面包屑导航

导航菜单

USA hero image

MSCI US intro

MSCI USA Index

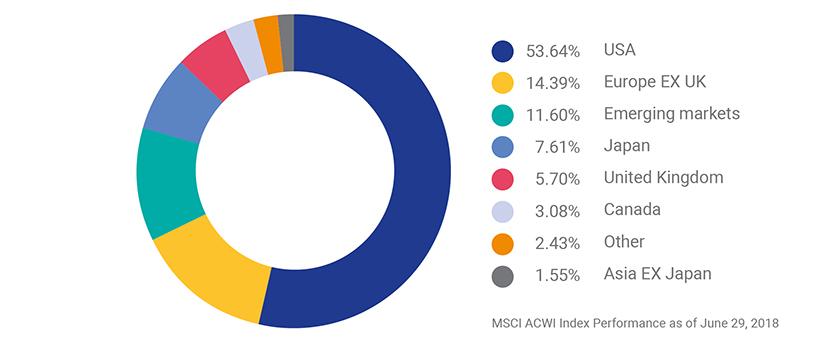

The U.S. market has always been at the center of the global equity opportunity set at MSCI and we believe it is important to view the U.S. through a global lens. MSCI USA makes up 54% of MSCI ACWI and is part of our modern, seamless, and global index framework which gives clients consistency across markets and ensures best practices in investability, replicability and cost efficiency.

Download the MSCI USA Index Brochure

MSCI US CTA Copy

If you would like further information about the MSCI USA index, please fill in the form below.

An MSCI representative will contact you.

Contact Us Button (Contact Sales)

MSCI USA

THE U.S. MARKET REPRESENTS MORE THAN 50% OF THE GLOBAL EQUITY OPPORTUNITY SET

MSCI USA REPRESENTS THE MODERN INDEX STRATEGY

MODERN

Evolves to measure and capture equity markets as they exist today. Our indexes are built using an innovative maintenance methodology that provides superior balance between the need for a stable index that is flexible enough to adjust quickly to a constantly changing opportunity set. We provide timely and consistent treatment of corporate events  and synchronized rebalancings, globally.

and synchronized rebalancings, globally.

SEAMLESS

Covers the full opportunity set and all its segments, including GICS® sectors. All of MSCI’s indexes are created using the Global Industry Classification Standard (GICS®), an industry classification system developed by MSCI and S&P Global, which provides a common framework to classify stocks. They offer exhaustive coverage of the investable opportunity set with non-overlapping size and style segmentation.

INTEGRATED

Consistent methodology for every market. Where other providers use either a long- or short-term liquidity measure to assess the eligibility of stocks for their indexes, MSCI uses both, recognizing the differences in liquidity between developed and emerging markets and enhancing the investability and replicability of our indexes. MSCI puts strong emphasis on investability and replicability of its indexes through the use of size and liquidity screens.

MSCI USA INDEX DAILY PERFORMANCE

Index Preview

FLAGSHIP INDEXES

- MSCI USA: Designed to measure the performance of the large and mid cap segments; aims to represent ~85% of the US market

Performance | Factsheet - MSCI USA Investable Market Index (IMI): Designed to measure the performance of the large, mid and small cap segments; aims to represent ~99% of the of the US market Performance | Factsheet

- MSCI USA Large Cap Index: Measures the performance of the large cap segment of the US market

Performance | Factsheet - MSCI USA Mid Cap Index: Measures the performance of the mid cap segment of the US market

Performance | Factsheet - MSCI USA Small Cap Index: Measures the performance of the small cap segment of the US market

Performance | Factsheet

APPLICATIONS

The MSCI ACWI Index provides a broad global equity benchmark to support:

- Asset allocation: Consistent, complete representation that captures the full spectrum of the global equity opportunity set, without home bias.

- Performance measurement and attribution: The industry-leading benchmark for global mandates, with regional, country, sector and other subsets available for more targeted investment mandates.

- Research: A trusted source for global equity markets and underlying security-level data for sell-side research.

- Investment product development: May be licensed for use as the basis for structured products and other index-linked investment vehicles, such as ETFs and ETNs.

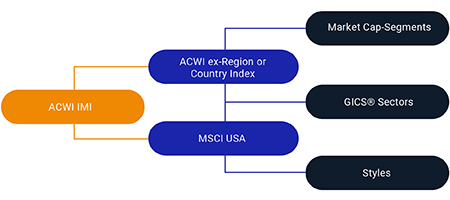

A BUILDING BLOCK APPROACH

Our building block approach

MSCI USA Indexes are part of the modern index strategy offering a building block approach with a rules-based, consistent and transparent methodology.

Using MSCI ACWI as a framework to build portfolios helps to avoid unintended bets and risks.

Robust foundation allows investors to measure exposure to all sources of equity returns using a single global framework.

MSCI USA

MSCI USA

The MSCI USA Index is designed to measure the performance of the large and mid cap segments of the US market. With 637 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the US.

MSCI USA all cap

MSCI USA all cap

The MSCI USA All Cap Index captures broad US equity coverage. The index includes 3,510 constituents across large, mid, small and micro capitalizations, representing about 99% of the US equity universe.

MSCI USA small cap

MSCI USA small cap

The MSCI USA Small Cap Index is designed to measure the performance of the small cap segment of the US equity market. With 1,858 consituents, the index represents approximately 14% of the free float-adjusted market capitalization in the US.

Interested in Indexes?

Get the latest trends and insights straight to your inbox.

Select your topics and use cases to stay current with our award winning research, industry events, and latest products.