Higher Energy Prices Fueled Equities More than Bonds

Higher Energy Prices Fueled Equities More than Bonds

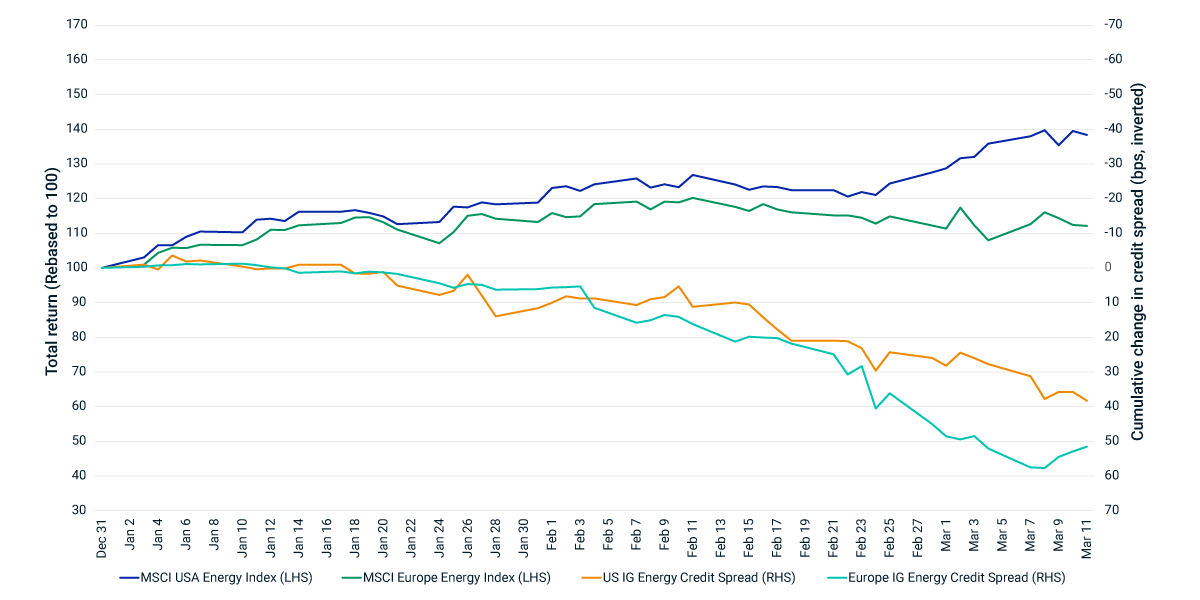

Higher energy prices have benefited developed-market energy-sector equities, generally, as illustrated by the fact that the MSCI USA Energy Index and the MSCI Europe Energy Index have significantly outperformed their respective broader market benchmarks, year to date through March 11. Investment-grade energy-company bonds, on the other hand, have not benefited as much from this tailwind, as the credit-spread expansion in the exhibit below shows.

While equity and corporate-bond returns of the same issuer have historically been positively correlated over the long term, this relationship may break down over shorter periods.1 One reason for the latest divergence may be the expectation that near-term earnings windfalls may accrue disproportionately to shareholders through dividends and share buybacks.1 Additionally, while both energy-company equities and corporate bonds were positively affected by higher energy prices in the near term, bonds (especially those from European issuers) have been negatively affected by the rising risk of default reflected in the widening credit spreads, due to the ongoing developments of the Russia-Ukraine war.

Energy sector: Equity returns vs. investment-grade credit spreads

1 Ilmanen, Antti. 2003. “Stock-Bond Correlations.” Journal of Fixed Income, 13: 55-66.

Related Content

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

Explore MoreSocial Sharing

Higher Energy Prices Fueled Equities More than Bonds footnotes

1 Ilmanen, Antti. 2003. “Stock-Bond Correlations.” Journal of Fixed Income, 13: 55-66.

Higher Energy Prices Fueled Equities More than Bonds related content

Related Content

Russia - Ukraine War

MSCI is closely monitoring the Russian invasion of Ukraine and how it might affect our colleagues, clients, and business partners. We will continue to assess the implications.

Explore MoreEquity-Market Dispersion Continued in the Face of War

Relatively better economic conditions, led by the U.S., have helped developed markets (DM) outperform emerging-markets (EM) equities by 22% over the 12 months ended Feb. 28, 2022.

Learn MoreRussia Indexes’ Reclassification Had a Large Effect on EM Energy

We wrote previously that the March 9 reclassification of the MSCI Russia Index to the status of a stand-alone market had minimal impact on the characteristics of the MSCI Emerging Markets (EM) Index.

Read More