Regulation at a Crossroads: Convergence or Fragmentation? Banner

Regulation at a Crossroads: Convergence or Fragmentation?

Social Sharing

Regulation at a Crossroads: Convergence or Fragmentation? Intro

With at least 34 regulatory bodies and standard setters in 12 markets undertaking official consultations on ESG in 2021 alone, it’s no wonder that companies’ and investors’ heads are spinning. We see convergence in some core areas, yet there are signs of further fragmentation, driven by differing regional priorities.

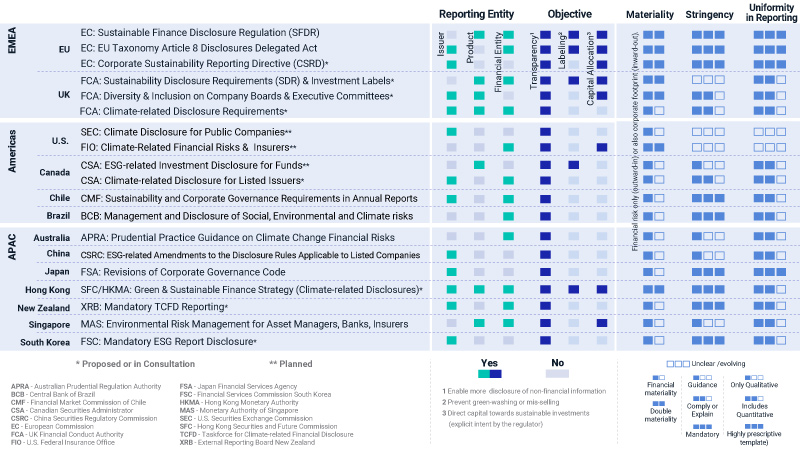

Just take a look at our preliminary analysis below that compared the current pipeline of rules and proposals from select agencies in key jurisdictions along five dimensions: reporting target; objectives; materiality; stringency and uniformity of reporting. All of these proposals tackle the issue of transparency in ESG investment standards, yet there is a lack of uniformity in the other initiatives of the regulations. Such differences could prove a persistent obstacle to global convergence on ESG-related regulations.

The table shows a representative selection of regulatory initiatives that meet three criteria: (1) directly affecting financing activities and/or investors’ reporting; (2) aimed at improving investors’ decision-making processes; (3) come into effect within the next five years. Only initiatives with sufficient details disclosed are included.1 Taxonomies2 and prudential regulation3 are excluded.

2022 ESG Trends Report Buttons

Regulation at a Crossroads: Convergence or Fragmentation? Related Content

Related Content

2022 Trends to Watch

Ten trends for the coming year that could shape the risk profile for investors.

Explore TrendsPutting ESG Ratings in Their Rightful Place

Regulation and market forces could encourage codes of conduct for constructing ESG ratings, making clear what they capture — and what they don’t.

Read MoreThe Story Behind ESG Trends

10 Year Anniversary – What Can The Past Tell Us About The Future?

Learn MoreRegulation at a Crossroads: Convergence or Fragmentation? footnotes

1 Initiatives that have been announced with limited detail as of the time of writing include: the U.S. SEC disclosure on human capital management and board diversity; the Swiss Federal Council planning mandatory climate reporting for large Swiss companies and for financial market players; the EU Sustainable Corporate Governance Directive (expected for Q4 2021); and the UK FCA Sustainability Disclosure Requirements for Companies.

2 As of the time of this writing, taxonomies existed or were in the proposal stage in many parts of the world: EU, China, Hong Kong, Malaysia, Singapore, UK, and the ASEAN region, plus the Common Ground developed between EU and China.

3 Inclusion of climate-related stress tests into prudential regulation is being promoted by the Network for Greening the Financial System (NGFS) with over 100 Central Banks. Climate stress tests for banks are currently being undertaken or planned in many jurisdictions, e.g. Canada, EU, Hong Kong, Malaysia, UK, US.