Promote consistency

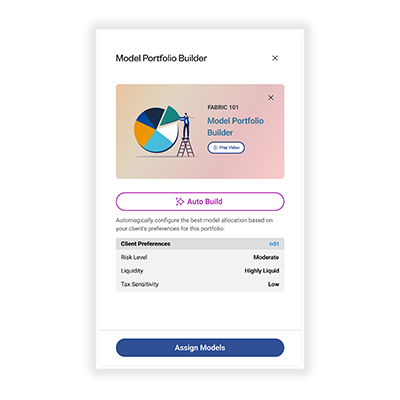

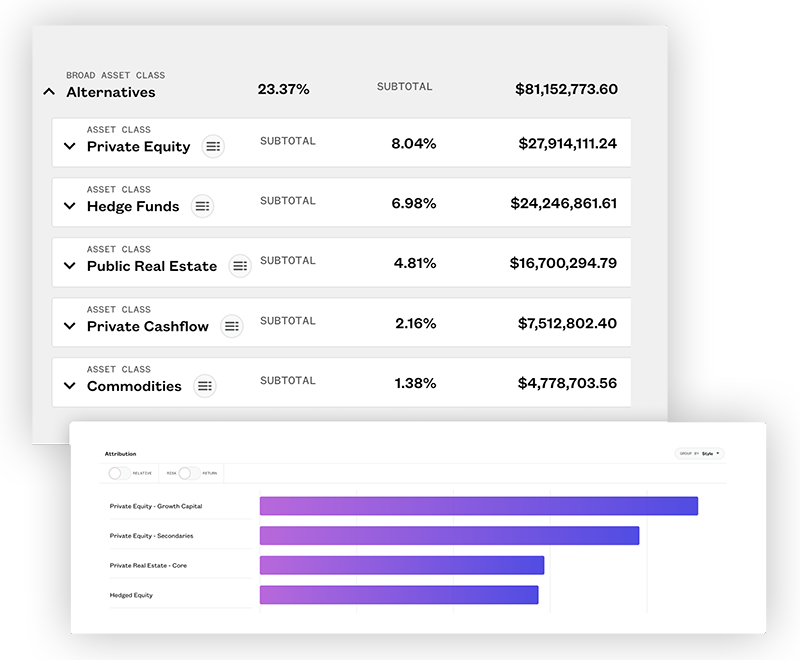

Distribute firm-wide strategies directly within advisor workflows to ensure portfolio consistency. Enable advisors to build client portfolios using house view models and approved funds.

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

main-menu-texts.default-featured-content-label

Find a competitive edge in meeting clients’ personal goals while adhering to your firm’s market views. MSCI Wealth Manager, formerly known as Fabric, offers a technology platform for portfolio design, customization and analytics, fully integrated with our indexes, sustainability data and private asset insights.

Design portfolios aligned with clients’ unique goals with enhanced ability to personalize around taxes, risk tolerance, values and climate.

Set and distribute your firm-wide investment strategies and models directly within your advisors’ workflows.

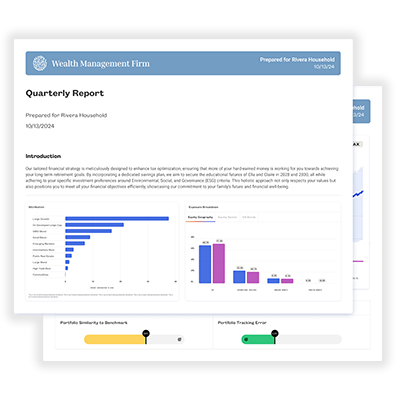

Deliver insights and proposals tailored to client needs, fostering stronger relationships through personalized, data-driven conversations.

Monitor portfolio alignment with target models, run stress tests and generate tailored reports to communicate risk and performance to clients.

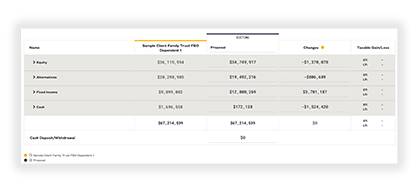

Assess the impact of portfolio changes on client goals, optimizing for taxes and transaction costs, with rebalancing to fit client needs.

