Climate risk reporting hero image

Climate Risk Reporting

Take advantage of MSCI ESG Research’s sophisticated climate risk analytics on securities across asset classes and streamline climate risk management processes within existing workflows using high volume climate reporting

spaces

内嵌的应用

MSCI Carbon Portfolio Analytics

| MSCI Carbon Portfolio Analytics |

| MSCI ESG Research’s Carbon Portfolio

Analytics report is a tool for

understanding, measuring and

managing carbon risk at the portfolio,

sector, and company level. It

is available directly from MSCI ESG

Manager or as a Managed Service. |

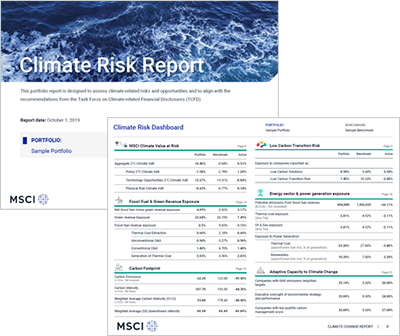

MSCI Climate Risk report

| MSCI Climate Risk & TCFD Report |

| Designed to assess climate related

risks and opportunities and to

align with the recommendations

of the Task Force on Climate related

Financial Disclosures (TCFD).

Available as a managed service

with batch reporting and customization

capabilities. |

Climate Value at Risk report

| Climate Value at Risk report |

| Climate Value at Risk (Climate

VaR) is designed to provide a forward-

looking and return-based

valuation assessment to measure

climate related risks and opportunities

in an investment portfolio.

The report offers deep insights into

how climate change could affect

company valuations. Available directly from MSCI ESG Manager or as a Managed Service. |

spaces

Key features and benefits

Key features and benefits

Integrated carbon risk assessments

Our climate risk reports include analysis of an extensive set of carbon risk management and exposure metrics, sourced from sophisticated in house research and climate models, from stranded assets to clean technology investments and scenario analysis.Identify outliers change regulations.

Analyze key sectors and companies where risk is concentrated to better inform carbon reduction strategies and support active dialogue and proxy engagement.Transparent and understandable

Our reports include clearly defined metrics and analysis with context to help with the interpretation of the results. For example, the report includes attribution analysis that evaluates how stock selection and sector weighting can explain the differences between the carbon footprint of a portfolio and the carbon footprint of portfolios replicating an index.Climate scenario analysis

Our reports offer deep insight into how various climate change scenarios could affect company valuations, looking at both transition and physical risks and opportunities. They also provide Warming Potential at portfolio level: the thermometer shows the warming trajectory of a portfolio, and relates it to important target temperatures in global climate change regulations.Actionable analysis

Our climate risk reports can help inform strategies to tilt the portfolio towards lower carbon emissions / intensity, or identify high risk companies with weak carbon management strategies relative to peers.Additional metrics on risks and opportunities

Our tools provides analysis on stranded asset exposure, together with assessments of carbon risk management practices and energy initiatives, in an effort to indicate possible exposure to environmental legislation and preparedness for transition to a low carbon economy.内嵌的应用

Data delivery

Data delivery

Data delivery Duplicate 1

horizontal ruler

内嵌的应用

TCFD-alignment Duplicate 6

Take the next step in your TCFD reporting with MSCI climate reporting solutions

The G20 Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD) released recommendations in June 2017, which highlighted the importance of using scenario analysis to assess climate change related impacts within the financial sector.

It calls for the assessment of both the risk and opportunity side of transition and physical climate change impacts, and creates a reporting framework that allows institutions to prepare themselves for upcoming regulations.

MSCI’s TCFD based reporting brief is aimed at institutional investors intending to report on their climate transition risk management processes according to the TCFD recommendations.

TCFD-alignment 2

horizontal ruler

subscribe callout

Related Content

Footnotes

MSCI ESG Research LLC. is a Registered Investment Adviser under the Investment Adviser Act of 1940. The most recent SEC Form ADV filing, including Form ADV Part 2A, is available on the U.S. SEC’s website at www.adviserinfo.sec.gov.

MIFID2/MIFIR notice: MSCI ESG Research LLC does not distribute or act as an intermediary for financial instruments or structured deposits, nor does it deal on its own account, provide execution services for others or manage client accounts. No MSCI ESG Research product or service supports, promotes or is intended to support or promote any such activity. MSCI ESG Research is an independent provider of ESG data, reports and ratings based on published methodologies and available to clients on a subscription basis.

Interested in Sustainable Investing?

Get the latest trends and insights straight to your inbox.

Select your topics and use cases to stay current with our award winning research, industry events, and latest products.