Hero image

Story

MSCI USA equal weighted index

IS YOUR U.S. BENCHMARK STILL RELEVANT?

The MSCI USA is part of ACWI, our global index framework with a consistent methodology across all markets. Traditional, standalone, domestic benchmarks, with a fixed number of stocks, do not reflect the complete opportunity set for today’s global investor. The MSCI USA Index is designed to be replicable and comprehensively reflects market size segments with no gaps or overlaps, thus accurately representing the performance of the U.S. market as it exists today.

WHY EQUALLY WEIGHT STOCKS?

The MSCI Equal Weighted Methodology offers an alternative to market capitalization weighted indexes. The idea is simple – an investor with an equally-weighted portfolio holds an equal dollar value across all the stocks that make up an index. This approach avoids concentrating too much of the weight into a few large stocks and gives more weight to stocks at the lower end of the market cap range. Equally-weighted indexes reflect an active view that seeks to capture the “low size” factor – one of six factors research has found to have historically provided a premium to traditional market-cap-weighted indexes over long time periods.

|

Avoiding concentration of the index in a few large stocks |

Market-cap weighting can result in the concentration of the index in a few names, which may not be desirable from the perspective of concentration risk. Equal weighting avoids this effect and reflects and active view that desires to give greater weight in a portfolio to smaller companies. |

|

Getting more exposure to smaller-cap stocks |

By definition, stocks with a smaller market cap are given lower weights in a marketcap weighting scheme. This result can be desirable (as these stocks may be riskier) or undesirable (as they have historically had stronger performance). Equal weighting an index assigns more weight to these smaller-cap stocks and less to larger-cap stocks. |

|

Building in disciplined rebalancing that takes account of mean reversal in stock returns |

Equal-weighted indexes are rebalanced at set frequencies (e.g., weekly, monthly). Between rebalancing dates, stock weights will fluctuate with prices. Thus, an equally weighted index builds in a disciplined rebalancing process, taking advantage of mean reversal in stock returns and locking in recent gains/losses. In contrast, a market-cap-weighted portfolio is not rebalanced as long as the portfolio constituents remain constant. |

BROAD U.S. MARKET EXPOSURE WITH REDUCED CONCENTRATION RISK

- Dynamically captures the full large- and mid-cap U.S. equity opportunity set (not “locked” on a fixed number of stocks or sampled).

- The underlying index is constructed with stringent liquidity screens aimed to ensure the index is replicable.

- MSCI's equal weighted methodology limits concentration risk to any one given stock, and can serve as a helpful tool for institutional investors seeking to capture broad U.S.market exposure and who believe the historically stronger performance of smaller companies.

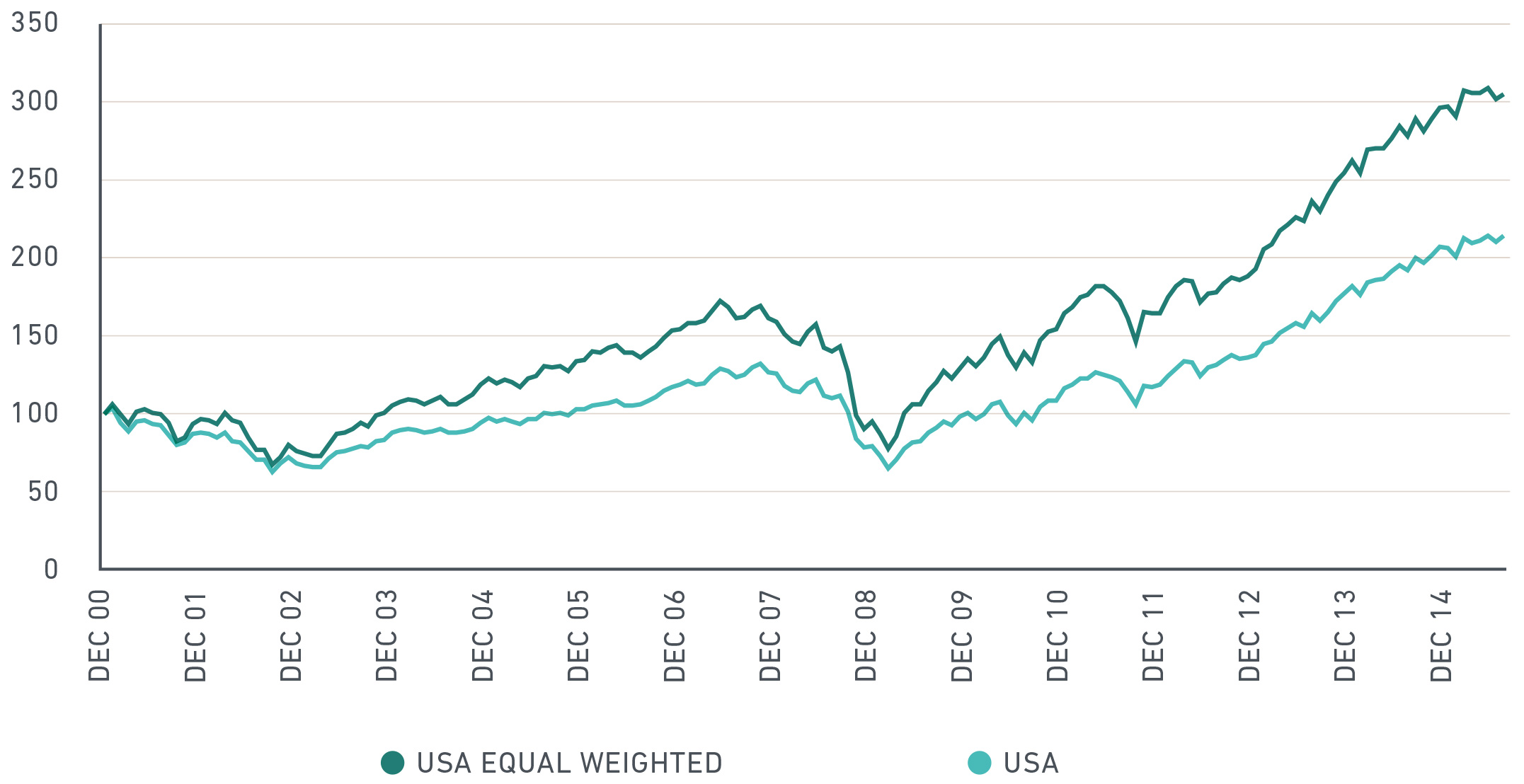

Cumulative Relative Return of the MSCI USA Equal Weighted Index to the Parent Index from December 2000 to July 2015

Performance Summary Based On Net Index Monthly Returns, January 1999 to July 2015

Equal weighting reduces the concentration in large company names

(Index Constituents as of June 1, 2015)

Issue brief - MSCI equal weighted indexes

Issue brief - MSCI equal weighted indexes

Equal weighting is one of the earliest and best-known alternatives to traditional market-cap-weighted indexes.

MSCI USA equal weighted index (USD)

MSCI USA equal weighted index (USD)

The MSCI USA Equal Weighted Index represents an alternative weighting scheme to its market cap weighted parent index, the MSCI USA Index.

MSCI equal weighted indexes methodology

MSCI equal weighted indexes methodology

For over 35 years, MSCI has constructed the most widely used international equity indexes for institutional investors.