Model private asset risks and returns to show clients the benefits of multi-asset portfolios, including those with private equity and real estate assets.

By unifying public and private asset insights in a single platform through MSCI Wealth Manager, Callan Family Office was able to deliver personalized, risk-aware portfolio guidance at scale across their client portfolios.

“A total portfolio perspective helps us visualize how risk is distributed across a client’s portfolio, including both public and private assets, and how risk changes over time.”

— Daniel Burke, CTO, Callan Family Office

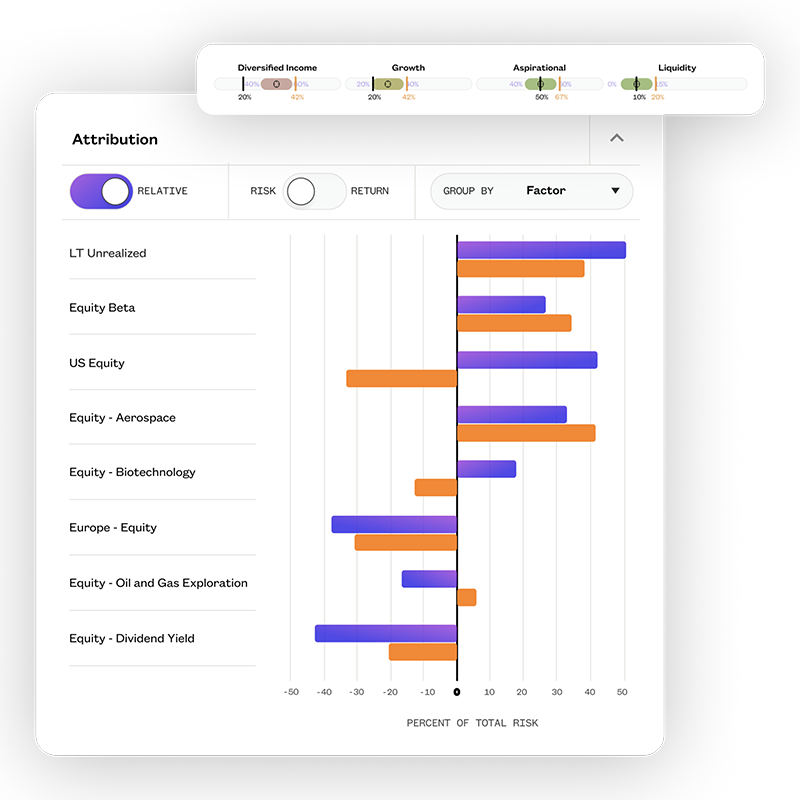

Redefine portfolio alignment by tracking investment team and client outputs through one simple, common score. Focus on portfolio risk and return rather than the exact holdings using a factor-based approach.

Learn moreDistribute firm-wide strategies directly within advisor workflows to ensure portfolio consistency. Enable advisors to build client portfolios using house view models and approved funds.

Monitor deviations between house view, client targets and actual portfolios. Identify misaligned portfolios and drill down into specific reasons to take corrective action efficiently.

Develop projections and scenario analysis to help understand how portfolios may perform under different market conditions for a clearer view of potential outcomes and better decision-making.

Facilitate prospecting by enabling advisors to build relationships and deliver personalized solutions. Import prospect data to generate insights, create reports and position to win new business.

A growing number of wealth managers are turning to model portfolios to offer personalization within a scalable business model.

What is tax alpha and how can wealth managers use it to explain a client’s after-tax performance?

The MSCI Similarity Score represents a significant evolution in wealth-management practice, aiding firms in balancing individual client needs with scalable processes and shifting perspective from a holdings-based analysis to behavioral similarity.

Our suite of portfolio management solutions enables you to create the capacity for long-term business growth.

Explore nowMSCI can help you stay ahead of the changing market and empower your investment strategies with a suite of index solutions designed to match your goals and values.

Explore indexesSearch the MSCI Implied Temperature Rise, decarbonization targets, MSCI ESG Rating and key ESG Issues of more than 2,900 companies.

Learn moreWe explore and explain topics covering ESG, Climate, thematic, and global investing through visually impactful infographics.

Explore moreMulti-Asset Class Factor Models help investors more clearly identify the drivers of risk and return in these complex, dynamic strategies.

Read more