Hero banner - 2022 Annual Report

Social Sharing

Letter to shareholder - 2022 Annual Report

Dear fellow shareholders,

As I write this letter in early March, we have just passed the one-year anniversary of Russia’s unprovoked and unjustified war in Ukraine, an event that has caused massive human suffering and significant disruptions around the world. We may eventually look back on the war as a hinge moment of history that permanently changed the global order. For now, it has forced leaders of all stripes to reimagine the future.

At MSCI, reimagining the future is part of our ethos. We constantly prepare for the unexpected while positioning ourselves to thrive in any environment. The past 15 months have offered a reminder that external challenges can quickly metastasize.

Indeed, it is hard to remember another time in the modern era when the global economy and financial markets faced so many different headwinds simultaneously: from war and geopolitical tensions, to high inflation and rising interest rates, to energy and food crises. These are the short-term realities that everyone must navigate.

They have intersected with longer-term, structural trends that are reshaping the investment landscape, such as the expansion of index investing, the shift to outcome-oriented investment strategies, and the increased focus on climate change and its impact on portfolios.

MSCI has always tried to capture the next evolution of global investing. This mindset helps us produce mission-critical data, models, analytics and technology. Today, we see enormous growth opportunities across product lines, asset classes and client segments.

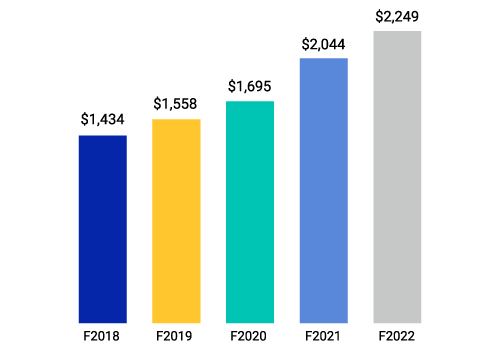

In 2022, these opportunities helped us achieve strong results despite significant market volatility. Among other highlights, MSCI delivered overall revenue growth of 10% — including recurring subscription-revenue growth of 16% — diluted earnings-per-share (EPS) growth of 23%, adjusted EPS growth of 15%, a record full-year retention rate of 95.2%, and share repurchases of nearly $1.3 billion. While the market unrest created headwinds and more variability for asset-linked fees, our index recurring subscriptions and transaction-volume businesses performed well through difficult operating conditions.

We have once again demonstrated the balance, adaptability and resilience of our all-weather franchise, which has enabled us to continue making crucial investments in long-term secular growth areas. These investments are helping us enhance our capabilities to meet the needs of a diverse client base.

For more information on our business, operations and financial condition as of and for the year ended December 31, 2022, please review our 2022 Annual Report.

Related content - 2022 Annual Report

Related content

Our Leadership

Our senior leadership team is comprised of highly experienced executives from diverse backgrounds.

Read more