Asset Owner Hero Image

Gain clarity over the complex

Asset Owner Intro

Actionable insights, granular analytics and global benchmarking for Institutional Investors

Real Estate is fast transforming from alternative to mainstream. Institutional investors need providers who can meet their needs in evolving best practice principles and the agility to adapt to changing markets.

MSCI’s team of dedicated experts and our extensive suite of real estate tools and services leverage our leading indexes, portfolio analytics and strength of our global market coverage. We provide a common language to bring true clarity to the complex.

REQUEST MORE INFORMATION

Gain clarity over the complex

Gain clarity over the complex

Our products are designed to enable the wider institutional investors community to get a clearer picture of risk and reward across the entire investment lifecycle, easily keep pace with global flux and drive better decision making.

Assess a fuller picture

Assess a fuller picture

Our robust global and multi-asset market coverage is designed with institutional investors in mind.

Capable of use in a benchmark agnostic way and implemented according to your investment strategy, our effortlessly accessible analytics present your view of the world, in one place.

Fixed and flexible reports provide you with detailed attribution analysis, granular comparisons and insight to help you better understand market impacts.

Power better investment decisions

Drive better decision making

We integrate enhanced transparency over risk, return, manager and peer performance to drive better decision making.

From country diversification to an expansion into private and real assets, MSCI’s products and services are designed to help you gain better insight as you tailor analysis across portfolios and benchmarks to determine future allocation, whatever your context.

THE FUTURE OF REAL ESTATE

According to our research, the next 12 months may see rapid changes in real estate arising from a variety of sources including environmental, social and governance-related (ESG) risks, geopolitical uncertainty and disruptive technology.

How do these trends impact large asset owner’s investment decisions in 2019 and beyond, and how can MSCI Real Estate’s holistic suite of solutions be applied to bring clarity to the complex?

Private Assets

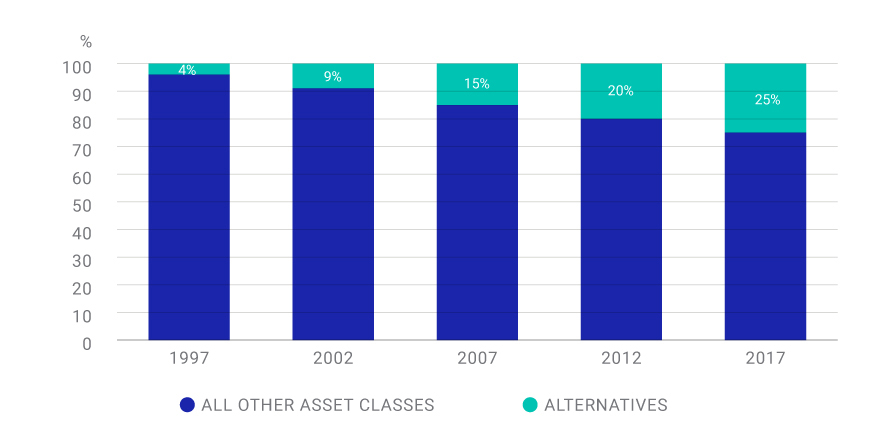

The sheer potential of Private Assets is fast transforming it from alternative to mainstream, a change that could see portfolio allocations rise to as much as 25% in the next 5-10 years*.

But opacity and illiquidity still cloud Private Assets investing and clarity is urgently needed for asset owners to effectively operate in the space.

Our database already spans $2 trillion of private real estate assets, across more than 30 countries** and we are rapidly enhancing our solutions to empower asset owners with the objective analytics and actionable insights they need to make better decisions across the entire investment process.

Integrating ESG

Real estate investors are increasingly integrating ESG considerations into their portfolio decisions***.

The U.S. government’s Fourth National Climate Assessment report, issued in November 2018, estimates that climate change may have an economic impact twice as large as that of the Great Recession and property in some places may experience the effects sooner than in others.

