面包屑导航

PG&E - Californdia wildfires Image

Wildfire Engulf PG&E Corporation

Pressed by liabilities PG&E considers bankruptcy filing

On January 14, 2019, PG&E Corporation announced plans to file for bankruptcy as it faced mounting pressure of historic environmental and community impact liabilities and new rulings and settlements linked to its role in California wild fires. The amount of liability is estimated by the company to exceed USD30 billion. Following the announcement of the intent to file for bankruptcy, Ms. Geisha Williams stepped down from her position as CEO and President of the company.

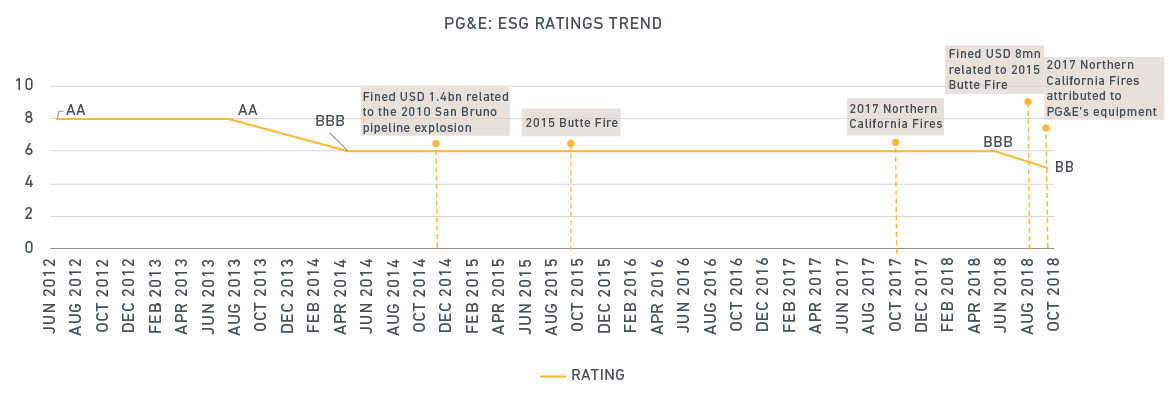

The company was downgraded by MSCI ESG Research in September 2018 from BBB to BB, based on concerns over potential financial liabilities related to the October 2017 Northern California wildfires. Due to the escalating regulatory scrutiny and growing projections over possible penalties related to the firm’s impact on land and communities MSCI ESG Research increased the overall weight of the Biodiversity & Land Use Key Issue in the September 2018 ESG Rating assessment for PG&E from 11% to 21%

PG&E’s Long History of Environmental and Community Impact Liabilities

The long list includes well publicized historic litigation over hexavalent chromium groundwater contamination that lasted 15 years, litigation over the San Bruno explosion in September 2010 that was settled in 2017, and regulators’ probe into the firm’s connection to the California wildfires in 2017 and possibly 2018. As a result, PG&E’s Biodiversity and Land Use risk management score, as measured on the scale of 0 (the weakest) to 10 (the strongest), has shown little fluctuation and has ranged between 0.0 and 1.1 over the last five years. We expressed concerns about PG&E’s safety record in our September 2017 assessment of the company, noting that “…a May 2017 report commissioned by the state regulator cited ‘uneven’ and ‘disjointed’ safety progress since the [San Bruno pipeline] blast.”

PG&E Corporation: MSCI ESG Rating Timeline

| Rating Date | Comments |

|---|---|

| April 2014 | Legal and regulatory proceedings related to the September 2010 rupture of its natural gas transmission pipeline in San Bruno, California result in cumulative charges of USD 565 million. |

| August 2015 | California Public Utilities Commission (CPUC) determined that PG&E committed approximately 3,700 violations and called for total penalties of USD 1.4 billion |

| July 2016 | The company continues to face legal and regulatory proceedings related to the San Bruno rupture. |

| September 2017 | PG&E was penalized for illicit backdoor communications with regulators related to the San Bruno incident |

| September 2018 | Investigations into the October 2017 fires allege PG&E of negligence in its vegetation management efforts. As of June 2018, the company had incurred charges close to USD 2 billion in wildfire-related claims. The potential liabilities associated with the scale of impact could result in significantly higher costs for the company. |

Volkswagen Scandal underlines need for ESG analysis

Volkswagen Scandal underlines need for ESG analysis

In September, German car manufacturer Volkswagen came under fire after admitting defective devices were installed on 11 million vehicles to cheat on emissions tests, leading to CEO Martin Winterkom’s resignation.

Introducing MSCI Climate Change Indexes

Introducing MSCI Climate Change Indexes

The indexes are designed to measure opportunities and risks associated with the transition to a low carbon economy.