ESG Ratings Header Sep 18

ESG Ratings Profile

Retail Investors

MSCI ESG Research LLC does not provide products or services to retail investors.

Contact your financial advisor or an investment professional

ESG Ratings Video

ESG Ratings Video

How do MSCI ESG Ratings work? What are significant ESG risks? What does a poor rating look like? How to use them?

ABOUT MSCI ESG RATINGS new top

About MSCI ESG Ratings

MSCI ESG Ratings provides insights into ESG risks and opportunities within multi-asset class portfolios.

View the ESG Ratings methodologyInteractive Assets

Has ESG historically compromised financial returns? NEW

How has ESG affected equity valuation, risk and performance?

In a recent study, MSCI researchers focused on understanding how ESG characteristics have led to financially significant effects. Our research showed that ESG had an effect on valuation and performance of many of the companies in the study.

Three things companies with high ESG Ratings have demonstrated1:

Higher

Profitability

Higher

ProfitabilityLower

Tail RiskLower

Systematic

Risk

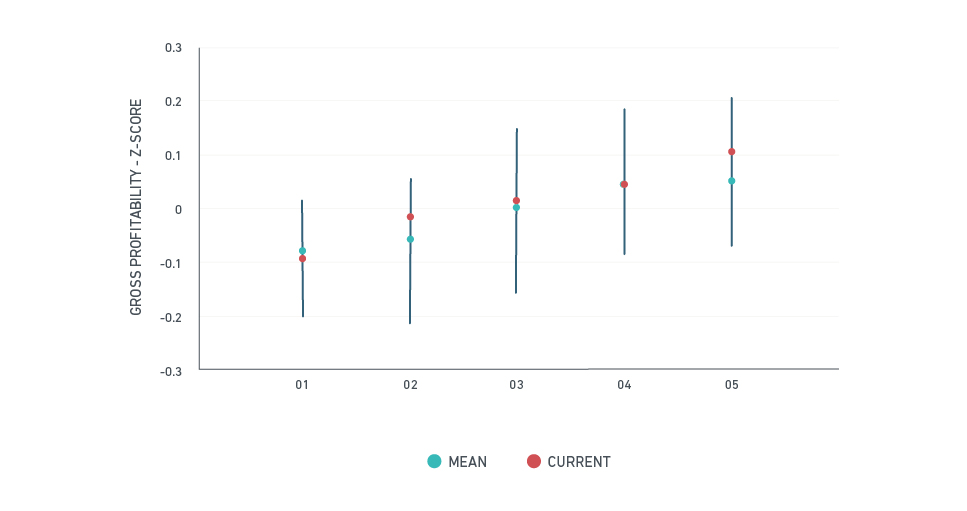

Cash-flow channel: High ESG-rated companies were more competitive and generated abnormal returns, often leading to higher profitability and dividend payments, especially when compared to low ESG-rated companies.

