Just Transition: Finding the Nexus of Need and Investability Banner

Just Transition: Finding the Nexus of Need and Investability

Social Sharing

Just Transition: Finding the Nexus of Need and Investability Intro

As the captains of private finance begin to steer global capital toward achieving net-zero, many are realizing that efforts to stem climate risk won’t succeed on the systemic level if we leave behind the most vulnerable populations, communities, and countries. The question of the day is: Are there areas where “need” and “investability” overlap?

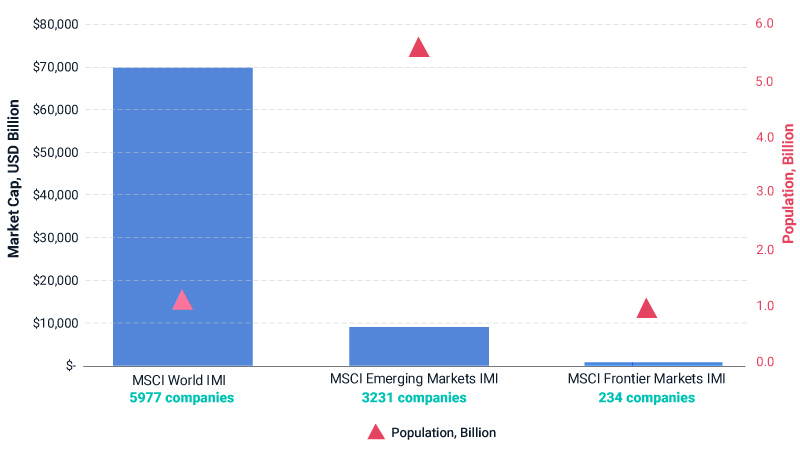

You can see in the chart below that there is a disproportionate amount of assets invested in companies operating in highly developed economies. This is true for public debt and in the private equity and debt space. For our world to facilitate a just transition, developing and frontier markets — and those not even sufficiently developed to qualify as frontier markets — need more and creative conduits if they hope for wider investor financing. And those channels arise when investors start to look further afield for their capital allocations.

Just Transition: Finding the Nexus of Need and Investability footnotes

Source: MSCI ESG Research LLC and World Bank as of Nov. 11, 2021

2022 ESG Trends Report Buttons

Just Transition: Finding the Nexus of Need and Investability Related Content

Related Content

2022 Trends to Watch

Ten trends for the coming year that could shape the risk profile for investors.

Explore TrendsThe New ‘Amazon Effect’: Corporates Pushing Corporates for Net-Zero Supply Chains

As the world’s big companies work to go net zero, downward emissions pressure may become as familiar to suppliers as downward price pressure.

Read MoreThe Story Behind ESG Trends

10 Year Anniversary – What Can The Past Tell Us About The Future?

Learn More