The Options Market Has a Story to Tell

The Options Market Has a Story to Tell

The MSCI Emerging Markets (EM) Index has fallen 11.7% year to date through March 11. For further insight into equity markets, we can turn to the options market, which has historically served as a window into investors’ views.

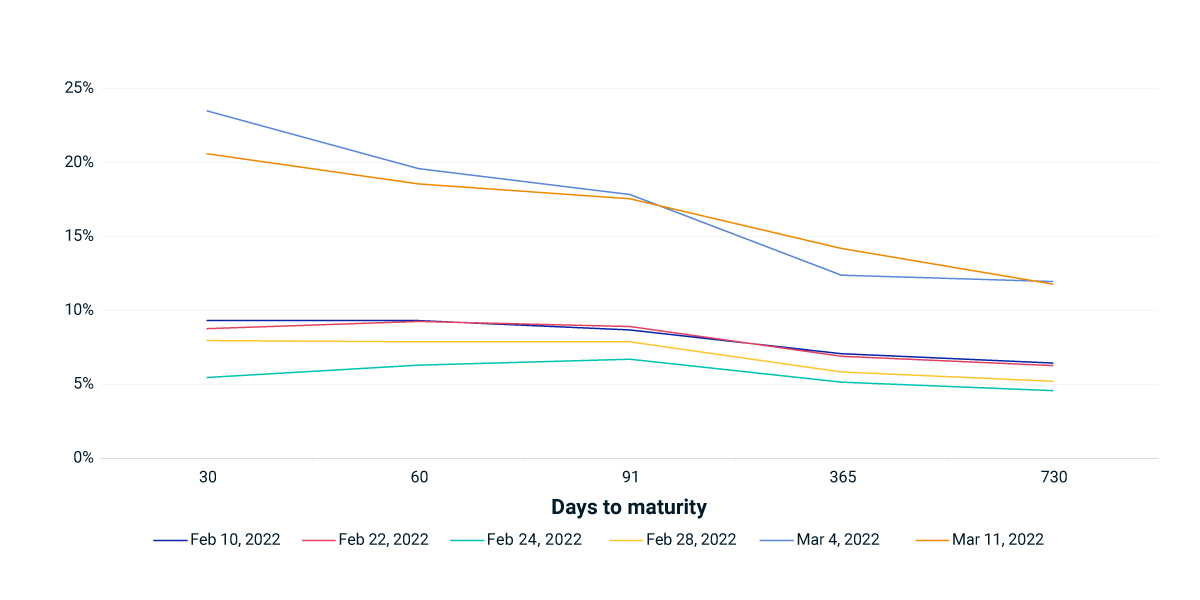

Currently, options linked to the MSCI EM Index have repriced downside risk (puts) relative to upside risk (calls), despite retracement in the underlying markets. This suggests option markets have priced in more risk to the downside, as opposed to recovery, at least in the short term.

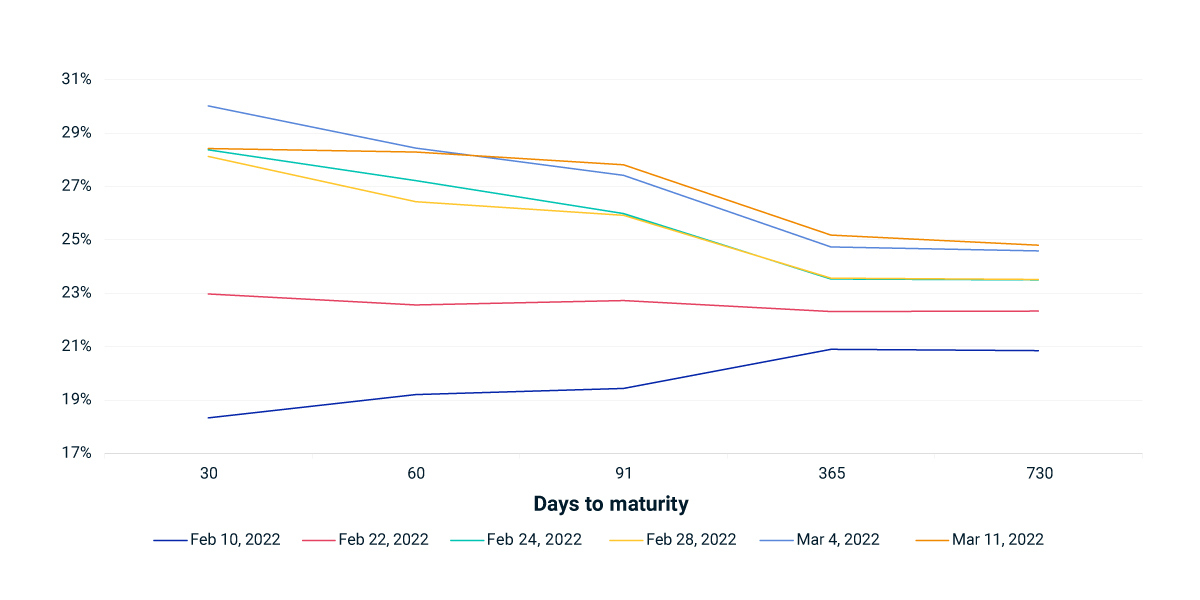

How does the options market expect volatility to change over time? For that, we can look to the volatility term structure implied in options linked to MSCI EM Index. This measure inverted on the day of Russia’s invasion of Ukraine, highlighting higher short-term volatility risk. And, as shown below, volatility term structure has shifted up, implying an increase in expected volatility for emerging markets in both the short and long term.

Implied Volatility Skew

Implied Volatility for Listed Options Linked to the MSCI EM Index

Related Content

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

Explore MoreSocial Sharing

The Options Market Has a Story to Tell related content

Related Content

Russia - Ukraine War

MSCI is closely monitoring the Russian invasion of Ukraine and how it might affect our colleagues, clients, and business partners. We will continue to assess the implications.

Explore MoreCybersecurity Firms’ Performance Rose Following Russia’s Invasion

One of the biggest question marks around the Russia-Ukraine war has been about cyberattacks — would they come and when?

Read MoreSigns of Contagion from the Russia-Ukraine War

Have the severe losses in the Ukrainian and Russian markets spread to other parts of the region, or beyond?

Learn More