Prior to Invasion, Russian Firms with Higher ESG Ratings Outperformed Peers hero

Prior to Invasion, Russian Firms with Higher ESG Ratings Outperformed Peers

Social Sharing

Prior to Invasion, Russian Firms with Higher ESG Ratings Outperformed Peers intro

March 16, 2022

MSCI ESG Research capped the MSCI ESG Ratings of Russian companies at B on March 3 and adjusted corporate-governance scores related to those firms’ financing difficulties. Following these actions, 71% of Russian companies were rated B and 29% were rated CCC. Meanwhile, the ESG government rating for Russia was downgraded to B on Feb. 28 and CCC on March 8.

Why not send all Russian companies straight to CCC, regardless of individual actions, as some proponents have argued? Simply put, we don’t believe that’s useful for investors. Even in a situation as unusual as this one, there is valuable daylight between different companies based on the characteristics of their businesses and how they manage ESG risks.

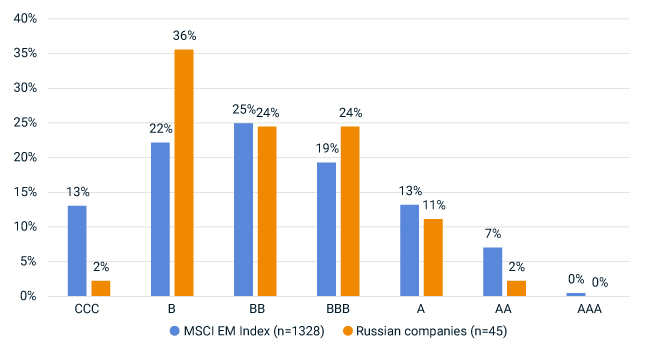

Prior to Russia’s invasion, the Russian companies in our coverage set were mostly rated in the B to BBB range with a handful above and below — toward the lower end of the range but generally not far off what we have seen across other emerging markets.

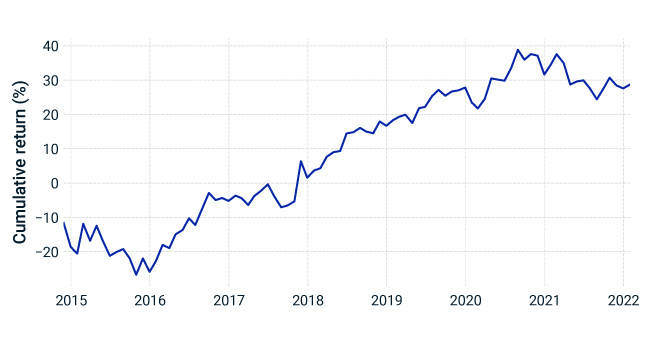

In that pre-invasion context, this differentiation provided meaningful information. With the caveat that our findings were constrained by the small number of companies, we found that Russian firms with higher ESG ratings had outperformed those with lower ESG ratings from 2015 through Jan. 31, 2022. Over those six years, companies in the top half of Russian firms, based on ESG rating, saw almost 40% higher cumulative returns than those in the bottom half.

The upshot is: It has been useful to look at ESG risks for markets and for individual companies in those markets separately, because different companies in the same market can be in better or worse position, and those differences have provided meaningful information for investors.

Ratings distribution of Russian companies pre-invasion vs. emerging markets

Data as of March 2, 2022. Emerging-market companies do not include Russian issuers.

Source: MSCI ESG Research LLC

Cumulative return of top vs. bottom half of Russian companies, based on MSCI ESG Ratings

Data as of Jan. 31, 2022. Source: MSCI ESG Research LLC

Prior to Invasion, Russian Firms with Higher ESG Ratings Outperformed Peers related content

Related Content

Russia - Ukraine War

MSCI is closely monitoring the Russian invasion of Ukraine and how it might affect our colleagues, clients, and business partners. We will continue to assess the implications.

Explore MoreSigns of Contagion from the Russia-Ukraine War

Have the severe losses in the Ukrainian and Russian markets spread to other parts of the region, or beyond?

Learn MoreThe Options Market Has a Story to Tell

The MSCI Emerging Markets (EM) Index has fallen 11.7% year to date through March 11.

Read More