Visualizing Investment Data Banner

Visualizing Investment Data

We explore and explain topics covering ESG, Climate, thematic, and global investing through visually impactful infographics.

Visualizing Investment Data Chart

Digital Wallets :The Future of Global Payments

Globally, cash and cards no longer make up the lion's share of retail transactions.

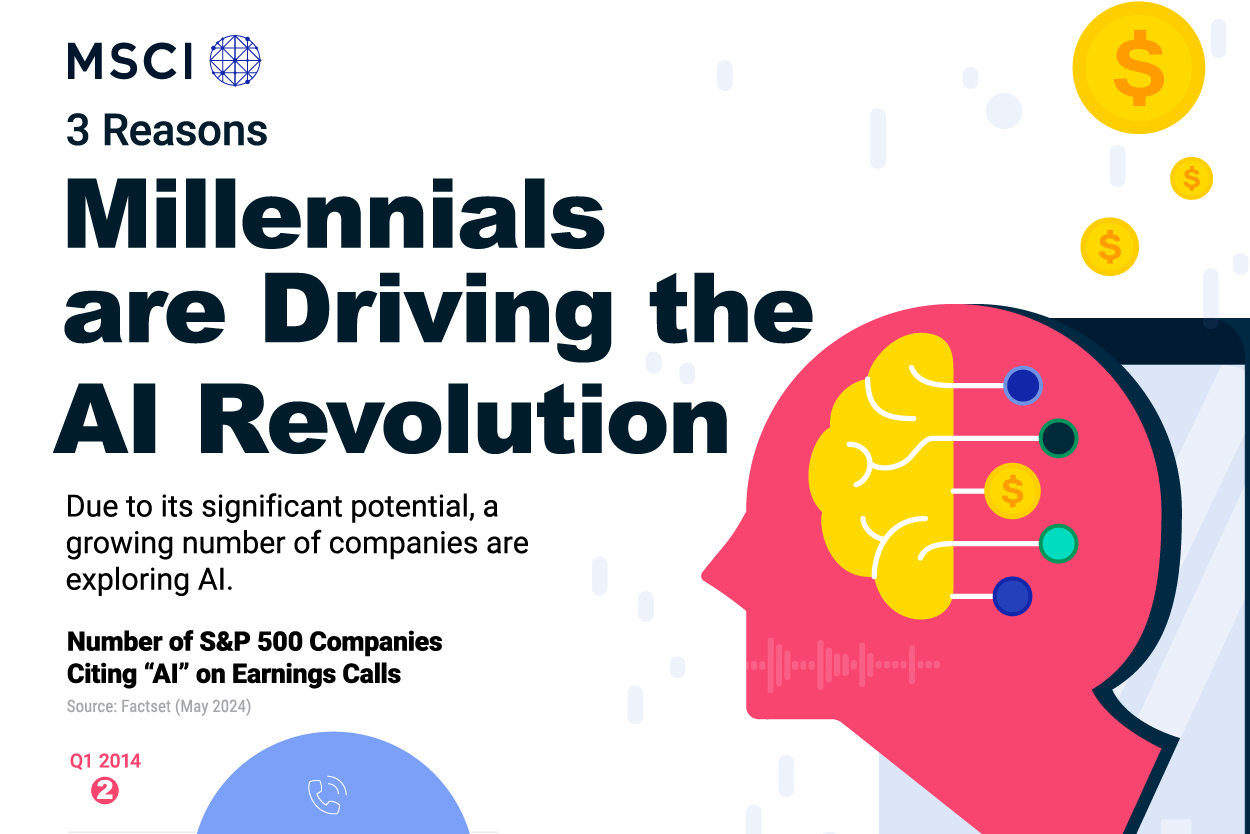

3 Reasons Millennials are Driving the AI Revolution

Due to its significant potential, a growing number of companies are exploring AI.

Could Tomorrow’s Internet be Streamed from Space?

Innovative Solutions: Satellite Internet for Faster Connectivity.

Weathering Physical Climate Risks

Gain a clear view of regional physical hazards to better manage risk and take climate action.

Climate Metrics Series Part 1: Measuring climate change – what metrics should you use?

Choosing the most suitable climate metric for specific investment goals can be challenging. Explore part 1 in our climate metrics series to understand the options.

Climate Metrics Series Part 2: Ranking sectors by carbon footprint

Understanding the carbon footprint of various sectors can help investors minimize their portfolios' greenhouse gas (GHG) emissions. Explore part 2 in our climate metrics series on carbon footprints...

Climate Metrics Series Part 3: Exploring the effect of climate change on investments

Natural disasters, policy changes, and technological shifts related to climate change could impact your portfolios. But to what extent? Explore the answer in the final part in our climate metrics...

