Carbon footprinting across multi-asset-class portfolios allows investors to measure and manage financed emissions on their road to net-zero emissions.

TPS Hero Banner

Total Portfolio Footprinting

A baseline for the net-zero transition

Social Sharing

TPS Intro

Why Total Portfolio Footprinting?

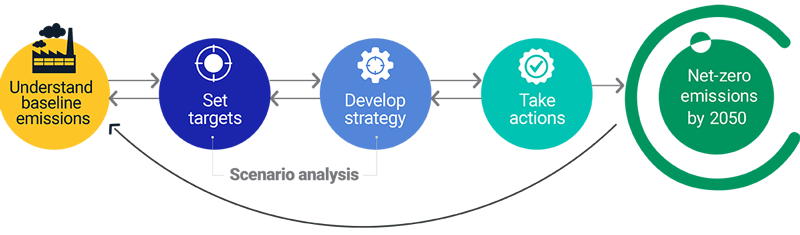

We’re all on a climate journey, figuring out our best next steps, and MSCI has listened to clients’ needs. In response, we’ve developed a new solution to measure the total amount of financed emissions across a portfolio. This means you now have a baseline from which you can work, outwards and onwards, to shape the direction of your climate journey.

Total Portfolio Footprinting means for the first time, you’ll benefit from visibility over your whole portfolio with a snapshot of financed emissions for all asset classes and subsets – the total climate impact of your lending and investment activities. This baseline measurement is designed to align with key standards and requirements, including PCAF, NAIC, TCFD, GFANZ and EIOPA to help you understand your portfolio’s climate impact and exposure.

TPF video

TPS contact us

What is PCAF and the Global GHG Accounting and Reporting Standard?

The Partnership for Carbon Accounting Financials (PCAF) is designed to help financial institutions assess and disclose the greenhouse gas (GHG) emissions from their loans and investments through GHG accounting. To standardize GHG accounting approach, PCAF developed the Global GHG Accounting and Reporting Standard for the Financial Industry. The Standard provides detailed methodological guidance for multiple asset classes to calculate the financed emissions resulting from activities in the real economy that are financed through lending and investment portfolios.1

How Total Portfolio Footprinting works

How Total Portfolio Footprinting works

Total Portfolio Footprinting leverages our leading climate data and multi-asset modeling to deliver a cloud-based data and API solution for clients needing a total portfolio carbon footprint that meets standard carbon accounting guidelines.

More than 70,000 emissions factor; maps to nine industry frameworks, including PCAF, TCFD and NAIC

- Syndicated

Bank Loans - Listed

Equity - Private

Equity & Debt - Corporate

Bonds - Sovereign

Bonds - Municipal

Bonds - Green

Bonds - Securitized

Products

Client-provided

asset data

- Bank

Loans - Green Project

Finance - Infrastructure

- Private

Equity & Debt - Home & Auto

Loans - Commercial

Real Estate

Financed

emissions output

- Scope 1

Intensity - Scope 2

Intensity - Scope 3

Intensity - Data Quality

Scores - Financed

Emissions

TPS Solutions

The Solution Can Help You

- Gain visibility of the carbon footprint of your total portfolio

- Set a baseline to begin your transition to a net-zero economy

- Align with key standards and requirements to assess your portfolio’s climate impact and exposure

- Make pertinent adjustments to focus your activities with more sustainable business practices to create more climate-aligned portfolios

TPS How 1

What about Data Security?

We’re acutely conscious of data confidentiality and have put in place steps to protect rather than store your data - so you can have confidence with the information you share with us.

If you prefer to take ownership over the data process, your analysts can use our emissions dataset and models to run their own analysis and get to the heart of your objectives. Or, if you prefer to minimize your total cost of ownership, we can hand a turnkey data and reporting solution over to you.

Uses for Total Portfolio Footprinting

TPS Tabs

Investment Managers

Investment Managers

- Measure their financed emissions to understand their investment activities

- Enhance granularity of climate reporting for all asset classes and subsets

- Benchmark climate progress against own targets and/or industry peers, to stay on track for the net-zero transition

Banks

Banks

- Gain deep insight into the risk profile of their loans and investments to better identify and manage these risks

- Navigate emissions reduction goals and disclose progress

- Act to reduce portfolio climate impact

- Ability to understand financed emissions, against a baseline and align this with specific net-zero commitments

Insurers

Insurers

- Measure the impact of assets in general account.

- Better understand the impact of underwritten liabilities

- Focus on more sustainable business practices, thereby creating a climate-aligned portfolio to stay on track for the net-zero transition

- Benchmark and track progress against own targets and wider insurance industry

- Measure their financed emissions to understand their investment activities

- Enhance granularity of climate reporting for all asset classes and subsets

- Benchmark climate progress against own targets and/or industry peers, to stay on track for the net-zero transition

Banks

Banks

- Gain deep insight into the risk profile of their loans and investments to better identify and manage these risks

- Navigate emissions reduction goals and disclose progress

- Act to reduce portfolio climate impact

- Ability to understand financed emissions, against a baseline and align this with specific net-zero commitments

Insurers

Insurers

- Measure the impact of assets in general account.

- Better understand the impact of underwritten liabilities

- Focus on more sustainable business practices, thereby creating a climate-aligned portfolio to stay on track for the net-zero transition

- Benchmark and track progress against own targets and wider insurance industry

- Gain deep insight into the risk profile of their loans and investments to better identify and manage these risks

- Navigate emissions reduction goals and disclose progress

- Act to reduce portfolio climate impact

- Ability to understand financed emissions, against a baseline and align this with specific net-zero commitments

Insurers

Insurers

- Measure the impact of assets in general account.

- Better understand the impact of underwritten liabilities

- Focus on more sustainable business practices, thereby creating a climate-aligned portfolio to stay on track for the net-zero transition

- Benchmark and track progress against own targets and wider insurance industry

- Measure the impact of assets in general account.

- Better understand the impact of underwritten liabilities

- Focus on more sustainable business practices, thereby creating a climate-aligned portfolio to stay on track for the net-zero transition

- Benchmark and track progress against own targets and wider insurance industry

TPS Contact Us

TPS Additional

Additional Resources

TPS Related Cards

Related Content

Climate and Net-Zero Solutions

A set of tools to help investors understand how climate change could affect their portfolios, identify low carbon investment opportunities, and set net-zero targets.

Explore MoreClimate Investing

Climate Investing investors and issuers utilize climate data and tools to support their investment decision making.

Read More