Enterprise Analytics - button 2- Using Enterprise Analytics Duplicate 2 Duplicate 2

Investment Drivers

Social Sharing

Drivers

The rise of the ethical investor

With academic studies showing that companies with better environmental, social and governance (ESG) scores generally experience lower share price volatility and fare better in times of crisis, the tide has changed.

In just two years, global assets managed using responsible investment strategies are up 34% from $22.9 trillion in 2016 to over $30.7 trillion in 20181 and institutional investors are leading the way in this shift.

Ireland’s sovereign wealth fund was the first in the world to divest from fossil fuels and just last month in the US, 515 investors with more than $35trn issued the largest ever Global Investor Statement on Climate Change.

ESG and Real Estate

Real estate investors are increasingly integrating ESG considerations into their portfolio decisions as climate change has a direct impact on the ownership and management of property.

"We believe climate change will become one of the most important investment factors over the long term. " - Remy Briand, Head of ESG at MSCI.

Property in some locations may experience the effects sooner than in others. For example, in the coming years the value of real estate in coastal zones with high risk of flooding may lag or decrease relative to property values in less flood-prone inland areas.**

Erosion of home bias

Another continuing trend is the move away from home bias in real estate, with asset owners in many countries already investing internationally or actively exploring options for building off-shore exposures.

The implications of international diversification vary significantly across countries. Analyzing market data from Global Intel shows broad trends in returns across the world and helps demonstrate how market diversification can mitigate concentration risk.

That is why MSCI Real Estate have developed tools to show stand-alone real estate risk for different countries at different levels of international exposure and diversification benefit. So investors can easily assess which markets are driving performance.

Sophisticated investing

As investment approaches become more sophisticated and complex, investors need a holistic view into all the moving parts of their portfolios as well as narrowing in on a particular strategy.

This was a key driver for a lot of our recent enhancements to Enterprise Analytics, including the new functionality which allows businesses to quickly assemble consistent track record analysis for assets from different fund strategies and regions in order to support its credentials in a particular sector.

As well as helping clients to answer strategy-specific questions such as “How can I simply demonstrate isolated industrial performance on a global basis?” or “Can I customize my time horizon to meet a specific holding period?”.

Questions That Matter

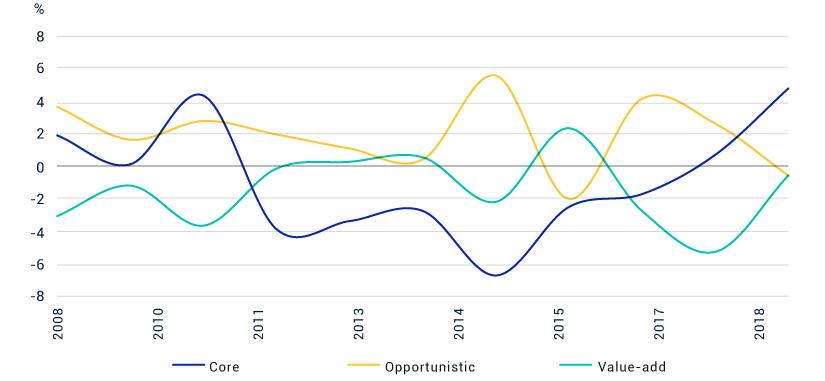

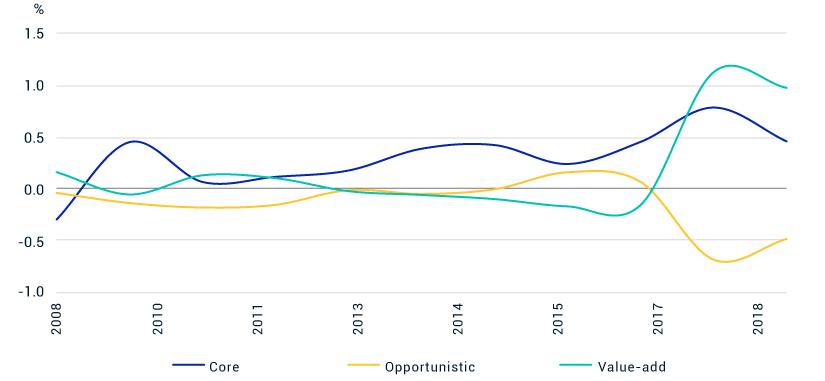

Are asset strategies performing as expected?

Am I seeing appropriate levels of returns from my higher risk strategies?

Answer with Enterprise Analytics:

By analyzing performance simultaneously with the main portfolio, the relative impact on the total can be understood to see if these asset pools are reaching their goals.

Overall, the manager is able to illustrate, on a rolling annual basis, that while returns for the assets defined by the manager as core are lagging behind the overall portfolio (except for a recent outperformance), they are providing a steady income return and serving to reduce volatility risk.

Take the wheel

Climate change, ethical investing, complex strategies and granular analysis are all changing the investor landscape and present their own risks and opportunities.

Our dedicated experts and extensive suite of real estate tools, services and research leverage our leading indexes and our global market and portfolio analytics to put investors in the driver’s seat of their investments.

Enterprise Analytics - button 2- Using Enterprise Analytics Duplicate 2

Want to get in touch to find out more?

Contact our Real Estate team to learn more about our enterprise analytics or to book a demo.