Gross profitability of ESG quintiles

01 = worst ESG quintile and 05 = best ESG quintile

1 Foundations of ESG Investing Part 1 - How ESG Affects Equity Valuation, Risk and Performance, MSCI November 2017

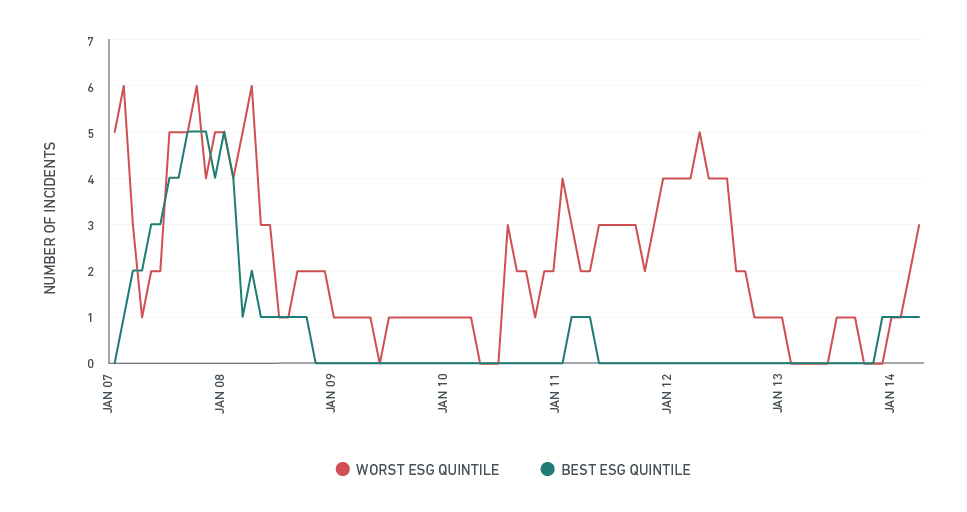

Idiosyncratic risk channel: High ESG-rated companies experienced a lower frequency of idiosyncratic risk incidents such as major drawdowns. Conversely, companies with low ESG ratings were more likely to experience major incidents.

Large drawdown frequency of top vs. bottom ESG quintile

1 Foundations of ESG Investing Part 1 - How ESG Affects Equity Valuation, Risk and Performance, MSCI November 2017

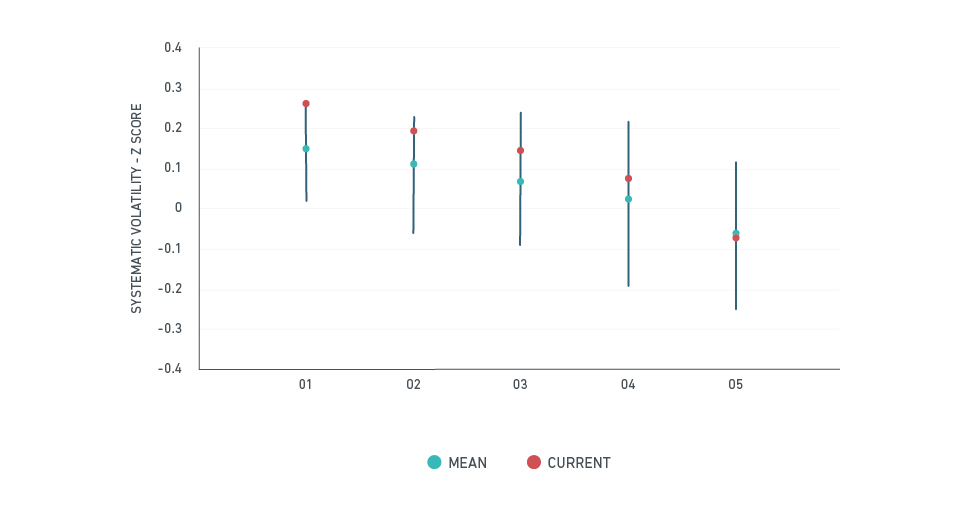

Valuation channel: High ESG-rated companies have shown lower systematic risk exposure, evidenced by less volatile earnings and less systematic volatility. Compared to low ESG-rated companies, they also experienced lower betas and lower costs of capital.

Systematic volatility of ESG quintiles

01 = worst ESG quintile and 05 = best ESG quintile

1 Foundations of ESG Investing Part 1 - How ESG Affects Equity Valuation, Risk and Performance, MSCI November 2017

ESG Ratings Parallax 01

OUR EXPERIENCE

Our Experience

We have over 40 years1 of experience measuring and modelling ESG performance.

We rate companies according to their exposure to industry-significant ESG risks and their ability to manage those risks relative to industry peers.

MSCI ESG Research is used by 46 of the top 50 asset managers and over 1,200 investors worldwide2, and forms the basis of our 1,000 Equity and Fixed Income Indexes.

We are recognized as a ‘Gold Standard data provider’3 and voted 'Best Firm for SRI research', ‘Best Firm for Corporate Governance research' and ‘Best firm for Indices and Benchmarks’ for the last three years.4

1 Through our legacy companies KLD, Innovest, IRRC, and GMI Ratings

2 As at August 2018

3 Deep Data Delivery Standard

4 The Extel & SRI Connect Independent Research in Responsible Investment (IRRI) Survey – 2015, 2016 & 2017

ESG Ratings of 7,000 companies (13,000 issuers including subsidiaries) and more than 650,000 equity and fixed income securities globally

ESG Ratings Separator

WHAT DO WE MEASURE?

