How Modern Wars Affected Market Performance and Volatility

How Modern Wars Affected Market Performance and Volatility

Russia’s invasion of Ukraine was followed by a marked increase in stock-market volatility. The Cboe Volatility Index® (VIX) spiked from 28 on Feb. 23 to 37.5 the next day. As new sanctions were imposed on Russia, including blocking some Russian banks from the SWIFT interbank messaging system, it was easy to think the markets would not remain hospitable.

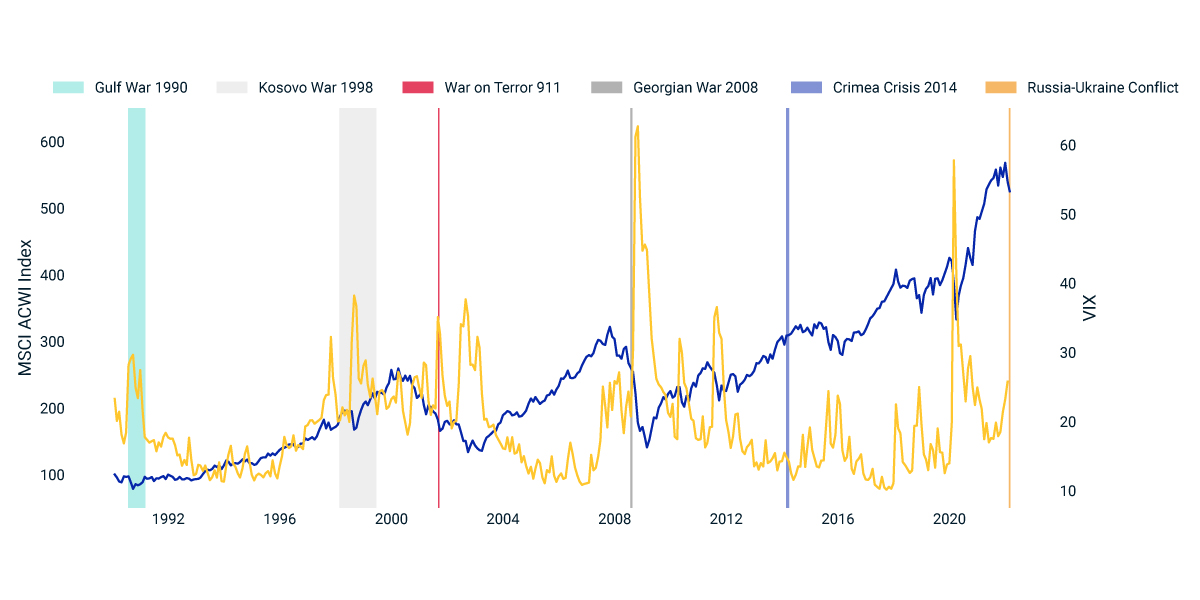

We looked at the major wars since 1990 in terms of equity-market performance, approximated by the MSCI ACWI Index, and market volatility, approximated by the VIX, to see whether history provided any lessons. The exhibit below shows that most of these wars had only a short-lived impact on equity markets and volatility. We saw neither the reversal of prewar market trends nor persistently high market volatility in the weeks after the conflicts began.

More specifically, the average return of the MSCI ACWI Index during the three months leading up to and after each event was -0.5% and -0.1%, respectively. Additionally, the average duration of heightened volatility following the wars was around 20 days.1

A key reason for this relatively mild impact was the largely contained scale of the wars in recent decades (in terms of the regions and length of these conflicts), as well as limited economic linkage of the targeted economy to the rest of world.

Of course, whether history will repeat itself remains to be seen.

Major wars since 1990 and global equity-market developments

Related Content

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

Explore MoreSocial Sharing

How Modern Wars Affected Market Performance and Volatility related content

Related Content

Russia - Ukraine War

MSCI is closely monitoring the Russian invasion of Ukraine and how it might affect our colleagues, clients, and business partners. We will continue to assess the implications.

Explore MoreGlobalization Gets Another Jolt

The Russian invasion of Ukraine is another reminder that geopolitics play an outsized role in determining economic relations between countries.

Read MoreFrom Crisis to Crisis: Russia’s Diminished Role in Emerging Markets

Russia’s weight in the MSCI Emerging Markets Index dropped sharply during February 2022.

Learn MoreHow Modern Wars Affected Market Performance and Volatility footnotes

1 Heightened volatility periods were days when the VIX was above 30. The Russo-Georgian War is excluded from the historical average change calculation to eliminate the impact of 2008 global financial crisis.