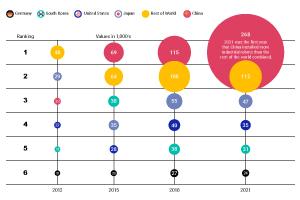

Industrial Automation: Who Leads the Robot Race?

Industrial robots are used around the world to mass produce everything from cars to medicine.

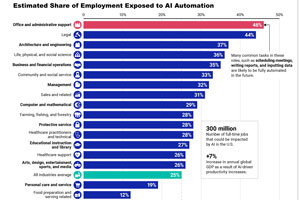

Which Industries Will AI Impact the Most?

Visualize industries with the highest % of automatable employment in U.S.

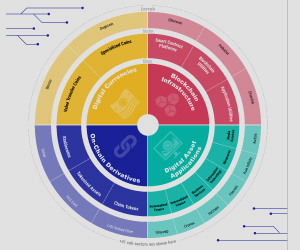

Decoding Digital Assets

While individual investors were early adopters of bitcoin and other digital assets, institutional interest has grown. Our Digital Assets solutions provide a meaningful framework to help investors...

datonomy™

Developed in partnership with Goldman Sachs and Coin Metrics, datonomy creates a common set of metrics and characteristics, enabling investors to analyze digital assets in a consistent way.

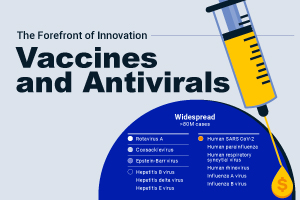

The Forefront of Innovation: Vaccines and Antivirals

Since the start of the global pandemic, the development of novel vaccines and antiviral treatments has accelerated significantly.

Balanced Exposure to the Blockchain Economy

Blockchain goes far beyond bitcoin, as it solves transparency and verifiability for financial systems and ownership of digital goods.

Is Space the Next Frontier for Investors?

Over the past several decades, space and satellite technology has become the invisible foundation of our digital world.

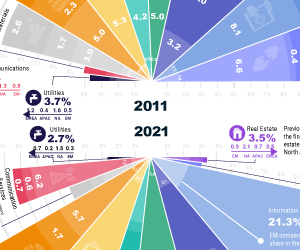

The Regional Breakdown of Market Sectors Over Time

The composition of the global stock market has changed substantially over the last 10 years.

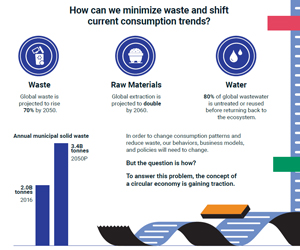

Rethinking material use. The Circular Economy 101

A circular economy is centered on the idea of resources being kept as long as possible within the economic system.

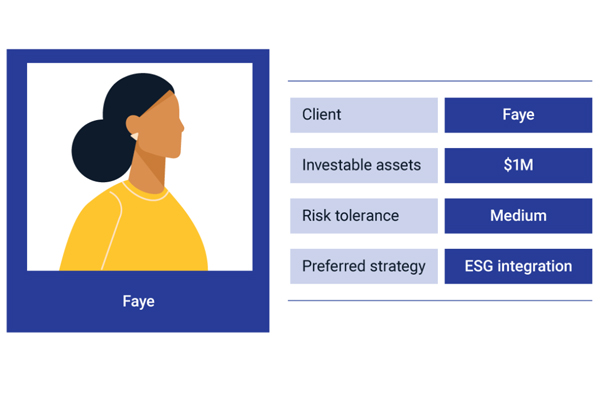

How Differentiated Insights Lead to Stronger Portfolios

Using risk and return insights with ESG considerations tailored to client preferences can help wealth managers build better portfolios.

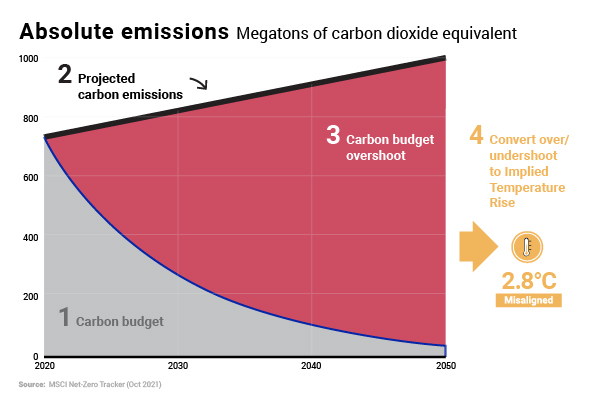

Implied Temperature Rise

How much are companies in your portfolio contributing to a warming climate? Implied Temperature Rise shows the alignment of companies and portfolios with net-zero pathways.

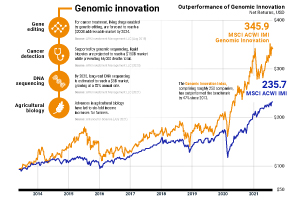

Why Genomics is poised for growth

Genomics is paving the way for transformative solutions in healthcare, with the potential for considerable growth.

