Markets Indicated Higher-than-Usual Downside Risk for EAFE and EM

Markets Indicated Higher-than-Usual Downside Risk for EAFE and EM

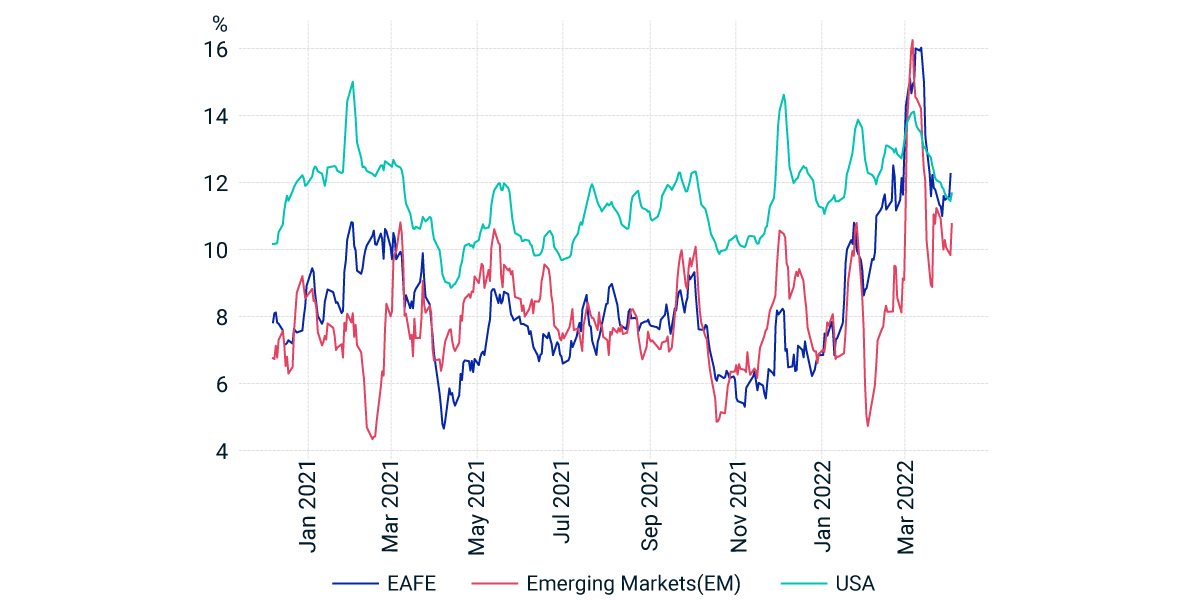

Using option-implied-volatility skew — a measure often used to gauge downside vs. upside risk — we have seen a substantial increase in EAFE and EM index skew since the start of the war. While this measure has historically been more pronounced in the U.S. markets, the change there was rather muted. This may indicate heightened risk aversion for international exposures. While the skew has more recently come down for EAFE and EM, we still observe higher-than-normal downside risk in those regions.

Greater implied-volatility skew for EAFE, EM compared to respective histories

Social Sharing

Markets Indicated Higher-than-Usual Downside Risk for EAFE and EM related content

Related Content

Russia - Ukraine War

MSCI is closely monitoring the Russian invasion of Ukraine and how it might affect our colleagues, clients, and business partners. We will continue to assess the implications.

Explore MoreNot Your Father’s Stagflation (or Is It?)

The first quarter of 2022 started with concerns about inflation and the potential for low growth — conditions many of today’s investors haven’t seen outside of textbooks.

Listen to PodcastRussian Bonds: The 100-Year Storm?

The U.S. Treasury Dept. decided this week to effectively block payments to holders of two USD Russian sovereign bonds.

Learn More