面包屑导航

Hero image

MSCI BARRA US TOTAL MARKET EQUITY MODEL SUITE

MSCI BARRA® U.S. TOTAL MARKET EQUITY MODEL SUITE

Based on the latest research methodologies, the models in the Barra U.S. Total Market Equity Model suite are designed to provide insight across the investment process, ranging from portfolio construction and risk monitoring to trading.

On our models

Barra Equity Models offer the highest quality data, world-renowned research and supporting client consulting services. The models are built by a large team of 400 experienced industry experts working in cross functional teams comprised of researchers, mathematicians, statisticians and financial engineers. This combination of talent and leading-edge technology is what continues to drive MSCI’s success as the leading, global provider of portfolio management solutions.

MSCI offers a variety of models that cover a broad range of developed, emerging and frontier markets and over 88 countries around the world. The models cover a wide range of asset-classes including Depositary Receipts, cross-listed securities, ETFs and equity index futures.

On the MSCI Barra U.S. Total Market Equity Model Suite

The models in the Barra U.S. Total Market Equity Model Suite are designed to analyze and forecast sources of performance and risk for investments in the U.S. market.

MSCI’s new Barra U.S. Total Market Equity Model Suite has been built to include a new set of factors and factor structures that are aligned with multiple investment horizons, marking a new era for advancing the standard for measuring and managing risk in U.S. Equity markets.

KEY FEATURES

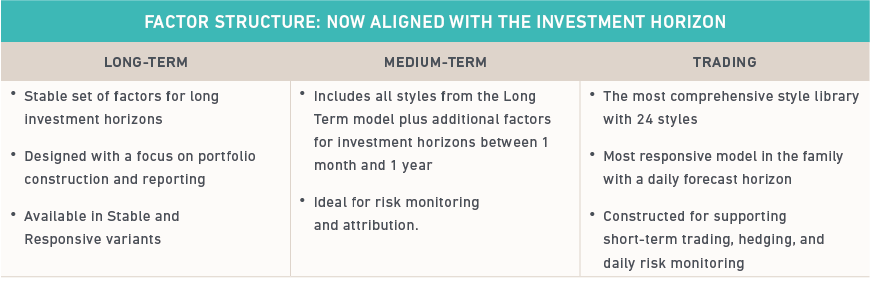

Aligned factor structure: The Long-Term Model incorporates the most stable set of investment styles. The Medium-term and Trading versions have additional styles best suited to their investment horizons.

New Factors: Inspired by the Systematic Equity Strategies research, they include Sentiment, Short Interest and Regional Momentum.

Full model data transparency: Model receipts are posted daily to our client support site. The receipt provides a summary of the model quality controls, providing transparency and insight into model reaction from changes in underlying data.

New methodologies: Includes Optimization Bias Adjustment, Implied Volatility Adjustment, and Volatility Regime Adjustment.

Descriptors: The building block of the model’s styles, are available to use across the investment process. This dataset is enriched by MSCI’s extensive quality assurance processes and the research team, to deliver value in alpha generation, portfolio construction and hedging.

Robust specific risk model: Incorporating Volatility Regime Adjustment and Bayesian Adjustment techniques for greater forecast accuracy.

Comprehensive coverage: We cover over 20,000 US securities including small-cap, microcap, IPOs, pink sheets, OTC securities and over 4,500 foreign-listed shares of U.S. companies.

Employing Systematic Equity Strategies

Employing Systematic Equity Strategies

In this Research Insight, we introduce "Systematic Equity Strategies" (SES), which refers to a rules-based implementation of investment strategies and anomalies.

MSCI BARRA® U.S. TOTAL MARKET EQUITY MODEL SUITE

MSCI BARRA® U.S. TOTAL MARKET EQUITY MODEL SUITE

Based on the latest research methodologies, the models in the Barra U.S. total market equity model suite are designed to provide an insight across the investment process.

Benefits of including Systematic Equity Strategy Factors

Benefits of including Systematic Equity Strategy Factors

In the MSCI Japan Equity Model, we include some well-known Systematic Equity Strategies as risk factors.