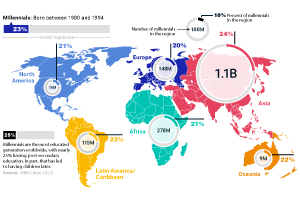

Visualizing Millennials by region

Millennials are now the largest adult cohort worldwide, spanning 1.8B people

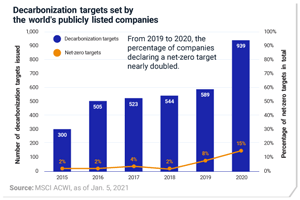

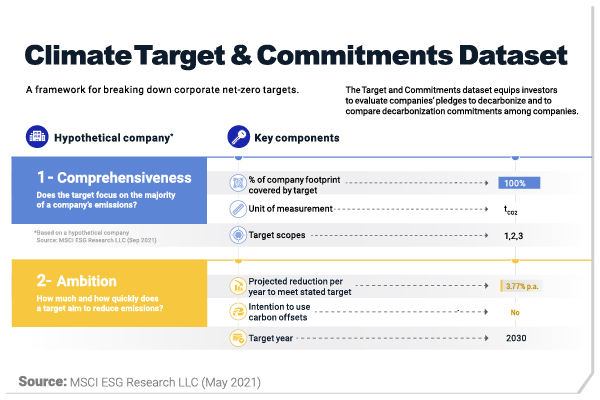

Evaluating a Company’s Net-Zero Target

Using the MSCI ESG Research Target & Commitments Dataset, investors can better understand how meaningful a company’s net-zero target is.

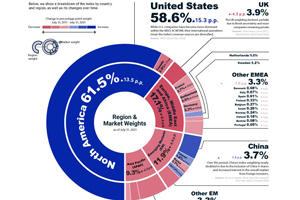

ACWI IMI's Complete Geographic Breakdown

How has the MSCI ACWI IMI Index breakdown by country and region, and how has that changed over time?

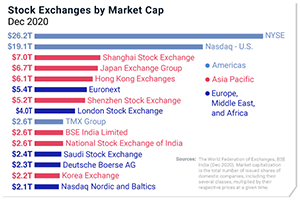

Indexes – Bringing the World into Focus

Economic development around the world has led investors to consider broadening their investment exposures.

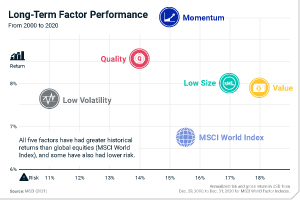

You’re a Factor Investor, and You Didn’t Even Know It

Learn about the five common factors and the scenarios where you likely experience their principles in your own life.

What is Direct Indexing?

Investors can customize an index to meet specific outcomes such as improved ESG score, lowered risk and reduced tax burden.

An ESG & Climate Index for Every Objective

As enthusiasm around sustainable investing builds, we see three motivations that broadly describe what investors are looking to achieve with the use of ESG and Climate indexes.

A Global Perspective: The Possibilities in International Equity Investing

Some investors choose to overweight their portfolio with stocks from their home country - but by moving away from home bias they can explore the options for international investing.

The Power of a Sustainable Dollar

More than $100 trillion in assets have voluntarily committed to support the UN's Principles for Responsible Investment1. But how do we know if sustainable investments have really made a difference?

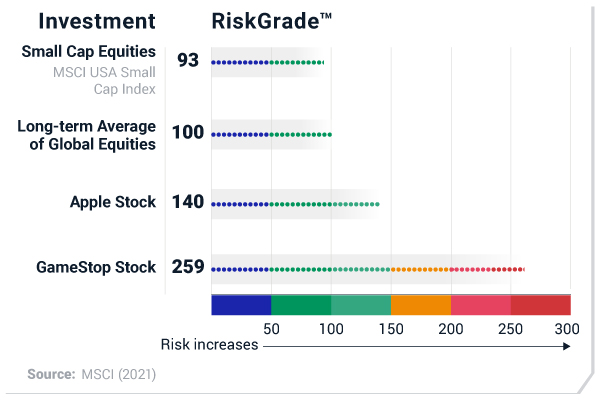

A More Intuitive Way to Calculate Investment Risk

Consider the risk associated with your investment decisions using a score-based measure of volatility.