What do we measure?

MSCI ESG Ratings Key Issues

MSCI ESG Ratings are constructed based on thousands of data points across 37 ESG Key Issues. Learn more about MSCI’s key issue scores and weightings.

Interactive Assets

Climate change

Natural resources

Pollution & waste

Environmental opportunities

Human capital

Product liability

Stakeholder opposition

Social opportunities

Corporate governance

Corporate behavior

ESG Ratings Parallax 02

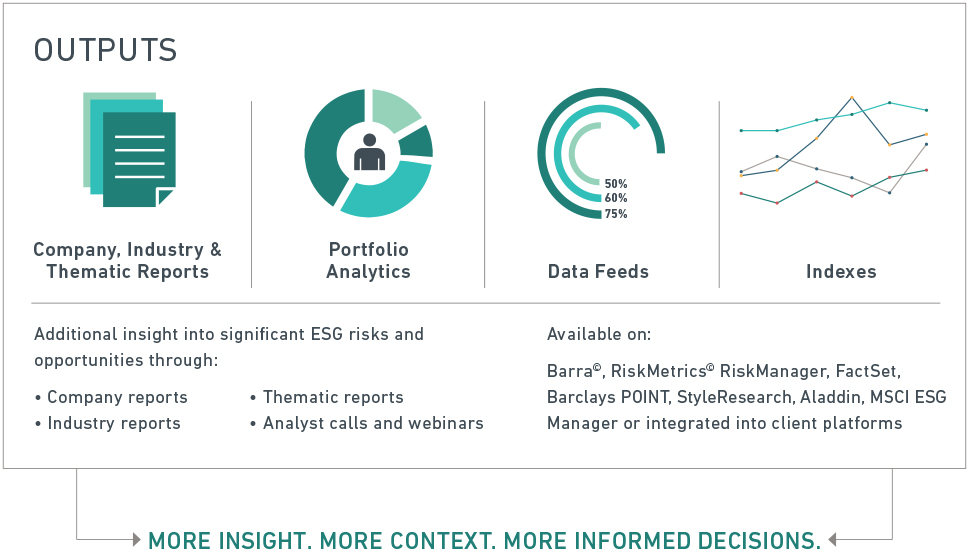

FORMATS & PLATFORMS

How to access ESG Ratings

MSCI ESG Ratings is available in a variety of formats and platforms

How our clients use MSCI ESG Ratings

We do not just offer our analysis; we find practical ways to make our data and analysis easy to use – contact our ESG client service team

For example, the MSCI ESG Quality Score is derived from ESG Ratings and provides a fund-level assessment of ESG quality. It is calculated as the weighted average of the portfolio or fund’s underlying holdings’ ESG Scores. It is provided on a 0-10 scale, with 0 and 10 being the respective lowest and highest possible scores. MSCI ESG Research scores underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. These issuer-level ESG scores correspond to an issuer-level ESG rating. For more information visit:

ESG Fund Metrics

Interactive Assets

MSCI emerging markets ESG Leaders

Cumulative Index Performance - USD Gross Returns (September 2007 - August 2018)

Interactive Assets

MSCI ACWI ESG Leaders

Cumulative Index Performance - USD Gross Returns (September 2007 - August 2018)

Interactive Assets

MSCI world ESG Leaders

Cumulative Index Performance - USD Gross Returns (September 2007 - August 2018)

ESG Ratings Our Topics

Legislation

MSCI ESG Research LLC. is a Registered Investment Adviser under the Investment Adviser Act of 1940. The most recent SEC Form ADV filing, including Form ADV Part 2A, is available on the U.S. SEC’s website at www.adviserinfo.sec.gov.

MIFID2/MIFIR notice: MSCI ESG Research LLC does not distribute or act as an intermediary for financial instruments or structured deposits, nor does it deal on its own account, provide execution services for others or manage client accounts. No MSCI ESG Research product or service supports, promotes or is intended to support or promote any such activity. MSCI ESG Research is an independent provider of ESG data, reports and ratings based on published methodologies and available to clients on a subscription basis.