Greenwashing Recedes as Common ESG Language Emerges Banner

Greenwashing Recedes as Common ESG Language Emerges

Social Sharing

Greenwashing Recedes as Common ESG Language Emerges Intro

Inflows to ESG funds in 2021 have been heady, but as ESG’s star has risen, so too have questions about its credibility. Skeptics and idealists alike tout examples of greenwashing or social-responsibility spin. The good news is that we see an emerging common vocabulary that should aid transparency and, more importantly, clarify choice.

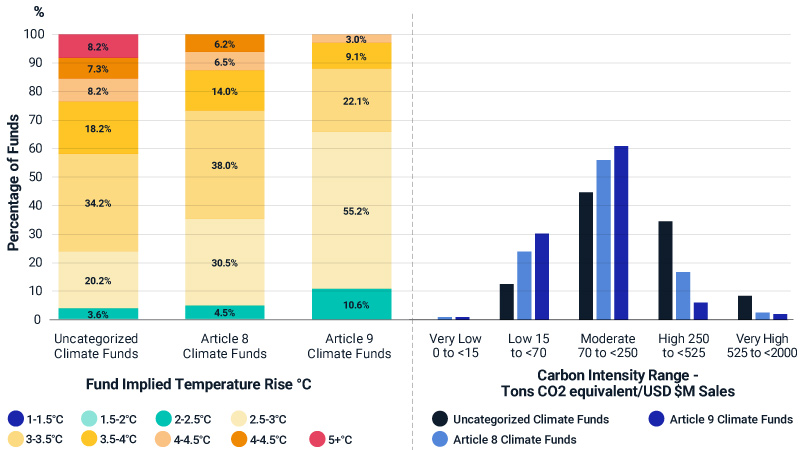

We’ve shown one way to use these fund labels below. With our Implied Temperature Rise metric1, we found that “Climate” equity funds categorized under SFDR articles 8 and 9 were more aligned with a 1.5o C to 2o C trajectory versus uncategorized funds (chart below to the left). These funds were also more distributed toward the lower end of the carbon-intensity spectrum (“very low” and “low”) and less towards the higher end relative to the entire fund universe (chart below to the right).

Greenwashing Recedes as Common ESG Language Emerges footnotes

Climate funds defined as mutual funds and ETFs that have “climate” in the product name and include climate-specific considerations in the investment strategy. No. of Funds: Uncategorized Climate Funds = 106, Article 8 Climate Funds = 45, Article 9 Climate Funds = 72. MSCI ESG Research LLC, as of Nov.11, 2021

At the product level, financial market participants are required to disclose whether they believe their funds fall under Article 8 or Article 9 of the SFDR, based on the funds’ objectives. Article 8 funds promote, among other characteristics, environmental or social characteristics or a combination of both. Article 9 funds must have a sustainable investment as its objective, in addition to adhering to good governance practices and taking into account the do no significant harm (DNSH) principle and the principle adverse sustainable impact (PASI) indicators.

2022 ESG Trends Report Buttons

Greenwashing Recedes as Cleaner ESG Labels Emerge Related Content

Related Content

2022 Trends to Watch

Ten trends for the coming year that could shape the risk profile for investors.

Explore TrendsRegulation at a Crossroads: Convergence or Fragmentation?

While we see convergence on some areas of ESG regulations and standards, there are signs of further fragmentation, driven by differing regional priorities.

Read MoreThe Story Behind ESG Trends

10 Year Anniversary – What Can The Past Tell Us About The Future?

Learn More