面包屑导航

Climate Solutions

Climate solutions intro

With our holistic MSCI Climate Solutions toolkit we aim to empower financial institutions with the tools necessary to build more climate resilient portfolios, protect assets from the worst effects related to climate change and also help identify new, innovative low carbon investment opportunities.

We are pleased to introduce the MSCI Climate-Value-at-Risk (Climate VaR) , provided by MSCI ESG Research LLC, which provides forward looking and return-based valuation assessments to measure the potential impact of climate change on company valuations. It provides financial institutions – including investment managers, banks, asset owners and insurers – with the means to identify assets that may be at risk from the worst effects resulting from climate change, while helping to identify innovative low carbon investment opportunities, through security specific modelling.

Contact our ESG Client Service team to learn more.

MSCI Climate Solutions

内嵌的应用

内嵌的应用

Climate Solutions 1

Climate Data & Metrics1

Extensive climate change metrics including Climate Value-at-Risk, carbon management assessment, carbon and clean tech metrics and fossil fuel screens.

|

|

State of the art model |

|

|

Broad coverage across equities, fixed income and real estate |

Climate Solutions 2

Climate Risk Reporting1

Scalable client reporting and automated report generation on the climate risk and opportunities exposure of your portfolio.

|

|

MSCI Carbon Portfolio Analytics |

|

|

MSCI Climate Risk report |

|

|

Climate Value-at-Risk report |

内嵌的应用

Climate Solutions 3

Scenario Analysis1

Assess portfolio vulnerability to scenarios and the potential financial sensitivity to these risks and opportunities.

|

|

Potential financial impact of different climate scenarios |

|

|

Warming Potential of portfolio to assess alignment with the Paris Agreement |

|

|

Climate stress testing |

Climate Solutions 4

Climate

Indexes1

MSCI offers a range of indexes for institutional investors who seek to incorporate climate risks and opportunities into their investment process.

|

|

Risk optimization in portfolios |

|

|

Capture disruptive opportunities |

|

|

Promote stewardship |

Cliamte solutions wheel

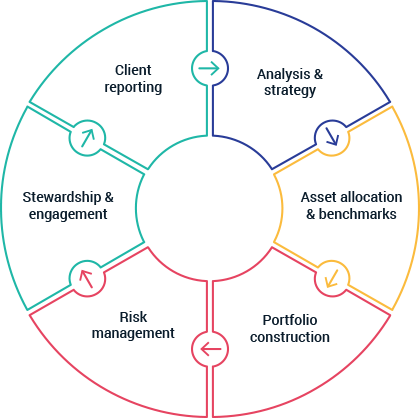

Integrating climate solutions into your investment process

MSCI’s Climate Solutions give you access to a wide range of tools and data designed to enable you to address a variety of needs including measuring and reporting on climate risk exposure, implementing low carbon fossil fuel-free strategies, factoring climate change research into risk management processes and engaging companies and external stakeholders .

内嵌的应用

Climate Solutions Wheel table 1

Engage

Integrate

Assess

Allocate

|

Climate Solutions Wheel table 3

|

Climate change – a key risk for institutional investors

Climate change – a key risk for institutional investors

A 2019 report by the United Nations estimates that delayed action on climate change could cost investors about $1.2 trillion worldwide during the next 15 years. Delayed action could not only increase policy risk, but may also result in much greater physical climate risk due the increased accumulation of GHG concentrations in our atmosphere.2

Responding and adapting in a timely fashion may mitigate the risk and can also create new investment opportunities. Green revenues generated from the sale of low carbon technologies may help companies offset costs from complying with greenhouse gas (GHG) reduction policies. Under the 2°C scenario, the sum of all green profits are significant – approximately USD 2.1 trillion.2

