chart 27 - banner content

How Have Small Caps Navigated Risk-On and Risk-Off Environments?

Social Sharing

How Have Small Caps Navigated Risk-On and Risk-Off Environments?

Ashish Lodh/ Abhishek Gupta/ Ana Harris

Aug 11, 2021

Market sentiment isn’t static, and we have seen that recently with the gradual reopening of the economy and its impact on the performance of small-cap companies.

One way to gauge changes in market sentiment is through the Cboe Volatility Index® (VIX®) term structure, which attempts to capture changes in overall stock market volatility. Another metric that is often used comes from the U.S. credit markets and is known as the option-adjusted spread (OAS). This measures the difference in yield between a corporate bond (with an embedded option) and U.S. Treasuries. We use and combine these metrics in the market sentiment pillar of MSCI’s Adaptive Multi-Factor Allocation Model which seeks to dynamically allocate across factors in both developed and emerging markets.

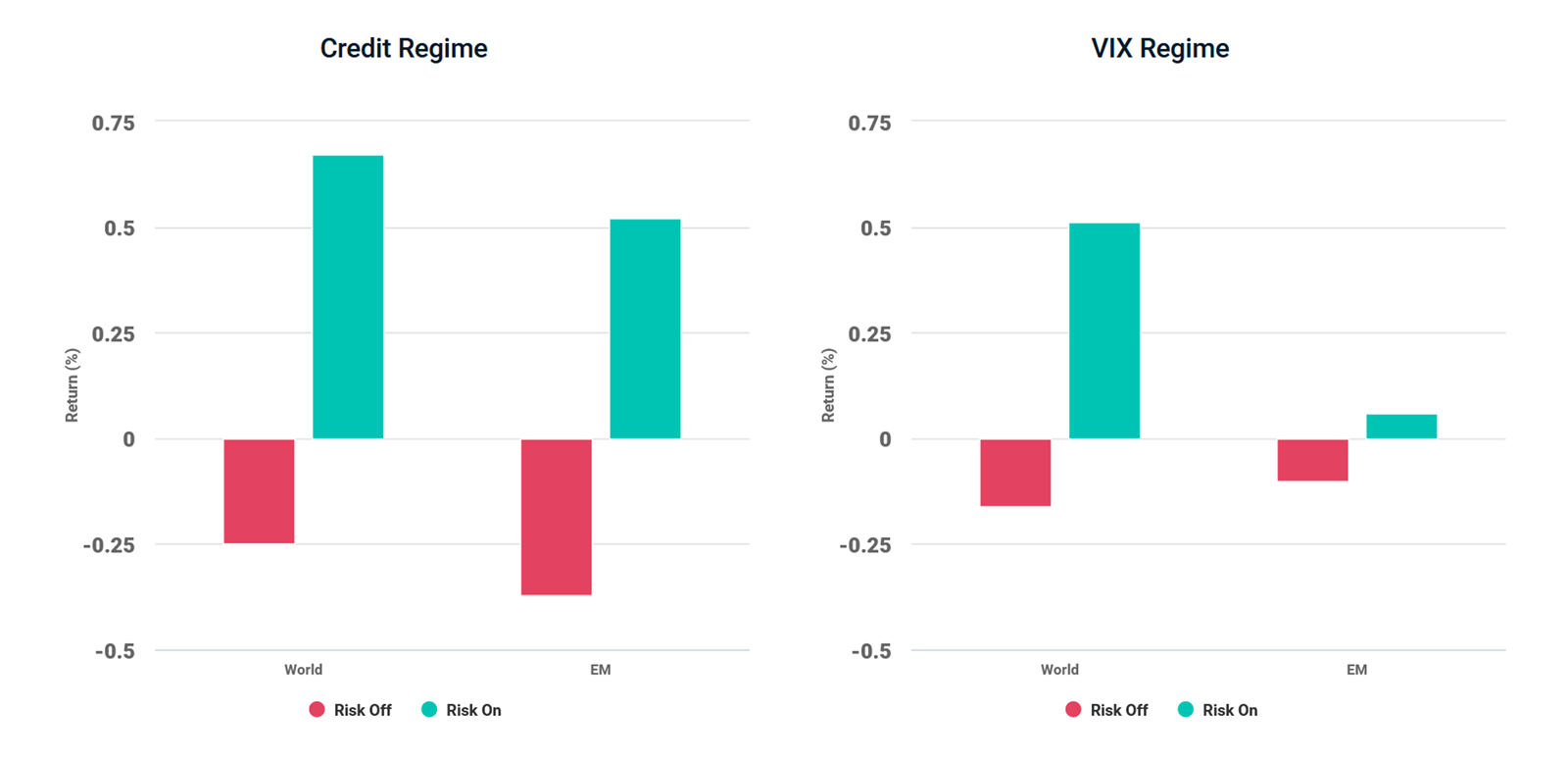

The charts below show the monthly returns of the MSCI World and MSCI Emerging Markets Small Cap Indexes relative to their larger-cap counterparts in “risk-on” and “risk-off” environments. The global equity markets have been risk-on in terms of the VIX since February 2021, characterized by a steep upward-sloping VIX curve (1-month/3-month) and in terms of OAS since November 2020 (i.e., U.S. credit spreads, as measured by BAML US Corporate BBB OAS have been notably below their 12-month average).

Historically, the small-cap indexes have outperformed the standard (i.e., large- and mid-cap) indexes during periods of risk-on market sentiment. From December 1998 to June 2021, for example, the small-cap indexes returned 67 basis points (bps) and 52 bps higher than the standard developed- and emerging-market indexes, respectively, during the risk-on credit regime, and we saw significant outperformance from developed-market small-cap versus standard indexes during the risk-on VIX regime. As of June 30, 2021, the MSCI Multi-Factor Allocation Model showed an overweight to low size, supported by positive market sentiment and momentum.

Small-Cap Index Performance Relative to MSCI World and MSCI Emerging Market Indexes

Data from Dec. 31, 1998, to June 30, 2021. A risk-on VIX regime is a period when the VIX term structure denoted by VIX (1-month) / VIX (3-month) is below 0.975. A risk-off VIX regime is a period when the term structure is above 1.025. A risk-on credit regime is a period when the OAS of the BAML US Corporate BBB Index is at least 0.25 below its 12-month average. A risk-off credit regime is a period when OAS is at least 0.25 above its 12-month average."

chart 27 - related content

Related Content

Global Investing Trends to Watch

Investing globally can help investors work toward global diversification, tap into new opportunities for growth and harness the potential in the rise in importance of emerging markets.

Explore MoreBringing a Style Lens to Small Caps

Despite the potential benefits of investing in small-cap stocks, investors often worry about liquidity, ease and ability to trade, at the lower end of the market-cap spectrum; specifically, costs (the scarcer the asset, the higher the cost) and access (how easy is to find a seller or a buyer).

Learn MoreAddressing the Lower Liquidity of Smaller Stocks

Investability and tradability, are two vital touchstones of our Global Investable Market Indexes (GIMI) construction methodology.

Read More