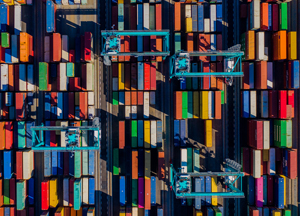

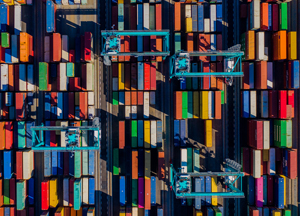

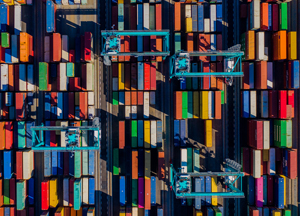

EU Sustainable Finance Package - hero banner

EU Sustainable Finance Package

Social Sharing

EU Sustainable Finance Package - intro paragraphs

The EU Sustainable Finance package aims to support the transition to a low-carbon, more resource-efficient and sustainable economy.

To learn more about the package and MSCI’s involvement, download our Sustainable Finance FAQ. To receive details of news and events, sign-up to our sustainable finance newsletter.

EU Sustainable Finance Package - tables

Deeper dive into the MSCI EU Sustainable Finance Package

MIFID II / IDD Solutions

Investment firms serving EU clients must inquire about the individual sustainability preferences of their clients under the revised rules of the Markets in Financial Instruments Directive (MiFID II) starting Aug. 2, 2022. Clients that have a sustainability preference can voice it with reference to the EU Taxonomy Regulation (EU Taxonomy) and/or the Sustainable Finance Disclosure Regulation (SFDR).

Based on feedback from MSCI’s work with investors, wealth managers and banks, we have introduced an all-in-one set of metrics, criteria and tools that equips investors to fulfill various aspects of the regulatory and non-regulatory requirements related to MiFID II and IDD and generate reports that match the European ESG Template (EET).

The MiFID II/IDD solutions underscore our commitment to drive further transparency and equip you with the information you need in an evolving regulatory environment. We anticipate that approaches to defining sustainable investments may evolve over time based on the availability of data, guidance from regulators and views of market participants.

Download Factsheet (PDF, 144 KB)

Webinars (watch on demand):

EBA ESG Pillar 3 Disclosure Solutions

The EBA ESG Pillar 3 Framework features a set of 10 templates that request banks to disclose climate-related risks and actions to mitigate them, together with exposure to green assets and information on how they are making sustainability part of their risk management.

The first set of mandatory disclosures cover five of the templates (Templates 1, 2, 4, 5 and 10), which the EBA has directed banks to disclose annually (PDF, 1.26 MB) starting in 2023 on the same date they publish their financial statements for 2022 or as soon as possible thereafter, based upon data as of the end of December 2022. Disclosures should be semi-annual thereinafter.

Sustainable Finance Disclosure Regulation (SFDR)

In February 2021, MSCI ESG Research launched the EU Sustainable Finance Module which covers more than 10,000 companies and 175 sovereign issuers and countries. The module incorporates two new datasets: MSCI SFDR Adverse Impact Metrics and MSCI EU Taxonomy Alignment, to support our clients in aligning with upcoming sustainability-related disclosure requirements stemming from the European Union's (EU) sustainable finance action plan.

In July 2021, MSCI launched its EU Sustainable Finance Index Level Module providing SFDR metrics for 6,000+ standard equity and fixed income indexes (e.g., Market Cap, Issuance-weighted, ESG, Climate and Factor indexes) as well as custom indexes. The module helps our clients compare and report the adverse impact indicators of their financial products with those of their MSCI indexes.

In Oct 2021, MSCI launched its Principle Adverse Sustainability Impacts Solution which provides a seamless process to help meet the EU regulatory requirement on sustainability risk disclosures using a scalable and robust reporting framework. We have added a Principle Adverse Sustainability Impacts Statement for real estate assets, as well as support for reporting Article 8 & 9 (ESG Impacts) and Articles 3 & 6 (ESG Risks). You can also better understand the application to real estate investments here with a simple breakdown of the indicators (PDF, 68 KB).

Click here to understand how we are supporting our clients to align and comply.

Proposed Article 6/8/9 Mapping Framework based on MSCI Client Feedback:

The MSCI Index Research team has put together a proposed Article 6/8/9 Mapping Framework following engagement with clients over the past few months. Our aim is to provide a generic mapping of MSCI ESG indexes to key Article 6, Article 8, and Article 9 SFDR distinctions using assumptions developed from MSCI’s analysis and client feedback. The Mapping Framework has been updated to reflect the Joint ESA’s Final Report on the draft Regulatory Technical Standards (RTS) dated February 2, 2021.

