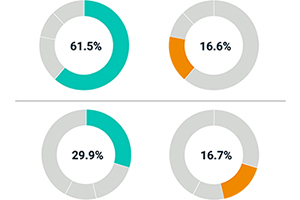

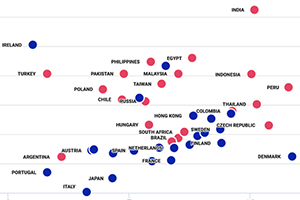

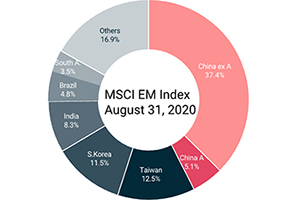

The weight of North American companies in global equity markets is at an all-time high, representing over 60% of market capitalization in the MSCI ACWI Index.

Global Investing overview banner content

Global Investing Trends

Global Investing overview intro copy

Investing globally can help investors work toward global diversification, tap into new opportunities for growth and harness the potential increased importance of emerging markets. But many investors may be missing out on these opportunities.

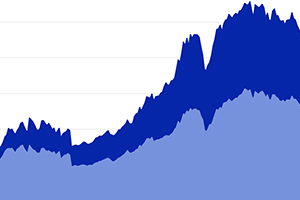

In some ways, it’s understandable. U.S. equities have outperformed global equities in three consecutive years — 2018, ‘19 and ‘20 — which has resulted in global investing losing its shine for many U.S. investors.

We provide a broader perspective, looking beyond North America to focus on growth in the economies of Asia and elsewhere. We shine a light on what have been the principal drivers of equity returns and the growing trends behind thematic investing, as well as the potential of emerging markets. You’ll find insights provided in research papers, blogs and a Chart of the Week that succinctly puts topical issues in context.

Global Diversification section starter

Global Diversification section

Global Diversification

内嵌的应用

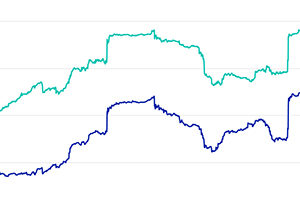

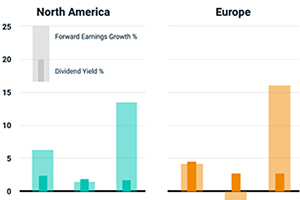

Chart 1: North America

内嵌的应用

Blog: Accounting for Revenue Sources Tells a Richer Story

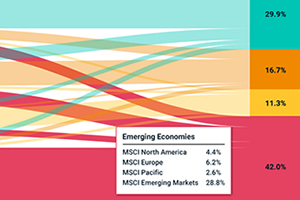

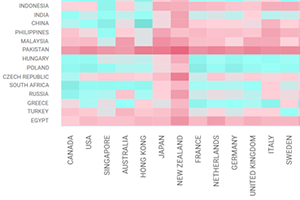

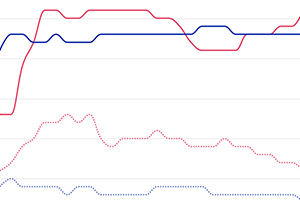

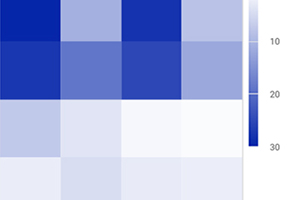

Chart 8 - Global Country Correlation Matrix by Sub-Regions

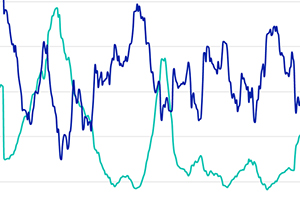

Chart 9 - Correlations Within and Across Global Markets

内嵌的应用

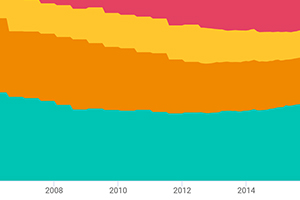

Chart 15- Going Digital: Tech-Led Growth Has Affected Country Concentration

Chart 14 - Where Next in Terms of Global Growth

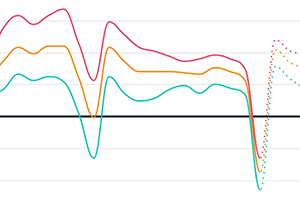

Chart 13-Increased Stock Market Concentration: Risk or Opportunity?

Back to Top

Growth and Opportunities section starter

Growth and Opportunities section

Growth and Opportunities

内嵌的应用

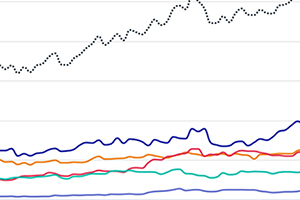

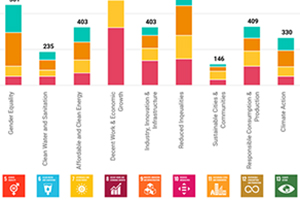

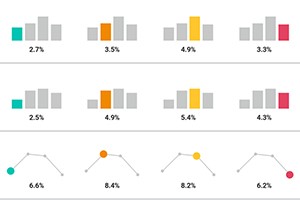

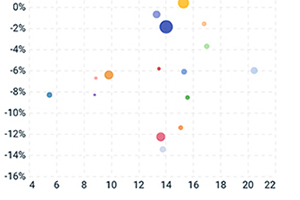

Chart 3 - Earnings-Growth Estimates Rose Across the Globe

Chart 4 - Global Research and Development Spending as Percentage of GDP

Chart 5 - Thematic Investing is a Global Phenomenon

内嵌的应用

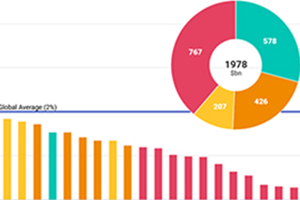

Chart 7 - Emerging-Market Companies Duplicate 3

Chart 16- Where Next in Terms of Global Growth

内嵌的应用

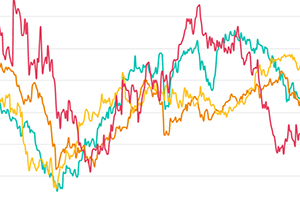

Chart 17-Does positive GDP growth lead to strong stock returns?

Chart 19 Understanding Emerging-and Developed-Market Equity Performance

Not All Listed Stocks Are Investable: The Concept of Free-Float Market Capitalization

Back to Top

Importance of Emerging Markets section starter