Index Options Indicated Negative Market Sentiment title

Index Options Indicated Negative Market Sentiment

Social Sharing

Index Options Indicated Negative Market Sentiment Intro

Dinank Chitkara and Hitendra Varsani

May 25, 2022

In the face of continued global equity-market volatility, we turn to the listed-options market to gauge the perception of market risk over the coming months for EAFE, emerging markets (EM) and the U.S.1

The four options-based indicators we analyzed showed investors were concerned about the trajectory of equity markets.

-

Heightened levels of implied volatility

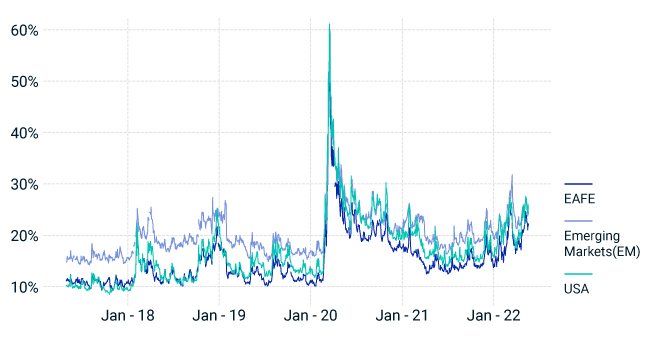

Three-month implied volatility across regions remained elevated, with levels in the top decile, 91st percentile, for EAFE and the U.S., and around the 83rd percentile for EM, based on 5-years of history.2. For the U.S., the current levels stood at 88th percentile based on data since January 2000. (See chart one.)

-

Steep implied-volatility skew: higher premiums for puts vs. calls

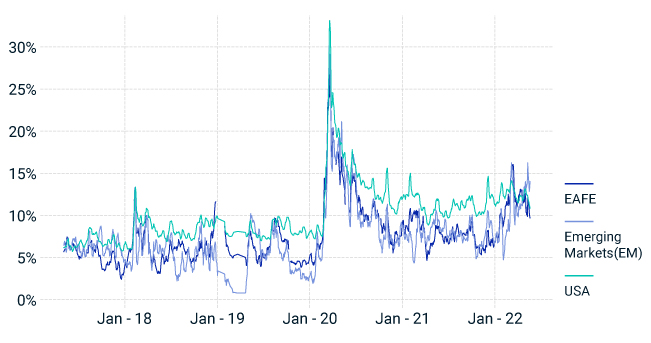

We observed rising skew across regions with heightened negative sentiment for EM relative to the U.S. and EAFE. Skew stood at 14% (93nd percentile) for EM; the U.S. and EAFE stood at 11% and 9% respectively (62nd percentile for the U.S. and 76th percentile for EAFE). (See chart two.)

-

Inverted-term structure: Short-dated volatility was higher than longer dated volatility

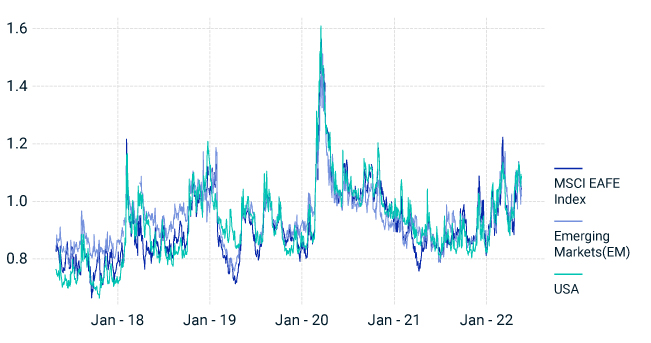

The term structure calculated using 91- to 365-day implied-volatility ratio of at-the-money (ATM) options remained inverted (ratio above 1), indicating higher short-term vs. long-term volatility. (See chart three.)

-

High CBOE Total Put/Call Ratio: Put volumes outpaced call volumes

A high CBOE Total Put/Call Ratio (calculated using index and equity options) suggests bearish sentiment. The measure stood at 1.1 based on a 10-day moving average, as of May 20, 2022. Over the last 10 years, the ratio has risen above this level only four times: March 2020, December 2018, November 2016 and September 2015.

Average implied volatility

Implied volatility is based on the average implied volatility of 91-day ATM call and put options from May 1, 2017 to May 20, 2022. Source: Optionmetrics.

Implied volatility skew

Implied-volatility skew is calculated using the five-day moving average of the put-call implied-volatility spread of the 91-day 20-delta strikes, from May 1, 2017, to May, 20, 2022. Source: OptionMetrics

Volatility term structure

Term Structure is calculated using 91-day to 365-day implied volatility ratio of ATM options, from May 1, 2017, to May 20, 2022. Source: OptionMetrics

1Options linked to the MSCI EAFE, MSCI Emerging Market and S&P 500 Indexes have been used for the EAFE, EM and U.S. implied volatility calculations, respectively.

2Percentiles calculated based on data since May 1, 2017.

Index Options Indicated Negative Market Sentiment related content

Related Content

Evaluating Options in Different Macro and Volatility Regimes

Over the past few months, developed- and emerging-market economies have witnessed a rise in inflation and slower growth.

Read MoreMarkets Indicated Higher-than-Usual Downside Risk for EAFE and EM

Using option-implied-volatility skew — a measure often used to gauge downside vs. upside risk — we have seen a substantial increase in EAFE and EM index skew since the start of the war.

Explore MoreESG and Climate Derivatives in Equity Exposure Management

Most efforts to manage climate and ESG portfolio risks have involved reducing holdings of stocks negatively exposed to these risks, and increasing those that are positively exposed.

Learn More