fixed income hero image

Sharpen your focus on risk and return

Sharpen your focus on risk and return

In today’s complex fixed income markets, portfolio and risk managers need trusted data and analytics in order to make better decisions. MSCI delivers comprehensive fixed income risk and performance analytics backed by expert research, high-quality data, flexible reporting options and data management services.

Speak the same language

Speak the same language

Facilitate internal and client communications using a consistent fixed income analytical framework.

- Risk and performance models aligned with how portfolio managers make active decisions

- Calibrate analytics to multiple prices, curves, or market data for collaboration across different groups and organizations

- Communicate exposures and returns with asset owners who use the same tools

Tap into research-driven expertise

Tap into research-driven expertise

MSCI fixed income analytics are developed by a global research team with expertise in rates, single security analytics, factor models and performance attribution.

- More than 150 researchers worldwide, 80% holding advanced degrees and 40% with PhDs

- More than 30 years of experience in fixed income

- More than 40 years of experience in factor models

Fixed income parallax

Access a broad and deep fixed income universe

Access a broad and deep fixed income universe

MSCI’s comprehensive fixed income coverage and high-quality data enable to you to manage your entire fixed income portfolio.

- More than 100 instrument types and pricing models across all fixed income sectors

- More than 21,000 individual fixed income benchmark indexes

- Reference data for more than 10.2 million assets

- Curated, research-quality global curves, rates, and prices

Generate flexible reports

Generate flexible reports

MSCI gives you the freedom to customize reports in virtually any format that fits your workflow.

- Open interface supports on-the-fly and high-volume automated batch reports

- Arrange data to highlight specific positions, exposures and other attributes

- Access data at any time, through multiple channels: APIs, user interface, Excel Add-In or flat files

Streamline data management

Streamline data management

MSCI’s managed services reduce the time and budgetrequired to feed analytics with trusted data.

- Daily market data collection, processing and remediation

- Flexible integration designed to fit with your existing processes

Fixed income content seperator

Scale up as you grow

Scale up as you grow

MSCI analytics and services can easily scale up to accommodate new strategies.

- Scalable and robust infrastructure supports on-demand processing

- Computational and reporting engine scales across thousands of portfolios covering multiple asset classes

- Certified Tier IV data center

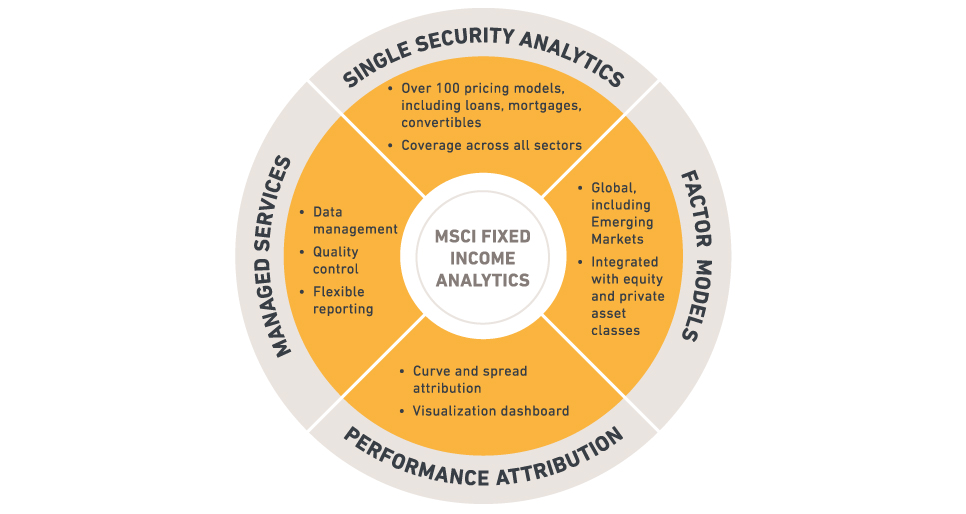

MSCI ANALYTICS ADDRESS FOUR CRITICAL AREAS OF FIXED INCOME PORTFOLIO RISK AND PERFORMANCE MANAGEMENT

Interested in Analytics?

Get the latest trends and insights straight to your inbox.

Select your topics and use cases to stay current with our award winning research, industry events, and latest products.