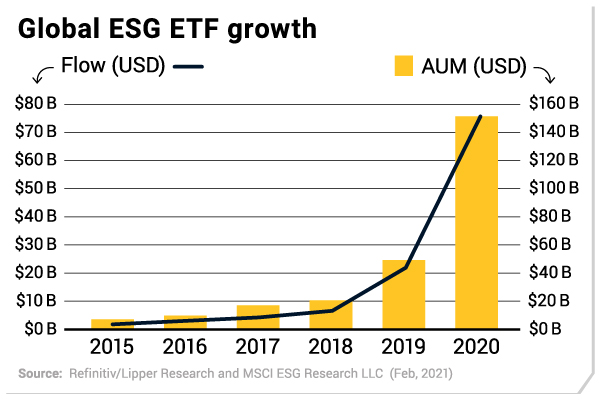

The Sustainable ETF Universe

In 2020, sustainable ETFs saw record inflows of $75 billion. Here we share details on the ESG type, carbon intensity, and domicile of this ETF universe

Fact Check: The Truth Behind 5 ESG Myths

We dispel five common ESG myths to help investors build more sustainable portfolios.

The Top 5 Sustainable Investing Questions Advisers Need Answered

When advisers ask the right ESG questions, they can make more effective decisions for their clients.

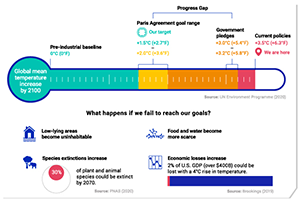

Global Progress Towards the Paris Agreement

The Paris Agreement gave the world a collective mission to limit warming to 1.5-2 degrees Celsius above pre-industrial levels. What happens if we fail to reach our goals?

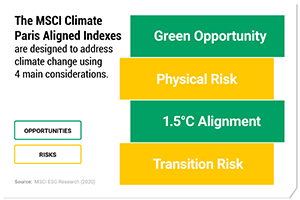

The Paris Agreement and Your Portfolio

Climate change is creating new risks and opportunities for investors. How can you align your portfolio with the Paris Agreement goals?

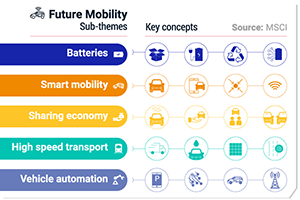

Meet Thematic Investing

The top-down investment approach designed to capitalize on transformational trends such as disruptive technology.

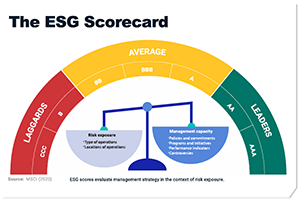

Inside MSCI ESG Ratings: How are companies scored?

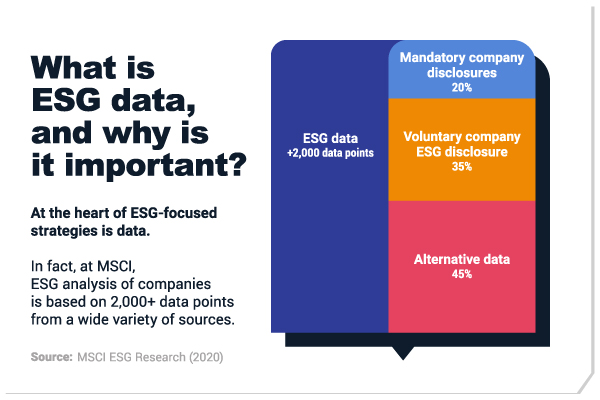

From innovative data collection to industry-specific key issues, MSCI ESG Ratings provide a measure of a company's resilience to long-term, financially relevant ESG risks.

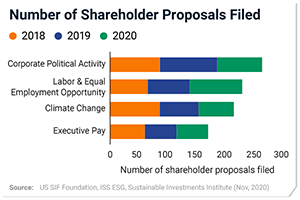

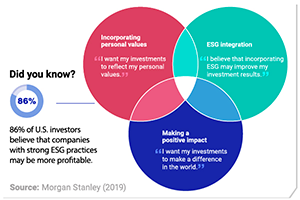

ESG Investing: Finding your Motivation

What are the three common motivations among investors for using ESG in their portfolios?

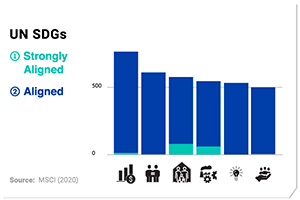

UN Sustainable Development Goals: How do companies stack up?

We measure the degree of SDG-alignment of 8,550 companies worldwide.

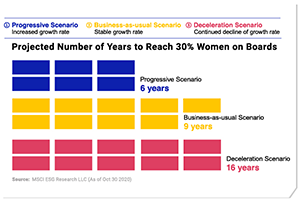

The Rise of Women on Boards

When will we reach 30% women directors on publicly traded companies around the world? We explore three scenarios.

The Rise of Women on Boards related content Duplicate 3

Related content

ESG Investing

Learn how our MSCI ESG Research and solutions can provide insights into ESG risks and opportunities within multi-asset class portfolios.

Read moreResearch & Insights

Backed by transparent data and more than 50 years of market intelligence.

Explore more