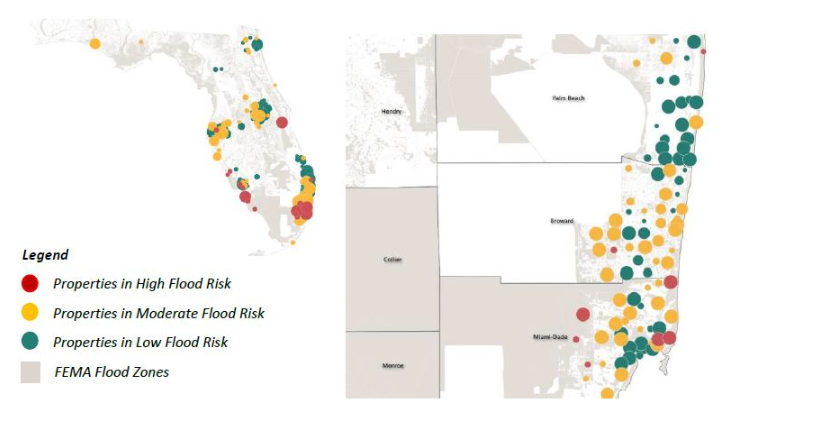

For example, in the coming years, the value of real estate in coastal zones with high risk of flooding may lag or decrease relative to property values in less flood-prone inland areas****.

Florida will have different risks and opportunities as sea level begins to inundate coastlines over the next decades

MSCI’s research teams provide critical insights that can help you identify ESG risks and opportunities, that traditional investment research may overlook.

Data informed positioning

Over a decade into the current expansionary cycle, how should insititutional investors position their portfolio?

Data is crucial to this whether you decide to take a defensive position to hedge against a potential downturn - searching for properties less correlated to market movements and offering more secure income - or fill the growth gap left by slowing yield compression, seeking properties with more potential growth in cash flow.

Using asset-level historical data to understand how specific combinations of risk factors have performed throughout different market conditions may help better understand how portfolios have performed during various markets.

MSCI Real Estate’s Enterprise Analytics and Global Intel solutions pull together portfolio and market analysis and data so you can assess a fuller picture.

Future-ready decisions

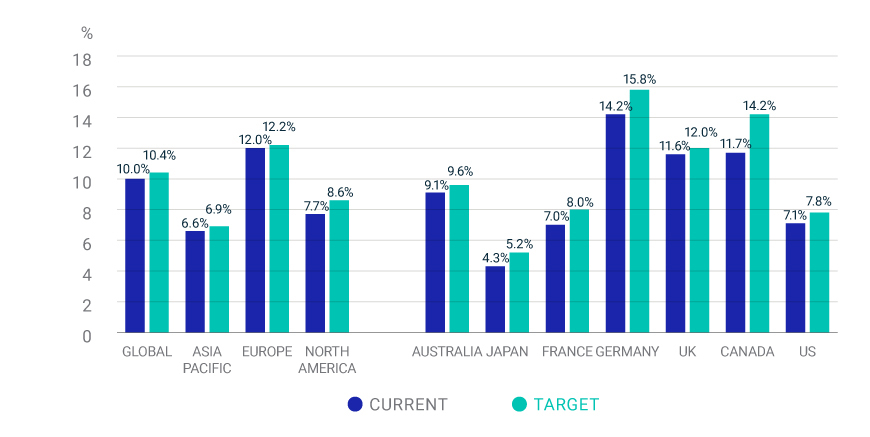

Determining future allocation in the new context of country diversification, expansion into private assets and erosion of domestic bias can be challenging for institutional investors.

MSCI’s Global intel solution provides clients with market characteristics such as size, price, yields and historical performance, our indexes support positioning against other asset classes such as infrastructure and our research power gives you a better understanding of the Market and peer performance across our significant institutional investors network.

Communicating future strategy

Whether you have decided to reduce your retail exposure or increase private asset allocation, it is important for asset owners to effectively communicate drivers for a shift in strategy – across every level of the organization.

MSCI Real Estate’s solutions can be used for flexible and tailorable internal reporting, providing a common language that bridges any communication gap between risk, real estate and c-suite decision makers.

*According to data from JP Morgan, IPE Real Assets and comments by Morgan Stanley

**Based on 2017 year-end figures of MSCI Real Estate

***MSCI 2019 emerging real estate trends

****MSCI 2019 ESG trends to watch

Asset Owner parallax2

Answer the questions that matter to you

Answer the questions that matter to you

Our actionable insights, unbiased benchmarks and objective-aligned analytics can help you answer the most pressing questions, at every stage of your investment process.

