Hero - Private Capital Indexes

Social Sharing

Intro - Private Capital Indexes

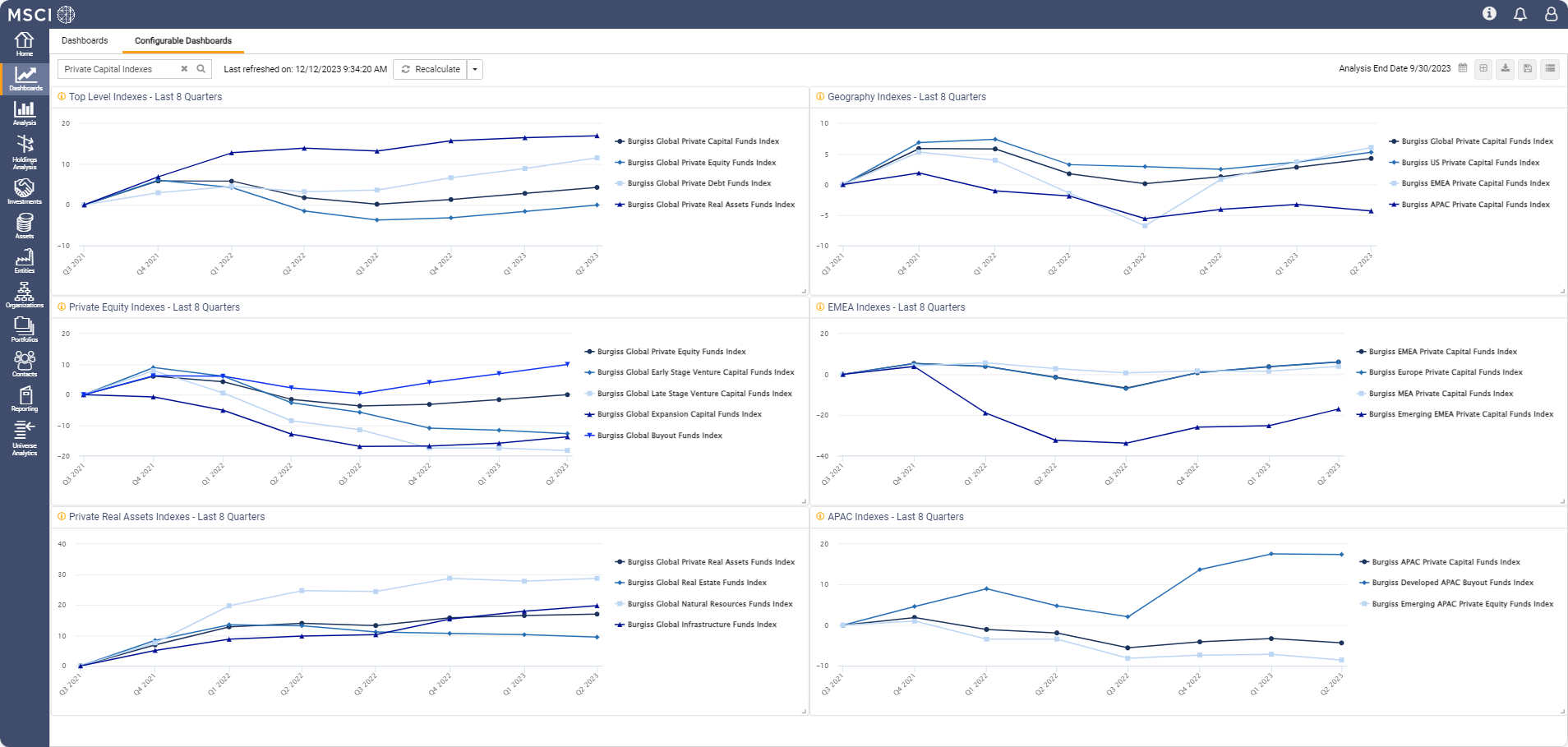

Distinct insights into returns with global and regional indexes covering private equity, venture capital, private debt and private real assets

Are you benchmarking your private capital performance to a private capital index? If not, consider making the switch. Our fleet of distinct indexes, calculated from our Private Capital Manager Universe — one of the largest private capital datasets of its kind — serves asset owners, asset managers and General Partners (GPs). Or, you can design your own index.

Get in touch - Private Capital Indexes

Learn how our indexes can help you gain a new window into performance.

Explore indexes (PDF, 354 KB) (opens in a new tab)numbers - Private Capital Indexes

-

130+Indexes

-

12,000+Funds

-

$10.1 trillion+Total capitalization1

Screenshot 1 - Private Capital Indexes

view brochure cta - Private Capital Indexes

vast database - Private Capital Indexes

Vast database

We offer over 130 indexes calculated from our Manager Universe, a dataset offering full coverage of private capital funds dating back over 40 years.

index methodology title - Private Capital Indexes

Index methodology

Index methodology - Private Capital Indexes

Quarterly returns for indexes are calculated:

access - Private Capital Index

Indexes can be accessed via:

-

Third-party partner solutions

-

SFTP delivery

Client designed - Private Capital Indexes

Client-designed indexes

You can measure and compare performance by sector, geography, asset class, vintage and fund size characteristics, and create a benchmark universe that reflects your mandate and portfolio constraints.

How our indexes - Private Capital Indexes

How our indexes can help you

Investors use our suite of indexes to inform allocation strategies, benchmark, and measure and manage the performance of portfolios across private capital funds.

Interested - Private Capital Indexes

why msci - Private Capital Indexes

Why MSCI?

MSCI has served as one of the global leaders in equity indexes for more than 50 years, working at the forefront of index construction and maintenance. We launched our first global equity indexes in 1969, helping shape the way investors track and compare global equity markets, and we serve as one of the leaders in private capital benchmarking data with the acquisition of the Burgiss Group in 2023. There is $14.9 trillion in assets under management benchmarked to MSCI indexes.2 MSCI also offers over 3,900 equity and fixed income ESG indexes.3

Related content - Private Capital Indexes

Related content

Universe Data and Analytics

Read morePrivate i® Platform

Learn moreResearch and Insights for Private Capital

Read moreFootnotes - Private Capital Indexes

- 1 As of September 30, 2023.

- 2 As of June 2023.

- 3 As of March 2023.