The Coal Conundrum: Divest and Engage Banner

The Coal Conundrum: Rethinking Divestment

Social Sharing

The Coal Conundrum: Divest AND Engage Intro

If the goal is a net-zero portfolio, divesting might seem the path of least resistance, especially when it comes to coal. But it may hardly move the needle on achieving a net-zero economy. To do that, investors will likely look to expand their toolbox: engage where they can exert leverage, divest where they can’t, plus insert themselves collectively into policy discussions to change the context.

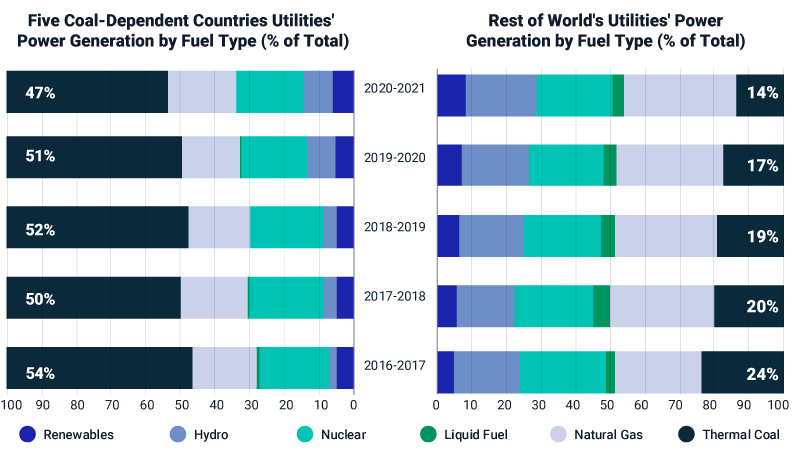

Irrespective of the choice, all roads go through the five key markets that are dependent on coal — the U.S., Australia, China, Russia and India,1 which together accounted for 75% of global coal consumption. The chart below shows how their dependence on the dirty fuel translates into power generation: 47% coal-based for the MSCI ACWI Index utilities constituents in these countries versus 14% for constituents located elsewhere.

The five coal-dependent countries: Australia, China, India, Russia and the U.S. Source: MSCI ESG Research. MSCI ACWI Index constituents and data selected on an annual basis. Figures represent a simple average of values for the companies included.

2022 ESG Trends Report Buttons

The Coal Conundrum: Divest and Engage Related Content

Related Content

2022 Trends to Watch

Ten trends for the coming year that could shape the risk profile for investors.

Explore TrendsNo Planet B: Financing Climate Adaptation

There’s no escaping the need for projects that help us adapt to a changing climate. Bonds issued to pay for them could greatly expand the green bond market.

Read MoreThe Story Behind ESG Trends

10 Year Anniversary – What Can The Past Tell Us About The Future?

Learn MoreThe Coal Conundrum: Divest and Engage footnotes

1“Global Coal to Clean Power Transition Statement.” UN Climate Change Conference UK 2021 website, Nov. 4, 2011.