We equip you with tools to help you best determine future allocation, translate idiosyncratic risk, quickly compare yields against the market, understand how peers are performing and select and appraise partners and managers.

BENCHMARKING IN REAL ESTATE

Examining the need for a coherent benchmarking framework to better understand the drivers of performance, irrespective of the portfolio's structure or investment objectives.

Read the paper

Asst Mid intro

Keep pace with the market change

Our broad suite of products and our client-centric research group focus on providing institutional investors with greater insight into market performance and macro trends.

This differentiated content can help your teams to stay ahead of evolving investment approaches and market trends.

Enhance your team performance

Enhance your team performance

Free up capacity and increase in-house capability with our objective-aligned analytics, benchmarks and up-to-the-minute insight for institutional investors.

Our tailorable interfaces, benchmarks, expert researchers and local hands-on Client Consultants aim to help you address your specific needs, work with your senior team and allow your organization to utilize a common language to enhance effectiveness throughout the investment process.

RESOURCING YOUR INVESTMENT STRATEGY

Resourcing your investment strategy

With a focus on performance, value and governance, and often only a couple of people overseeing tens of billions of dollars in Real Estate portfolios, how can institutional investors appropriately resource their investment strategies?

To enable lean teams to do more, MSCI have developed a holistic suite of solutions to support institutional investors gain clarity over the complex, assess a fuller picture to drive better decision making, answer the questions that matter, keep pace with change and ultimately enhance your in-house team capability

Allocation (and scrutiny) on the rise

Allocations to alternatives in general, and real estate in particular, have been increasing steadily over recent decades as investors have sought to diversify and access the unique attributes of the asset class.

Aggregate asset allocation

Real estate now has greater significance in the wider portfolio context and as a result it is attracting more scrutiny from asset allocators and risk managers.

The need for transparency and insight into your real estate portfolio is therefore greater than ever, and growing.

Current and Target Real Estate Allocations

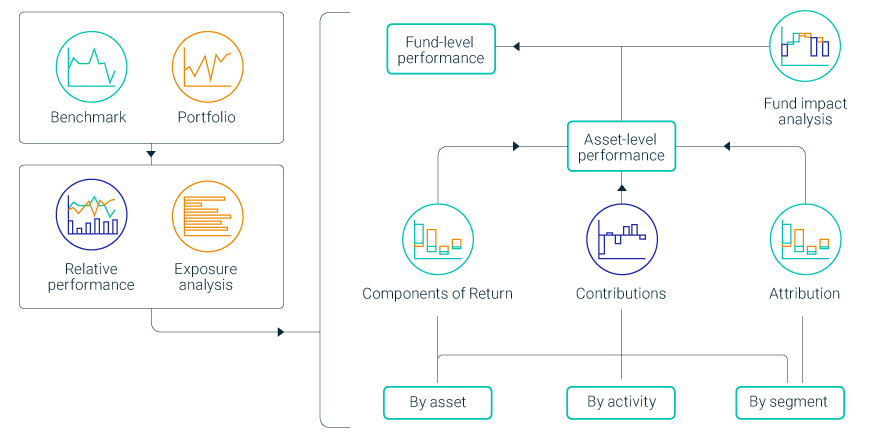

Our Enterprise Analytics solution presents global market and portfolio analytics to fit your view of the real estate investment world.

We do this by providing a single source of analytics across all teams and allowing you to assess the drivers of the total performance of your entire real estate portfolio through 60+ analytical measures - all refreshed on a quarterly basis.