Examples of Climate-related financial impact

![California – Clean Energy Act of 2015: US solar installation companies saw their revenues soar between 2013 and 2017.[1] / Massachusetts –tidal flooding: Since 2005 the local real estate market has collectively lost about $273 million of coastal property value due to flooding from sea level rise.[2] / India – electric vehicles: According to government plans every car sold in India from 2030 will be electric.[3] / Australia – Wildfires 2019: Insurers have received claims worth of $480.8million as of January 8 and they expect the number will grow significantly.[4]](/documents/1296102/16985724/climate-financial-impact-map-empty.png/ec47bd13-17a7-fc9f-b482-9eae32acfbb1?t=1580824555007)

| Massachusetts – tidal flooding Since 2005, the local real estate market has collectively lost about $273 million of coastal property value due to flooding from sea level rise.3 |

|

| California – Clean Energy Act of 2015 US solar installation companies saw their revenues soar between 2013 and 2017.4 |

|

| India – electric vehicles According to government plans, every car sold in India from 2030 will be electric.5 |

|

| Australia – Wildfires 2019 Insurers have received claims worth of $480.8 million as of January 8, and they expect the number will grow significantly.6 |

test 1

Compliance with global policy

|

|

Paris Agreement went into force in November 2016 |

|

|

189 countries committed to greenhouse gas targets by 2030 |

|

|

2°C long term climate stabilization goal |

Here to stay

|

|

Warming is up by 1°C over the past 100 years7 |

|

|

CO2 concentration levels could lead to an additional 0.5°C in the years to come7 |

|

|

Warming above 2°C could have disastrous effects7 |

Opportunities

|

|

Energy efficiency projects can reduce energy costs |

|

|

Climate change mitigation may brings socio-economic benefits |

|

|

Low carbon technologies are experiencing high growth4 |

Remy's quotes

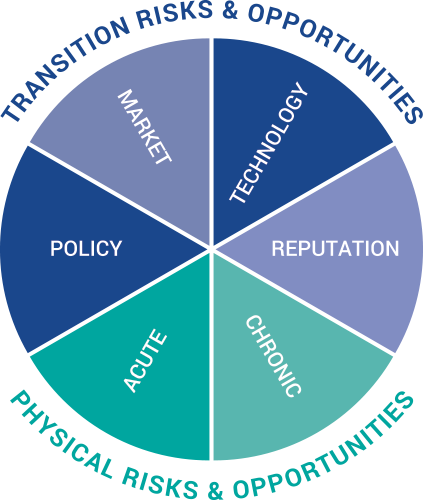

TCFD-alignment

TCFD-alignment

The G20 Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD) released recommendations in June 2017, which highlighted the importance of using scenario analysis to assess climate change related impacts within the financial sector.

It calls for the assessment of both the risk and opportunity side of transition and physical climate change impacts, and creates a reporting framework that allows institutions to prepare themselves for upcoming regulations.

MSCI’s TCFD based reporting brief is aimed at institutional investors intending to report on their climate transition risk management processes according to the TCFD recommendations.

Climate Solutions Product card without image

Learn more about our ESG solutions

Sustainable Finance

Introducing MSCI Climate Change Indexes

Index Profile Search Tool

ESG Solutions for Issuers

Net-Zero Solutions

Circular Economy Indexes

Sustainable Finance

Introducing MSCI Climate Change Indexes

Index Profile Search Tool

ESG Solutions for Issuers

Net-Zero Solutions

Circular Economy Indexes

Legislation

MSCI ESG Research LLC. is a Registered Investment Adviser under the Investment Adviser Act of 1940. The most recent SEC Form ADV filing, including Form ADV Part 2A, is available on the U.S. SEC’s website at www.adviserinfo.sec.gov.

MIFID2/MIFIR notice: MSCI ESG Research LLC does not distribute or act as an intermediary for financial instruments or structured deposits, nor does it deal on its own account, provide execution services for others or manage client accounts. No MSCI ESG Research product or service supports, promotes or is intended to support or promote any such activity. MSCI ESG Research is an independent provider of ESG data, reports and ratings based on published methodologies and available to clients on a subscription basis.

Interested in Sustainable Investing?

Get the latest trends and insights straight to your inbox.

Select your topics and use cases to stay current with our award winning research, industry events, and latest products.