Download the proposed framework (PDF, 960 KB).

We believe this framework will help provide transparency for our clients as they work towards classifying funds as part of product level disclosure requirements. An expanded version of the mapping framework that includes all standard MSCI ESG indexes is available to clients through the MSCI Client Support site.

Climate Indexes

With the new voluntary climate benchmark regime in the EU, MSCI launched its first provisional EU Paris-aligned benchmarks (PAB) and EU Climate Transition benchmarks (CTB) in November 2019 based on the TEG Final Report issued in September 2019. In October 2020, MSCI launched a series of Climate Paris Aligned Indexes which are designed to exceed the minimum standards of the Paris Aligned Benchmarks in the EU Benchmark Regulation (BMR). Learn more.

MSCI led a consultation to transition the MSCI Climate Change Index to include the EU requirements to qualify as an EU Climate Transition Benchmark (CTB). The results were announced on March 31, 2021. MSCI implemented the enhancements to the MSCI Climate Change Indexes as part of the May 2021 Semi-Annual Index Review.

To follow the Glasgow Financial Alliance for Net Zero (GFANZ) recommendations on addressing real-economy emissions reductions, MSCI launched its new Climate Action Indexes in October 2022. The new index is aimed at equity investors who want an index with exposure to all sectors of the economy and who favors a bottom-up index selection approach based on both current and forward-looking climate indicators. The index aims to include companies that are taking steps to tackle their emissions. The index is sector balanced and offers a broad market coverage.

Green/EU Taxonomy

Since July 2020, MSCI ESG Research has made available to clients the Estimated EU Taxonomy Alignment Guide setting out possible approaches for institutional investors to identify global companies with business activities potentially aligned with the EU Taxonomy in the absence of corporate disclosure of Taxonomy-aligned revenue and expenses. The guide provides information on how to identify and measure companies’ involvement in sustainable activities based on available data and metrics along with potential screens and results. We have also developed a new screening factor, available as part of the MSCI EU Taxonomy Alignment dataset of the MSCI EU Sustainable Finance Module, that combines each of the core data elements of our standard approach to analyzing Taxonomy alignment into an off the shelf screening factor.

MSCI ESG Research’s EU Taxonomy-aligned Report (registration required) is a summary version of the Estimated EU Taxonomy Alignment Guide, providing an overview of the EU Sustainable Finance Taxonomy and possible approaches to identifying and measuring companies’ involvement in sustainable activities based on available data and metrics in the absence of corporate disclosure of Taxonomy-aligned revenue and expenses.

EU Sustainable Finance Package - outro

MSCI’s involvement in the EU committees and forums

MSCI is actively involved in, and providing its expertise to, several EU expert committees including:

- The European Securities Market Authority (ESMA)’s Consultative Working Group to the Coordination Network on Sustainability.

- The AMF Climate and Sustainable Finance Commission.

- The Taskforce on Climate-Related Financial Disclosures (TCFD), the Glasgow Financial Alliance on Net Zero (GFANZ) and the Taskforce on Nature-Related Disclosures.

- FinDaTex, the body developing the European ESG Template (EET).

- MSCI is supporting the Ad-hoc Working Group for the EU Ecolabel which is helping to define the standards for an EU Ecolabel for financial services.

- MSCI was a member of the EFRAG’s European Lab Project Task Force (PDF, 6.4 MB) (opens in a new tab) which has been instrumental in defining enhancements to the EU Non-Financial Reporting Directive (NFRD).

- MSCI was a member of the EU Commission’s 35 member Technical Expert Group and focused on requirements for the EU climate benchmarks and ESG benchmarks disclosures in the TEG Final Report (PDF, 3.2 MB) (opens in a new tab) in September 2019. The TEG expired in September 2020.

We value your feedback and questions. For details about how to access any of the available resources, please contact us.

EU Sustainable Finance Related cards

Related Content

Sustainable Finance Resource Center

Our resource page summarizes our sustainable finance experience, research, transparency and consultation responses.

Read MoreSustainable Finance Newsletter

Sign-up to our Sustainable Finance newsletter for a summary of the latest news, research, solutions and events.

SubscribeSustainable Finance Events

We will be running a series of Sustainable Finance virtual workshops throughout the year. Visit our events page for more details.

Search EventsFrequently Asked Questions

Download our FAQ for an update on Sustainable Finance legislation and what we’re doing to support SF initiatives globally.

Access FAQSustainable Finance Solutions

Adverse impact and EU taxonomy metrics for over 10,000 companies.

Read MoreTCFD-Aligned Climate Risk Reporting

MSCI ESG Research data and metrics can be used at the portfolio, sector and security level to support the TCFD reporting framework.

Learn More