Evaluating your exposure

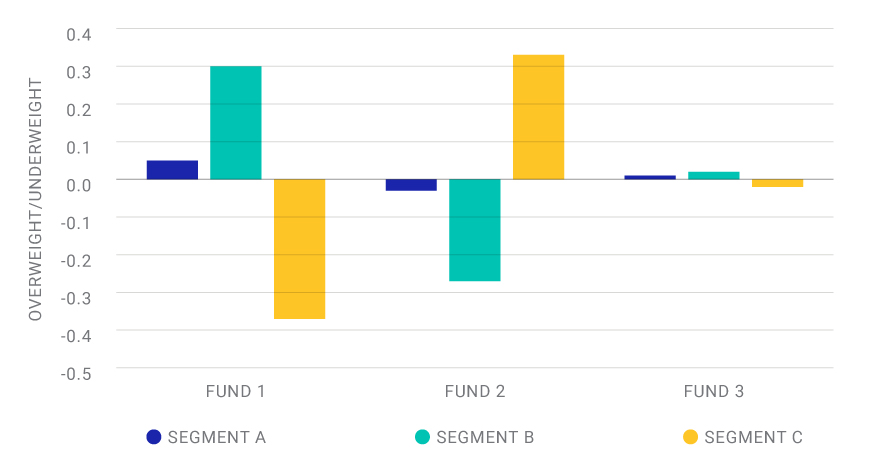

Institutional investors will invest across multiple vehicles and channels and it can be challenging for in-house teams to get a true understanding of how these individual exposures relate to one another.

For example, if you invest in one fund that is actively targeting a certain submarket, while another fund is actively underweighting that same market, you are potentially paying fees to fund managers to take active risks that are ultimately cancelling each other out.

Enterprise Analytics can help you keep track and avoid inefficiencies like these by presenting one view, in one place.

Identifying return drivers

In a rising market, it isn’t hard for managers to achieve positive performance, after all, a rising tide lifts all boats. But if markets turn, will you be left exposed?

Linking asset-level to fund-level performance adds another level of detail that helps you understand where your returns come from and what risks you may be exposed to.

Updated on a quarterly basis by up to 83 data points per asset and 43 per fund or vehicle, Enterprise Analytics and our powerful Global Intel market data engine bring together various levels of performance and analysis so lean investment teams can easily access tens of thousands of datapoints.

This makes the job of identifying return drivers more manageable and teams can focus on managing your portfolio, rather than managing data.

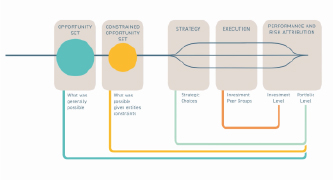

A benchmark that fits

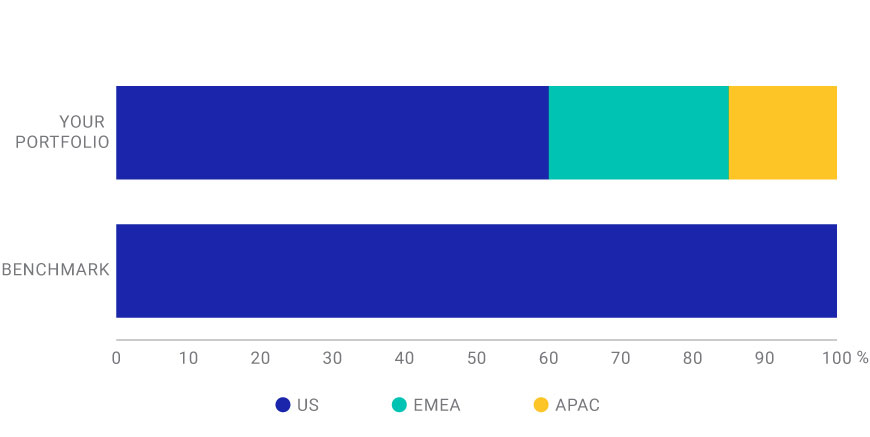

Benchmarking and the analytics it supports, aids decisions and communication right across the investment process, from strategy to allocation to execution.

Our indexes can be tailored to ensure that the benchmarks being applied are fit for purpose to make the right comparisons and offer the right insights.

For example, as real estate becomes increasingly global, a US institutional investor may build up sizable international exposures while still using domestic benchmarks.

In selecting a bespoke benchmark – with global coverage - that aligns to your objectives and incentives, you can select and appraise managers, conduct due diligence, make informed allocation decisions and assess performance at every level.

Relative benchmarking enables detailed performance analysis

Dedicated support

Along with the 800+ reports we produced every quarters for our U.S. clients alone, these are just some of the ways Pension Funds and the wider institutional investor community can leverage our tailorable technology, expert researchers and local hands-on client consultants to address their specific needs.

MSCI Real Estate are proud to support institutional investors right across the investment process by working with your senior team and providing entire organisations with a common language to communicate risk, reward and strategy.

Freeing up capacity and increasing in-house capability.