggest contributors of troubled assets. We summarize our latest findings on distress.

Learn moreConcerns about U.S. banks’ exposure to a slumping commercial-property market have put pressure on bank stocks. We analyze a sample of banks to discern differences in lending patterns by property type and location.

Read moreIn an environment of tighter lending and increased debt costs, commercial-property loans totaling nearly $900 billion will come due in 2023 and 2024 total. The biggest source is commercial mortgage-backed securities, according to our analysis.

Explore moreMSCI Real Capital Analytics has more than 15 years of experience tracking distress cycles using this proprietary methodology. Our global commercial real estate database spans over a million properties, $42trn transactions, 200,000 investor and lender profiles, and 1.5m deals across more than 170 countries. Our data is verified daily, and delivered how and when you want it via desktop portal, API or Snowflake.

*Source: US Capital Trends, March 2023. Contact us to learn more about the report.