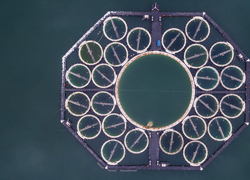

Climate Paris-Aligned Benchmark Select - hero

Climate Paris Aligned Benchmark Select Indexes

Social Sharing

Paris-aligned benchmark select - intro copy

What are the Climate Paris Aligned Benchmark Select Indexes?

The MSCI Climate Paris Aligned Benchmark Select Indexes are designed to support investors seeking to reduce their exposure to transition and physical climate risks and who also wish to pursue opportunities arising from the transition to a lower-carbon economy while aligning with a 1.5°C scenario and exceeding the minimum standards of the EU Paris Aligned Benchmark label.

Key Features:

- Designed to exceed the minimum technical requirements laid out in the EU Delegated Act. For example, a higher “self-decarbonization” rate of 10% year-on-year

- Targets a reduction in carbon intensity by at least 50% by underweighting high-carbon emitters assessed using Scope 1, 2 and 3 emissions

- Designed to reduce the Index's exposure to physical risk arising from extreme weather events by at least 50%

- Increases the weight of companies that are exposed to climate transition opportunities and reduces the weight of companies exposed to climate transition risks

- Increases the weight of companies with credible carbon reduction targets through the weighting scheme

- Aims to shift index weight from “brown” to “green” using the MSCI Low Carbon Transition score and at least doubling the exposure to green revenue

- Targets a modest tracking error compared with the Parent Index and low turnover

Climate Paris Aligned Benchmark Select Indexes

The indexes follow a transparent and rules-based methodology, which aims to meet the following objectives:

Product Insight Document

Product Information

Product Insight Document

Learn more about the features, applications, exclusions, ESG & Climate characteristics and simulated performance of the Climate Paris Aligned Benchmark Select Indexes

Methodology

Paris-aligned benchmark select - related content

Related Content

Foundations of Climate Investing

To what extent has climate risk been priced into equity markets? Is there a “brown” discount and a “green” premium? Has this shifted over time?

Learn MoreClimate Solutions

We help institutional investors benchmark, measure and manage portfolio exposure to climate risk and identify low carbon opportunities.

Explore MoreThe Role of Capital in the Net-Zero Revolution

Companies have a fundamental responsibility to reduce their impact on the planet and join the journey to a decarbonized economy.

Read More